With Tax Day just around the corner, we have some good news that should help ease the pain. Yesterday, Governor Glenn Youngkin signed HB 1121 into law, making Virginia the 25th state to adopt our SALT Parity reform. As a result, more than 200,000 Virginia S corporations and partnerships will have access to about $160 million in annual tax relief, starting with their 2021 returns.

As S-CORP readers know, the new cap on state and local tax (SALT) deductions does not apply evenly to all businesses. C corporations may continue to deduct the full value of their SALT as a business expense, while pass-through businesses like S corporations and partnerships may only deduct those taxes paid by the entity, not the business owner. Our SALT Parity bill restores the full deduction by allowing S corporations and partnerships to elect to pay their taxes at the entity level. If enacted across the country, we estimate that over 3 million pass-through businesses would receive more than $6 billion in annual tax relief, all at no cost to states.

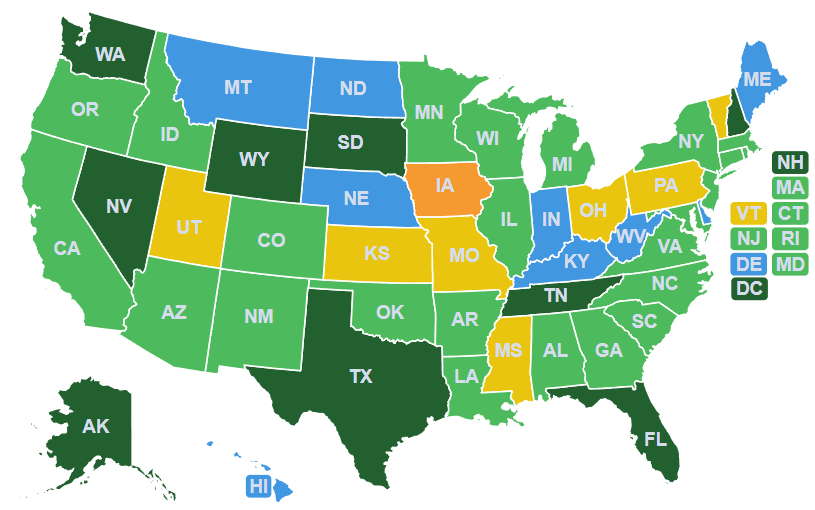

These benefits have not gone unnoticed. As we said, twenty five states have adopted our reform to date, including three states in 2022 – while several more are on the cusp of acting. Here’s where those efforts stand:

- Kansas: last month B. 2239 was passed by the Kansas Senate in a 26-2 vote, and a week later easily cleared the House. That bill is currently awaiting the signature of Governor Laura Kelly.

- Mississippi: The House passed B. 1691 this February, and the Senate followed suit in March. The bill is currently awaiting the signature of Governor Tate Reeves.

- Ohio: B. 246 was passed by the state Senate just last month, and we expect the House to take up the measure soon.

- Pennsylvania: S. 1709 was introduced last June but has not yet received a vote. With the PA legislature in session for two weeks this month, we expect to have some activity to report before May.

- Missouri: B. 807 passed the Senate in a 23-7 vote at the end of March, and now heads to the House.

- Vermont: H. 527 was introduced in January of 2022 and remains pending.

With employers struggling to find workers, and the latest inflation report showing prices still skyrocketing, adopting SALT parity is a no-cost way for states to help their businesses now, when they could use it. Most of the states that would benefit from SALT parity – we count forty-one states that would benefit from the reform – have already acted or are taking action right now. The question we have is, why haven’t all the eligible states acted?