The “framework” released by the White House this morning continues the assault on family-owned businesses. Advertised as a less aggressive plan than the Administration’s Build Back Better (BBB) proposal, the bill would result in higher marginal rates on family-owned businesses than the BBB, and it would apply those rates to S corporations and other pass-through businesses making as little as $500,000 a year.

For pass-through businesses, the bill includes three substantial tax increases. It would:

- Apply the 3.8 percent Net Investment Income Tax to all income earned by S corporations and partnerships. This tax was enacted as part of Obamacare, and it was designed to apply to passive investment income, not the income from active businesses where their owners run the business. This provision would apply to pass-through businesses only and is estimated to raise $250 billion over ten years.

- Make permanent and expand the loss-limitation rules under Section 461. These rules impose a $500,000 limit on the ability of a pass-through business owner to offset their active losses against other forms of income. The Framework would make these rules permanent (they are set to sunset in 2026) and change the rules, so that owners would be severely limited in their ability to deduct these losses. As S-Corp noted in its letter opposing these changes, the result of this revision is to impose more restrictive rules on active losses than are imposed on passive losses. This obviously makes no sense, but it does raise $170 billion over ten years. Again, this entire tax increase would be shouldered by the pass-through community.

- Impose a new surtax on taxpayers, including pass-through business owners, whose Adjusted Gross Income (AGI) exceeds certain thresholds. Specifically, the Framework would impose a 5 percent surtax on a taxpayer’s AGI exceeding $10 million and an 8 percent surtax on AGI exceeding $25 million. As we have noted previously, these high thresholds do not apply to income from family businesses that are held in trust. For those businesses that do have ownership held in trust, which represent a large percentage of successful family businesses, the thresholds are $200,000 and $500,000, respectively. While not all the income subject to these new surtaxes comes from pass-through activities, a substantial portion of it does. This provision is estimated to raise $230 billion over ten years.

Added up, S-Corp estimates the total tax increase on pass-through businesses from just these three provisions is over $500 billion. That’s not modest, and it’s much higher than the tax hike faced by public C corporations, with or without the new minimum tax.

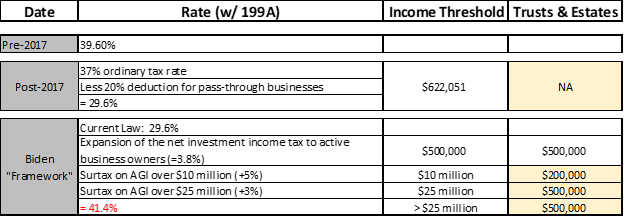

Moreover, it would push top rates on pass-through businesses to new highs, starting with incomes as low as $500,000, even as marginal rates on C corporations remain the same.

As you can see from this table, an S corporation with shares held in trust would pay a marginal rate of over 40 percent if its income exceeds $500,000.

For an S corporation that does not qualify for the 199A deduction, its marginal rate approaches 50 percent! This is at a time where, under the Framework, the C corporation down the street is paying 21 percent.

These three provisions are not the only hits on pass-through businesses in the Framework, but they are sufficient to illustrate just how bad the Framework will be for family businesses and Main Street, and why the business community is going to strongly oppose this legislation. Congress should soundly reject this effort and tell the negotiators to try again.