S-Corp has had about 24 hours to digest the White House “framework” and corresponding legislative text, and the more we read, the worse it gets. For those members worried about raising rates, it’s important to note that a “surtax” is still a rate hike, as is expanding the Net Investment Income Tax (NIIT) to all pass-through income.

As we wrote yesterday, just three provisions – applying the 3.8 percent NIIT to all pass-through profits, expanding and making permanent the loss-limitation rules, and imposing a new 8-percent surtax on pass-through income – amount to a $500 billion-plus tax hike on family-owned businesses.

These tax hikes would apply to business income starting at just $13,000 (for the NIIT) with the top rates kicking in at just $500,000, or well below the $25 million threshold in the headlines. Under this bill, many family-owned businesses will face a marginal rate of 48.8 percent, while public C corporations like Amazon, will skate by with a 21 percent rate.

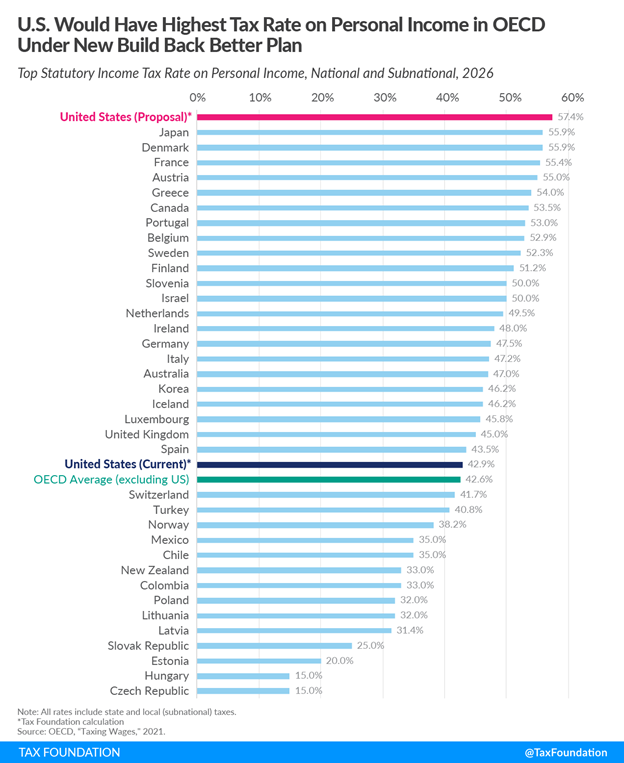

Those rates take into account federal taxes only. As a number of our readers observed, adding in state and local levies will make matters worse. How much worse? Our friends at the Tax Foundation have an excellent writeup that illustrates just how high these taxes get when state and local taxes are layered on:

In addition to the top federal rate, individuals face taxes on personal income in most U.S. states. Considering the average top marginal state-local tax rate of 6.0 percent, the combined top tax rate on personal income would be 57.4 percent—higher than currently levied in any developed country. This assumes the deduction for state and local taxes remains capped.

Taxpayers in New York and California would face the highest tax rates, at 66.2 percent and 64.7 percent respectively, while six other states plus the District of Colombia would have top rates exceeding 60 percent. Even in states that forgo an income tax, such as Florida, taxpayers would have a top rate of 51.4 percent, which far exceeds the top rates found in most OECD countries.

One interesting point made by the Tax Foundation is that the proposed surtaxes are imposed on modified AGI rather than taxable income. Since AGI is larger than taxable income in most cases, that means the 8-percent rate hike in the framework is closer to 9.1 percent when converted into an income tax rate. They also recognize that the current top rate of 37 percent is scheduled to rise to 39.6 percent beginning in 2026. The framework does nothing to stop this tax hike. Add it all up, and the top marginal rate on family businesses is 51.4 percent! Add in average state and local levies, and the rate rises to 57.4 percent.

That means, if this bill is signed into law as is, the United States will hold the dubious honor of having the highest tax rate on personal income among developed nations:

So while some of the rate increases included in earlier versions of the bill have been stripped out (yeah!), they’ve been replaced with new tax hikes that leave some family businesses worse off than before (boo!). Their tax rates are going even higher than the original Biden plan called for.

The Biden framework claims that it “asks more” from large corporations and billionaires in paying for some $2 trillion in new spending, yet saddles America’s Main Street businesses with the bulk of the tax hikes instead. Rather than “building back better,” this bill would be a death knell for the family business community. It needs to be defeated.