Over the past year, S-Corp has attempted to arm its allies on and off the Hill with as many tools and resources as they need to fight the tax hikes moving through Congress. Today, we are releasing new data from EY showing just how many communities and districts rely on private companies and pass-through employers for their jobs.

These numbers are just the latest in a long list of advocacy items S-Corp has authored or sponsored that show just how misguided the House tax hike legislation is. Below is a complete summary of all these items, together with links to all of them.

New EY Employment Numbers Confirm Pass-Through Importance

Individually- and family-owned businesses don’t just employ the vast majority of private sector workers or comprise nearly all businesses in America. They do so literally everywhere, making them the building blocks upon which thousands of communities across this country are built.

A new analysis from EY shows the extent to which that’s true. Thanks to EY, we now know just how many Americans are employed by individually- and family-owned businesses in each of the country’s 435 Congressional districts. The results are staggering and reveal how important private businesses are to this nation. Below are a few highlights:

- Pass-through businesses, including S corporations, partnerships, and sole proprietorships, employ 62 percent of the American workforce;

- Private companies (pass-through businesses plus private C corporations) employ 80 percent of workers;

- For every worker employed by a public C corporation (27 million), there are more than four employed by a privately-held business (113 million);

- Of the 435 total Congressional districts in America, private companies are responsible for 80 percent or more of total employment in 316 of them;

- Public companies employ the majority of workers (more than 50 percent) in just one Congressional district.

To access the EY Database or to look up the employment numbers for your state or District, use these links:

- EY Study: Employment Data by Congressional District

- EY Study: Full Dataset

Why does any of this matter? Because the Build Back Better Act (H.R. 5376) would disproportionately harm private businesses, putting those jobs at risk. Under the plan, some 5,000 public companies would still pay a 21 percent tax rate while thousands of private firms would be subject to a litany of rate hikes resulting in them paying the highest marginal rates in the OECD – over 57 percent when state and local taxes are added in.

Assault on Family Businesses Continues

The “framework” released by the White House last week continues the assault on family-owned businesses. Advertised as a less aggressive plan than the Administration’s Build Back Better (BBB) proposal, the bill would result in higher marginal rates on family-owned businesses than the BBB, and it would apply those rates to S corporations and other pass-through businesses making as little as $500,000 a year.

For pass-through businesses, the bill includes three substantial tax increases. It would:

- Apply the 3.8 percent Net Investment Income Tax to all income earned by S corporations and partnerships. This tax was enacted as part of Obamacare, and it was designed to apply to passive investment income, not the income from active businesses where their owners run the business. This provision would apply to pass-through businesses only and is estimated to raise $250 billion over ten years.

- Make permanent and expand the loss-limitation rules under Section 461. These rules impose a $500,000 limit on the ability of a pass-through business owner to offset their active losses against other forms of income. The Framework would make these rules permanent (they are set to sunset in 2026) and change the rules, so that owners would be severely limited in their ability to deduct these losses. As S-Corp noted in its letter opposing these changes, the result of this revision is to impose more restrictive rules on active losses than are imposed on passive losses. This obviously makes no sense, but it does raise $170 billion over ten years. Again, this entire tax increase would be shouldered by the pass-through community.

- Impose a new surtax on taxpayers, including pass-through business owners, whose Adjusted Gross Income (AGI) exceeds certain thresholds. Specifically, the Framework would impose a 5 percent surtax on a taxpayer’s AGI exceeding $10 million and an 8 percent surtax on AGI exceeding $25 million. As we have noted previously, these high thresholds do not apply to income from family businesses that are held in trust. For those businesses that do have ownership held in trust, which represent a large percentage of successful family businesses, the thresholds are $200,000 and $500,000, respectively. While not all the income subject to these new surtaxes comes from pass-through activities, a substantial portion of it does. This provision is estimated to raise $230 billion over ten years.

These three provisions are not the only hits on pass-through businesses in the Framework, but they are sufficient to illustrate just how bad the Framework will be for family businesses and Main Street, and why the business community is going to strongly oppose this legislation. Congress should soundly reject this effort and tell the negotiators to try again.

