Since its introduction, the Biden administration has repeatedly claimed that its tax plan would reverse a trend of rising income inequality in America. The ensuing debate focused almost exclusively on who pays what. Serious questions about the underlying premise – that income inequality is historically bad and getting worse – have largely been ignored.

That’s a mistake, as our previous posts have made clear. Income shares tend to fluctuate from generation to generation, but it’s increasingly clear that the narrative of a massive increase in inequality over the past four decades has been driven by a handful of academics utilizing remarkably bad data.

As Larry Summers pointed out while debating Emanuel Saez back in 2019 – “I find myself about 98.5 percent persuaded by their critics that their data are substantially inaccurate and substantially misleading.”

Saez’s reply? “Maybe we got all our numbers wrong but read our book, look at the numbers, make your own judgement.”

Summers: “I think I am familiar with your numbers and I have made my own judgement, as have a legion of other scholars who have thought about the consequences of 90 percent tax rates….”

That’s it. This is what the entire progressive agenda is built on – French academics sporting bad data sets who are unable or unwilling to defend them in public.

Just how inaccurate their data might be was amplified last week. George Mason Professor Vincent Geloso is out with a new paper that looks at income captured by top earners prior to 1960.

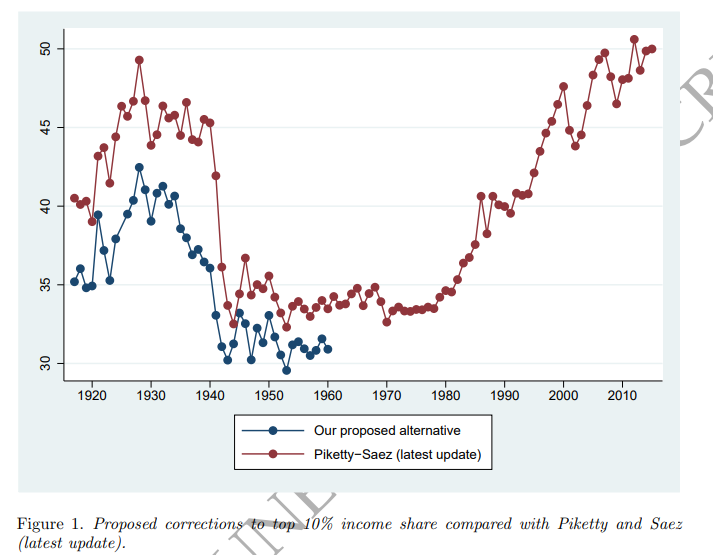

That blue line above is Geloso’s corrected percent of income earned by the top 10 percent from 1915 through 1960. As you can see, their income share popped during the roaring 20’s and subsequent Great Depression but fell to a fairly stable 30-plus percent thereafter. Throughout the entire period, however, Geloso’s income share estimates for the top ten percent are significantly lower than corresponding ones from Piketty-Saez.

What’s helpful about these new numbers is that they sync up nicely with previous work done by economists Auten and Splinter, who focused on correcting the Piketty-Saez errors from 1960 on.

Far from the top 10 percent seeing their income shares rise from the mid-thirties in 1940 all the way up to nearly 50 percent today, the combined Geloso-Auten-Splinter data show the top 10 percent have derived a steady thirty-plus percent of overall income since the end of the Great Depression. That’s not just steady – it is amazing. Think of the dramatic changes to both our society and our economy over the last 80 years. To find that the basic distribution of income shares over that time has remained this stable is something we should be proud of. It certainly doesn’t scream “transform me!”

So the data showing a massive increase in income inequality over the past century are fatally flawed post-1960, and fatally flawed pre-1960. No wonder Saez didn’t defend his work. Inequality rises and falls with the times, but the idea that it is rising out of control in the last few decades is simply false.

Why does S-Corp care? Two reasons. First, this flawed narrative of a massive growth in inequality is driving lots of bad tax policy these days. As Auten-Splinter write:

The idea that U.S. income inequality has increased dramatically since the 1960s has become one of the most powerful narratives of our time, fueled by the conclusions of studies using income tax data (Piketty and Saez, 2003; Piketty, Saez, and Zucman, 2018). Broad acceptance of this view has raised concerns that increasing inequality could indicate greater concentration of political power and increased rent-seeking (Stiglitz, 2012; Lindsey and Teles, 2017) or increased bargaining power of top earners (Piketty, Saez, and Stantcheva, 2014). In turn, such concerns have led to speculation that inequality could lead to decreasing institutional accountability, reduced economic efficiency, and stagnating middle-class wages.

We spent the past year opposing one tax hike proposal after another, including the imposition of capital gains at death, mark-to-market taxation, wealth taxes, surtaxes, and, as always, plain old-fashioned rate hikes. To one extent or another, all these proposals were motivated by the idea that the rich have gotten richer while the middle-class has remained stuck. These papers effectively challenge that premise and undermine the validity of the policies built upon it.

Second, failure to account for the growth of the pass-through sector is one of the major flaws in the Piketty-Saez data. As Auten-Splinter wrote previously:

The most significant tax reform in the period studied was TRA86, which lowered individual tax rates and broadened the tax base. The base-broadening was targeted at high income taxpayers, including limiting deductions for losses on rental income and passive investments. The reform also motivated some corporations to switch from filing as C to S corporations and to start new businesses as passthrough entities (S corporations, partnerships, or sole proprietorships), causing more business income to be reported directly on individual tax returns. This is because all passthrough income is reported on individual tax returns while C corporation retained earnings are not. Before TRA86, the top individual tax rate was higher than the top corporate tax rate (50 percent vs. 46 percent), allowing certain sheltering of income in C corporations with retained earnings. This incentive was even larger when the top individual rate was 70 percent in the 1970s and 91 percent before 1964. TRA86 lowered the top individual tax rate below the top corporate tax rate (28 vs. 34 percent), reducing the incentive to retain earnings inside of C corporations and creating strong incentives to organize businesses as passthrough entities. Our analysis accounts directly for the limitations on deducting losses and indirectly for the shift into passthrough entities by including corporate retained earnings. This leads to important findings for in the 1960s and 1970s, when high individual income tax rates created strong incentives to shelter income inside corporations. Without these corrections, top income shares are understated before 1987. [Emphasis added.]

In other words, pass-through businesses don’t create income inequality, C corporations mask it. That’s why everybody was a C corporation pre-Reagan, and why everybody would go back to being a C corporation if the Build Back Better Act were enacted. Imposing marginal rates of 50 percent or more on pass-through owners, all based on badly flawed data, would force them to change how they are structured, how they do business, and whether they keep the company. That would be great for Wall Street, but bad for Main Street and bad for the people who work there.

The data sets from Piketty, Saez and Zucman are badly flawed and should be discarded by policymakers. So should the tax policies built upon them.