Larry Summers has been right on inflation for the past year, but what about his recent comments on tax hikes? Here’s what he told reporters last week:

“I sure wish we could get past this basically ludicrous economic idea that tax increases are inflationary — it’s just not right,” and “The right thing to do is to raise taxes right now to take some of the demand out of the economy.”

S-Corp has argued that tax hikes can be inflationary, and that the House-passed hikes are inflationary, so this argument caught our eye. Did we miss something in the economics? Is it true that ALL tax hikes reduce prices as they “[pull] money out of the economy,” as some Democrats told Richard Rubin in the WSJ?

No, in this case, it’s Larry Summers and the other tax hike advocates who are wrong, for the simple reason that not all taxes are created equal, nor do they impact the economy in the same way. Here’s Will McBride in a recent Tax Foundation post:

Kim Clausing, who recently stepped down as one of the administration’s top Treasury officials, claims that economists have reached “near consensus” that “tax increases reduce inflation.” In fact, there is no such consensus on this statement, since it depends on several things, including how the tax revenue is spent.

Clausing further claims that as long as the taxes exceed spending then it will reduce inflation. Again, this is far too simplistic. It depends on the type of taxes, the type of spending, and how this impacts the economy and the ability of the federal government to repay its debt over the long term.

McBride is correct that Clausing is wrong about any supposed consensus. Our experience argues that the consensus runs the other way. For example, the National Association of Business Economists held a panel discussion back in November where these questions were fully discussed. As Bloomberg reports:

The roughly $2 trillion tax and spending bill being championed by President Joe Biden will act to push up inflation next year if passed by Congress. That’s according to three senior economists — Mark Zandi at Moody’s Analytics, Douglas Holtz-Eakin of the American Action Forum and Harvard University professor Doug Elmendorf — who appeared on a virtual panel sponsored by the National Association for Business Economics on Wednesday.

McBride is also correct that different taxes affect the economy in different ways, as does how those taxes are spent. What sort of taxes were part of the Build Back Better Act? Were they demand-killing taxes on families and consumption?

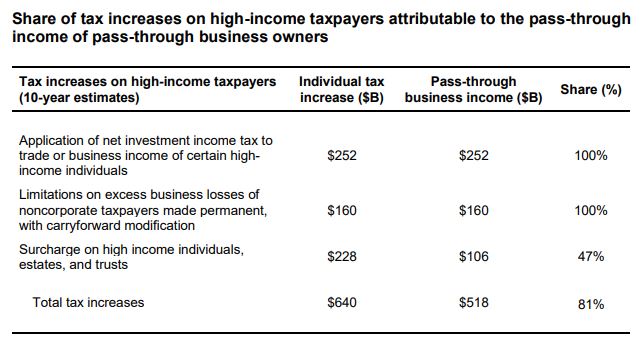

No, not. As S-Corp readers know, the BBB Taxes were targeted directly at C corporations and pass-through businesses. As our EY analysis found, over 80 percent of the so-called individual tax hikes in the House-passed BBB Act were targeted directly at family businesses, not rich individuals.

In recent tweets, Summers refined his position to argue that tax hikes that avoid raising marginal rates would be okay and deflationary:

There is every reason to expect that a well-designed program of tax increases that includes a variety of corporate tax loophole closings and measures to enforce that tax law we have – that does not raise rates on any individual or parting good – that program is deflationary.

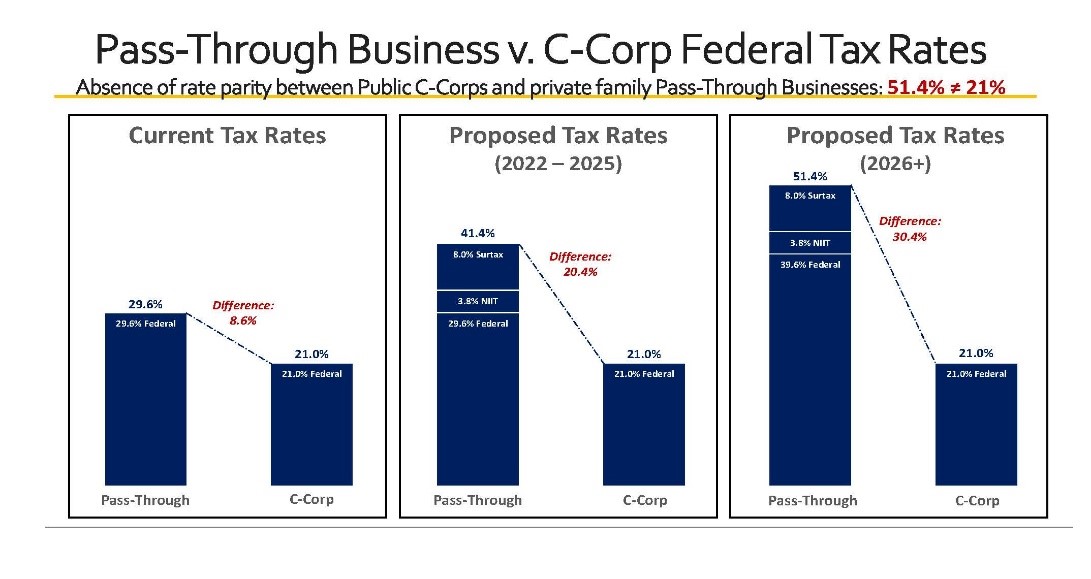

The problem with this argument is that the tax hikes that passed the House and are before the Senate do raise rates on businesses and individuals – by a lot. As we’ve noted in the past, the combination of the 3.8 percent NIIT and the new 5- and 8-percent surtaxes (rate hikes by another name) would push marginal rates of S corporations and partnerships up over 50 percent!

Meanwhile, there’s good reason to believe tax hikes that avoid raising marginal rates, such as the proposed corporate minimum tax, would also have the effect of pushing up prices. A recent “Working Paper” from the National Bureau of Economic Research shows how tax hikes on businesses increase inflation – nearly one-third of the tax increases highlighted in the paper were passed on to consumers in the form of high prices.

Do tax hikes push up prices? As noted above, it depends on what tax hikes are being considered, and where the money is going. A more relevant question is: Would the tax hikes in the House-passed reconciliation bill make inflation worse? The answer there is an emphatic yes, and for that reason – among many – the Senate should reject them.