Resources

- EY Study: Employment Data by Congressional District

- EY Study: Full Dataset

- S-Corp: Assault on Family Businesses Continues

- S-Corp (PowerPoint): Biden Framework and Pass-through Businesses

A $1 Trillion Tax Hike on Main Street

As we wrote last month, the House tax bill is nothing short of a declaration of war on private businesses. The cumulative tax hikes take the top rate paid on S corporation and partnership profits from today’s 29.6 percent all the way up to 46.4 percent, and include:

- Increasing the top individual rate from 37 to 39.6 percent while lowering the bracket’s threshold to $450,000 for joint filers;

- Expanding the 3.8 percent Net Investment Income Tax to include all S corporation and partnership income above $400,000;

- Capping the maximum 199A deduction at $500,000 for joint filers and just $10,000 for ownership held by estates or in trusts;

- Imposing a new 3 percent surtax on individuals with incomes exceeding $5 million;

- Making significant changes to estate tax rules, including:

- Reducing the unified exemption to $5 million per spouse;

- Limiting the use of grantor trusts; and

- Eliminating valuation discounts for assets not used in the active conduct of a trade or business.

- Increasing the top capital gains rate from 23.8 to 25 percent (not counting the 3.8 percent NIIT and the new 3 percent surtax) for taxpayers making more than $400,000;

- Tightening and making permanent the $500,000 loss limitation rules.

Not only would more than one million family businesses see their rates go up, but the low income thresholds for the 199A deduction cap and 3-percent surtax for family businesses held in trust would hit businesses with owners whose incomes are well under President Biden’s $400,000 pledge.

The JCT’s distribution analysis showed the extent to which family-owned businesses already pay their fare share, and how much they’d suffer under the House tax bill. As we wrote at the time:

According to the tables, under the Neal bill taxpayers making more than $1 million a year would see their effective (average) rate rise from 30.2 percent 37.3 percent. Average rates are the taxes you pay on every dollar you earn and that is a massive increase at any time, let alone at the end of a pandemic.

How much of this affects Main Street? According to a 2011 Treasury study on small businesses, four out of five taxpayers with incomes exceeding $1 million were business owners. That proportion is likely higher today.

But wait, there’s more. Remember how the rich don’t pay their fair share? The tables show just how much of a lie that is. Not only is the Code obviously progressive, with low-income taxpayers paying negative rates and upper income taxpayers paying multiples of the rates paid by the middle-class, but according to the JCT, taxpayers making more than $100,000 will pay $3.2 trillion of the total $3.8 trillion expected to be collected in 2023 under current law.

That means families and businesses representing just 20 percent of all taxpayers pay over 80 percent of the total taxes paid. That’s more than fair, and that’s the law as it currently stands.

Resources

- S-Corp: Neal Draft Targets Main Street

- S-Corp: JCT Confirms Assault on Main Street

- S-Corp: White House Shortchanges Main Street

199A Essential for Parity

Capping the Section 199A deduction is a core part of the rate hikes outlined above. It comes after four years of continuous criticism from both the left and right, including representatives of public corporations, for whom hundreds of billions in tax cuts, shutting down Main Street in response to COVID, and floods of cheap money courtesy of central bankers are just not enough.

To respond to these critiques, S-Corp posted a comprehensive analysis that looked at the economic impact of paring back the deduction.

S-Corp advisor and Board member Tom Nichols, of law firm Meissner Tierney Fisher and Nichols, also published a solid defense of the deduction in Tax Notes last month. The excerpt bellow speaks to the importance of the deduction:

Section 199A was enacted to provide rough parity between passthrough businesses (which are typically closely held by a small number of owners and often constitute new or multigenerational family businesses) on one hand, and C corporations (for which most taxable income is earned by publicly held entities) on the other hand. Substantially limiting its scope — especially when tethered to the other drastic tax increases for estates, trusts, and high-income individuals described above — will unavoidably suppress the economic activity of the targeted businesses. More important, destroying the current rough parity between closely held passthrough businesses and publicly held C corporations will force even more closely held businesses into the distortive double tax C corporation regime.

