Yesterday, California became the latest state to adopt our SALT Parity legislation. The reform was included in the state’s budget for the new fiscal year, which is good news for the State’s 600,000 S corporations who, along with California partnerships and LLCs, can now deduct the full amount of their state and local tax (SALT) payments on their federal taxes. The California good news came on the heels of Minnesota Governor Walz signing into law that state’s SALT Parity bill – H.B. 9 — just yesterday afternoon.

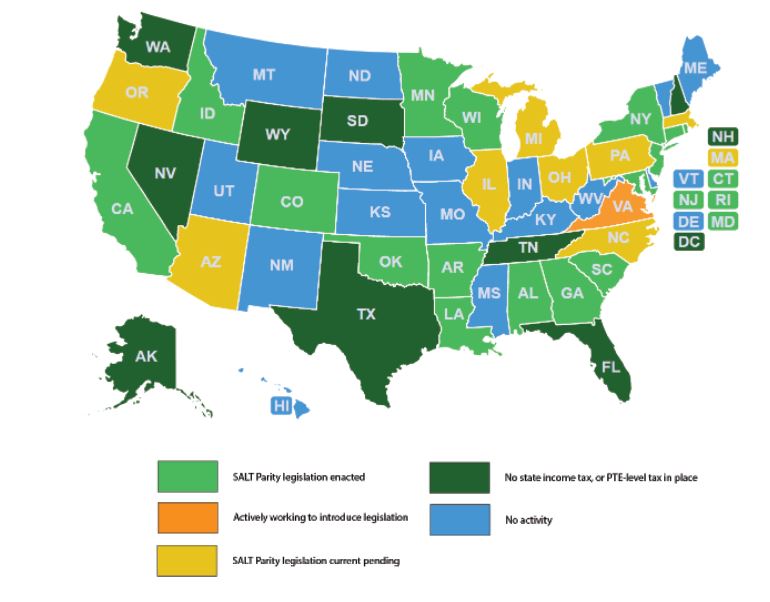

By our rough estimates, that means some $1.7 billion in annual tax relief for businesses in these two states alone. That’s a lot of green – and it’s a benefit that’s spreading across the county (states in green have adopted SALT Parity):

That means SALT Parity has now been enacted in 16 states nationwide, with California and Minnesota beating out a handful of other key states in getting the reform enacted. Here’s a quick review of the progress being made in other states:

- Arizona: H.B. 2838 easily passed the state Senate on Third Read, 26-3, and is now headed to the Governor. The most recent state budget, which included funding for implementing H.B. 2838, is also sitting on Governor Ducey’s desk awaiting signature.

- Illinois: S.B. 2531 passed the Senate in April, the House in May, and the bill is currently awaiting signature by Governor Pritzker.

- Michigan: The state Senate adopted H.B. 4288 earlier this month and the bill is awaiting signature by Governor Whitmer.

- North Carolina: H.B. 334 passed the House in April and cleared the Senate in June. Our SALT Parity language has also been included in three other legislative vehicles.

- Oregon: S.B. 727 was recently introduced in the state Senate and is pending consideration.

- Pennsylvania: H.B. 1709 was introduced in the House just last week, making PA the most recent state to join the SALT Parity parade.

- Ohio: H.B. 124 was introduced back in February and remains pending in the Ways and Means Committee.

- Massachusetts: SALT parity language was included in the Senate version of the state’s FY2022 budget. The MA Department of Revenue has already endorsed the reform and the Governor included it in his budget.

At the beginning of the year, S-Corp set a goal of seeing our SALT Parity bills enacted in at least 20 states. We’re at 16 now, with three bills sitting on governors’ desks and five other states where we’re seeing progress, so our goal is within reach. Businesses in these states will save over $5 billion annually on their federal taxes.

At some point soon, there will be fewer states which haven’t adopted SALT Parity than those who have. That should send a clear signal to the remaining states that now is the time to take up this reform and unlock billions of dollars in relief for their Main Street businesses.