Much of today’s tax policy debate is premised on the notion that income inequality is bad and getting worse. Economists Piketty and Saez have published numerous papers making this case (here, and here), and Saez recently wrote a book arguing for a wealth tax to address this inequality. But what if their premise is simply wrong? What if the whole income inequality narrative itself is built on a faulty foundation?

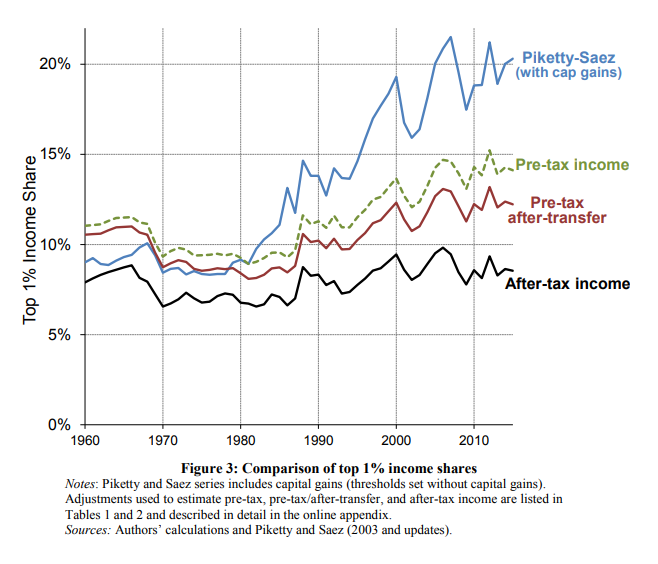

It’s been known for a long time that Piketty’s and Saez’s estimates fail to fully account for missing income sources, shrinking households, and the effects of tax policy on reported income. A new paper by Treasury economist Gerald Auten and Joint Committee on Taxation economist David Splinter takes a comprehensive look at all these issues and comes to the conclusion that income inequality since the 1960s is largely unchanged. Here’s the key illustration:

That black line shows that when you fully account for these missing items, the income share of the top 1 percent is essentially flat. As the authors write, “Our estimates for after-tax income suggest that the top one percent share increased 1.3 percentage point since 1979 and a quarter of a percentage point since 1962.”

One interesting aspect of Auten’s and Splinter’s paper is how much the growth of the pass-through sector affects the figures on income inequality. The sizable shift in business activity from C corporations to S corporations following the 1986 tax reform had the side effect of artificially inflating income for higher income shareholders. Income that previously appeared on C corporation returns was now showing up on 1040s. Auten and Splinter do a nice job of identifying and adjusting for that fact:

The most significant tax reform in the period studied was TRA86, which lowered individual tax rates and broadened the tax base. The base-broadening was targeted at high income taxpayers, including limiting deductions for losses on rental income and passive investments. The reform also motivated some corporations to switch from filing as C to S corporations and to start new businesses as passthrough entities (S corporations, partnerships, or sole proprietorships), causing more business income to be reported directly on individual tax returns. This is because all passthrough income is reported on individual tax returns while C corporation retained earnings are not. Before TRA86, the top individual tax rate was higher than the top corporate tax rate (50 percent vs. 46 percent), allowing certain sheltering of income in C corporations with retained earnings. This incentive was even larger when the top individual rate was 70 percent in the 1970s and 91 percent before 1964. TRA86 lowered the top individual tax rate below the top corporate tax rate (28 vs. 34 percent), reducing the incentive to retain earnings inside of C corporations and creating strong incentives to organize businesses as passthrough entities. Our analysis accounts directly for the limitations on deducting losses and indirectly for the shift into passthrough entities by including corporate retained earnings. This leads to important findings for in the 1960s and 1970s, when high individual income tax rates created strong incentives to shelter income inside corporations. Without these corrections, top income shares are understated before 1987. [Emphasis added.]

This is not a new observation – as we wrote back in 2016, “Pass through taxation doesn’t add to income inequality. C corporation tax treatment masks it.” To our knowledge, however, this is the first time somebody has attempted to fully quantify the income equality effect of the growth in the pass-through sector.

The bottom line is that the Auten-Splinter paper is worth a serious read. While its clear there is a high level of unrest in the country, their analysis suggests our challenges are much deeper than a superficial measure of relative incomes. For tax policy, meanwhile, it suggests there’s a whole lot of policy being driven by bad data these days.