As we’ve written many times before (see here, here, and here), the concept of the “double tax” is a relic, as the bulk of corporate earnings today aren’t subject to it. Nonetheless, this argument continues to rear its ugly (and patently inaccurate) head.

In another excellent defense of the 199A deduction, former JCT head Ken Kies addressed these claims:

Current law should be retained in its entirety. Taking into account all the proposed changes in the pending legislation, passthrough businesses would wind up being taxed more heavily than C corporations, even if current law section 199A is retained in its entirety.

…In the United States it’s common to talk about the double tax on corporate earnings. As a general proposition, it’s not fake news: A corporation pays tax on its earnings and the owners of corporations — that is, the shareholders — generally also pay tax on any remaining earnings that are distributed to them.

Based on the best available data, it’s estimated that no more than 9 percent of annual corporate profits are subject to tax a second time, and no more than 14 percent will eventually be taxed upon later distribution (that is, as taxable pension or retirement account distributions). That means that only around a maximum of 23 percent of U.S. corporate earnings ever face a second layer of taxation.

Resources

- S-Corp: The Main Street Defense of the 199A Deduction

- S-Corp: Nichols Explains 199A in Tax Notes

- S-Corp: Analysis Shows 199A is Essential for Parity

- Tom Nichols (Op-Ed, Tax Notes): SOS: Save Our Section 199A

- Ken Kies (Op-Ed, Tax Notes): The Ryder Cap and Section 199A – Really!

- Joint Trades Letter on 199A Repeal

- Joint Trades Letter on 199A Permanence

Family Ownership in the Crosshairs

The proposed changes to grantor trusts included in the Build Back Better Act (H.R. 5376) are a serious threat to Main Street employers nationwide. Its authors claim these changes would ensure billionaires “pay their fair share,” but in reality they would fall most heavily on family-owned businesses, making it all but impossible for some of them to survive from one generation to the next.

To highlight this threat, S-Corp sent a letter to the House’s top tax writers detailing the history of grantor trusts, the flaws in the proposals in H.R. 5376, and the harm they would inflict on Main Street. It states:

…It is important to point out that the grantor trust rules were created by Congress and have been in place for more than fifty years. The practices described above are in full compliance with the rules and, in fact, have been blessed by the courts and by Congress multiple times. Moreover, these tools would need to exist with or without an estate tax. Trusts are used to facilitate the transfer of ownership of a business and to give younger generations a stake in the business while also protecting the business’ assets from creditor claims, claims of a spouse in divorce, etc. There are many non-tax reasons why trusts are necessary.

Given this background, it is one thing for Congress to change these rules looking forward. It is entirely different, and wrong, to retroactively apply the changes to grantor trusts created in the past. Considering the length of time some of these plans have been in place, Congress should take great pains to ensure that established grantor trusts that have relied on rules in place for decades are not upended now, just before they are called upon to preserve a family business.

The proposed changes to existing grantor trust rules will unfairly punish family businesses at a very difficult time, driving many of them into forced liquidations or sales, while stacking the deck in favor of the large, multinational corporations who have thrived throughout the pandemic. They should be discarded.

Resources

- S-Corp: S-Corp Opposes Grantor Trust Changes

- S-Corp Grantor Trust Letter

- Joint Trades Letter on Grantor Trusts and Discounts

Where the Jobs Are

In a recent Wall Street Journal op-ed, S-Corp President Brian Reardon wrote:

The House tax package would hit privately held companies twice as hard as publicly traded C corporations. It would impose marginal rates of 46.4% or more on the former, while taxing the latter as little as 26.5%. No business structure can survive such an imbalance, so the net effect would be to encourage further economic consolidation away from Main Street and toward Wall Street.

