EY has published a new study commissioned by the S Corporation Association entitled “Large S Corporations and the Tax Cuts and Jobs Act: The economic footprint of the pass-through sector and the impact of the TCJA.” The study’s author, Robert Carroll, will be featured at the Main Street briefing today held in the Russell Senate Office Building. You can read the full study here.

Key takeaways from Bob’s work include:

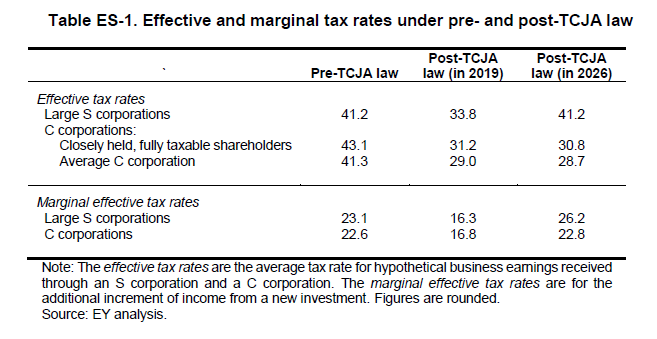

- Pass-Through Tax Parity: In terms of both effective and marginal tax rates, the analysis shows that prior to TCJA, large S corporations and C corporations faced similar tax rates. Rough parity remained following enactment of the TJCA. However, the sector will face significantly higher tax rates in 2026 than C corporations with the expiration of key TCJA provisions, such as the 20% Section 199A deduction for qualified business income.

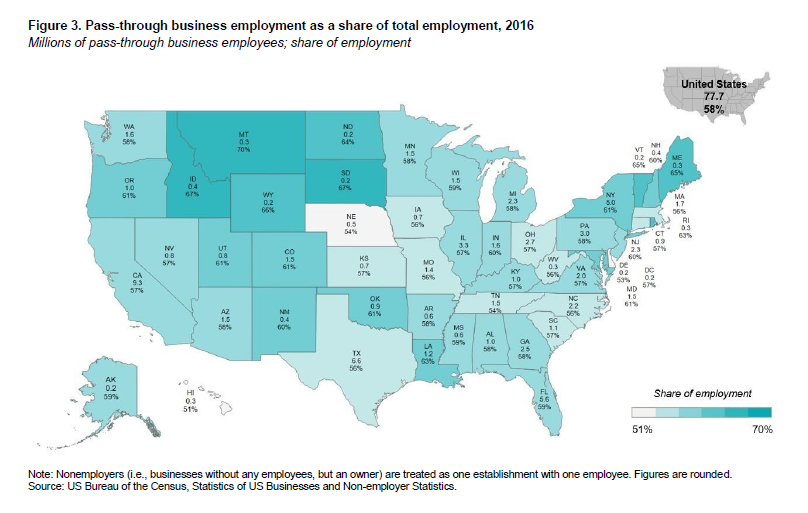

- Pass-Through Employment: Looking at the latest data available (2016), EY estimates that the pass-through sector (S corporations, partnerships, and sole proprietorships) employed 58 percent of the private sector workforce, up several percentage points from our last estimate. Large S corporations, defined as those with 100 or more workers, employed 13.1 million workers, or 10% of the 133 million private sector workers in 2016. States with the highest levels of pass-through employment include 1) Montana (69.7%), 2) South Dakota (67.4%), 3) Idaho (67.2%), 4) Wyoming (65.6%), and 5) Vermont (64.9%).

- Pass-Through Taxes: Finally, EY found that in 2018, individual owners of pass-through businesses paid 51% of federal business income taxes ($326 billion), while C corporations and their individual shareholders paid 49% ($316 billion). The $131 billion in individual income taxes paid by owners of S corporations in 2018 comprised 20% of all business taxes and 40% of pass-through business taxes.

The takeaway for S-Corp is that tax reform succeeded in maintaining rough tax parity between large pass-through businesses and large C corporations, but only if the 199A is in effect and only if it’s made permanent.