At a roundtable event on Thursday, President Biden unveiled a new White House report that touts a “small business boom,” and attributes this success to his administration’s economic strategy.

The timing of the event was a bit odd – the Commerce Department had just released its first quarter GDP estimates, showing the economy shrank by 1.4 percent, and businesses continue to face rampant inflation, job shortages, and supply chain disruptions. So what’s this “boom” the President is bragging about?

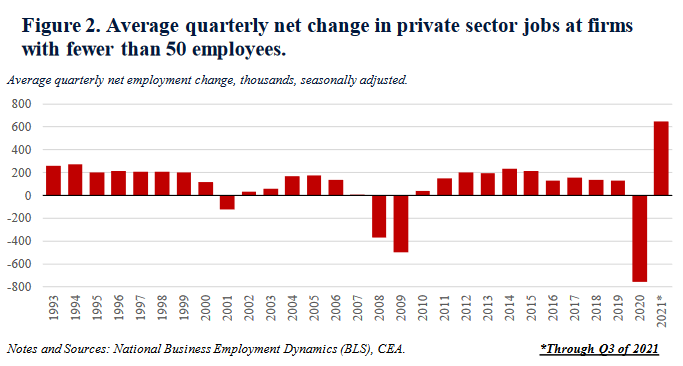

In framing its success, the White House report leans heavily on 2021 job figures:

Under the Biden-Harris Administration, small businesses are creating jobs. In the first three quarters of 2021, small businesses with less than 50 employees created 1.9 million jobs, the fastest 9-month start to small business growth in any year on record. These 1.9 million jobs represented 49% of net job growth across firms of all sizes over that period, the second highest share on record.

The accompanying chart, shown below, puts this figure into perspective:

That massive dip in 2020 shows just how devastating the Covid pandemic and the ensuing policies were to the small business community. While larger firms were allowed to stay open, small businesses were told to shut their doors, shedding close to 800,000 jobs each quarter. The only way you can describe 2021 as a “small businesses boom” is to completely ignore what happened just one year prior.

The report also highlights data on applications for new businesses to make its case, stating:

In 2021, Americans applied to start 5.4 million new businesses—more than 20 percent higher than any previous year on record and more than two-thirds higher than the annual average of 3.2 million new businesses applications per year in the five years prior to the start of the pandemic. Of these applications, roughly 1.8 million applications were for businesses that planned to hire employees (“high-propensity applications”), an increase of more than 17% over the previous annual record and more than 40% above the pre-pandemic average.

Of course, the same dynamic applies here: as a result of the pandemic, millions of businesses were forced to close their doors for good. The subsequent spike in new business formations is in keeping with a recovery.

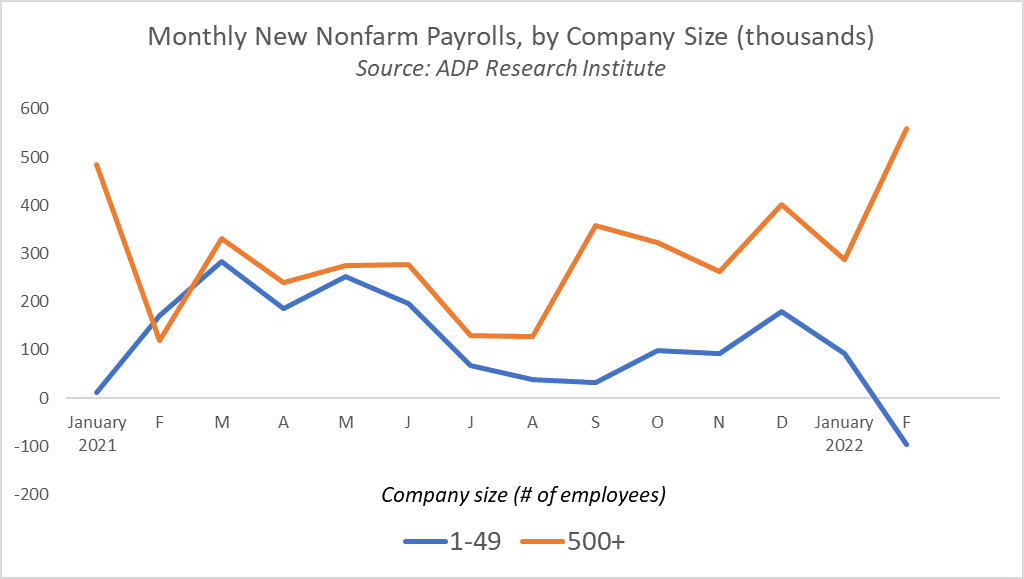

But submitting an application is not the same as hiring new workers. To see how small businesses have fared in terms of job creation since 2021, it’s worth taking a look at the ADP payroll data over that time:

The graph above plots monthly changes in employment for companies with fewer than 50 employees versus those with over 500 since the start of 2021. While small businesses were creating jobs at the beginning of the Biden administration, the rate has been trending down for the past year and was actually negative in February. Meanwhile, job creation at larger companies has been positive and accelerating throughout. This trend of economic consolidation away from Main Street and into the hands of a few large, publicly-traded companies is one we’ve been warning about for years, and would only be exacerbated by the tax policies under consideration in Congress.

Speaking of which, the White House report concludes with a series of proposals to further help small businesses. While not explicitly labeled the “Build Back Better Act,” they are suspiciously similar to the stalled reconciliation bill. For example, under the heading “Leveling the Playing Field for Small Business Owners by Reforming the Tax Code,” the report states:

According to a White House analysis, the President’s Agenda would deliver tax cuts to more than 3.9 million entrepreneurs and only raise taxes on those making over $400,000. That means 97 percent of small business owners would not face any income tax increases, and, in fact, millions would be getting tax cuts.

To be clear, the tax cuts referenced above are not “business” relief per se. Instead, the White House is counting family tax relief, like the expanded child tax credit. If you are an entrepreneur who has children and you get the credit, then that’s the tax cut referenced above. These aren’t increased incentives for business owners; they are increased incentives for parents. Might be worthwhile, but it’s not the same. If you’re an entrepreneur with no eligible children, no tax cuts for you.

On the other hand, there might be tax hikes, big ones. We’ve covered this before but it bears repeating: under the BBB, family businesses with ownership held in trust would get hit with the new, 5-percent surtax on income exceeding just $200,000. For the proposed expanded 3.8 percent Net Investment Income Tax (NIIT), that would apply to these family businesses when they earn just $13,000. In the context of family businesses, that $400,000 minimum threshold for tax hikes just isn’t accurate.

So the White House report trumpets cherrypicked and flawed data while pushing a tax plan that hurts the very businesses it purports to care about. If this administration is serious about helping small businesses it should abandon efforts to pass the BBB and instead focus on alleviating the real-world problems affecting Main Street right now – inflation, supply chain challenges, and a lack of workers.