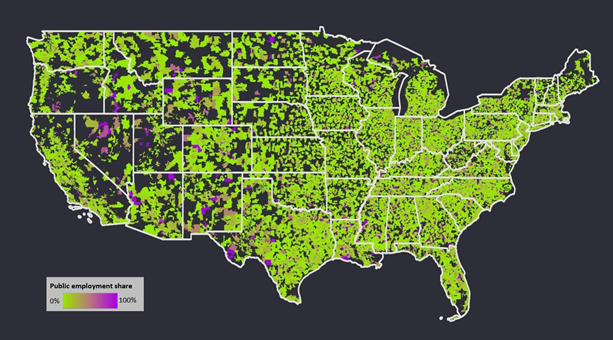

Why should policy makers care? Because private companies are where the jobs are. A new study from EY demonstrates that private companies supply the vast majority of business-sector jobs nationally—77% of them. Public companies supply only 23%. As important, private-company employment is spread evenly across the country while public-company jobs tend to be concentrated in a few cities and states. The Democratic bill would accelerate the decline of less-prosperous regions.

Beyond the massive disparity in employment numbers between public corporations and private businesses, the study showed where these are located. In short, large corporations prefer to hire in dense, urban areas, while private businesses hire workers literally all across the country (there are 22 states where private companies account for more than four out of five workers).

Resources

- Op-Ed, WSJ: The Democratic Plan to Soak Main Street

- S-Corp: Where the Jobs Are

- EY Study: Distribution of Private and Public Company Employment Across the United States

Opposed by the Business Community

It’s common for businesses and trade associations to voice their concerns over specific aspects of a certain bill, or to suggest small tweaks and improvements. What’s far less common is the outright opposition to a legislative proposal, especially by dozens of organizations representing millions of businesses in every sector of the economy.

But that’s exactly what happened last month, when over 120 groups called on lawmakers to oppose the House tax bill in its entirety. The letter sent to Ways and Means Chairman Richie Neal read in part:

As inflation and unemployment remain stubbornly high, Main Streets across the country remain

boarded up, their businesses closed and their workers idle. Estimates suggest up to one-third of all private businesses have closed their doors during the COVID-19 lockdowns, with more joining them every day.

Congress should avoid tax policies that harm Main Street employers at any time, much less at this difficult moment in our nation’s history. The Biden tax hikes pose a triple threat to the ability of these individually- and family-owned businesses to survive an uncertain future, and we urge Congress to reject them.

Resources

Opposed by Voters

Back in July, The Gazette featured an op-ed by S-Corp President Brian Reardon on how Americans really feel about raising taxes on individually- and family-owned businesses and farms:

The Senate needs to decide how to pay for the massive, $3.5 trillion spending plan announced last week, but according to a Punchbowl News poll, only 37% of congressional staffers believe it is likely Congress will pass a tax bill by the end of 2022. Among Democratic staffers, just half think it is likely.

Why so pessimistic? Maybe because Biden’s tax plans aren’t popular with voters. Contrary to what the White House might tell you, a new poll conducted on behalf of the S Corporation Association confirms that American voters do not support aggressive tax policies or those that target individually- and family-owned businesses and farms.

The results of the survey referenced above – which revealed a remarkable lack of support for the President’s agenda – were later presented on a webinar by David Winston, whose firm conducted the survey.

Resources

- Op-Ed, The Gazette: Biden’s Tax Hikes are Unpopular and Congress Knows It

- S-Corp Webinar: What do Voters Really Think About the Biden Tax Plan?

- Survey Findings

Conclusion

The tax bill currently being debated in Congress would hurt private companies and the workers that rely on them. It would accelerate the consolidation of economic power and decision making into the C-suites of a few thousand public companies, leaving thousands of communities worse off. The bill is bad for Main Street and bad for the country.

For anyone still on the fence, we urge you to read the materials outlined above and see if you’re not persuaded. And for those who already understand how devastating this tax bill would be, it’s time to engage. Individual and family-owned businesses are the bedrock of local communities nationwide and they work hard to improve the lives of their employees and neighbors every day.

That message won’t be heard, however, if family businesses stay on the sideline.