The Experts are Wrong (Part 4)

The key debate before Congress next year is how to tax large, family-owned businesses. There is no debate over how to tax smaller businesses. Nobody on the left or right is arguing to raise taxes on small businesses.

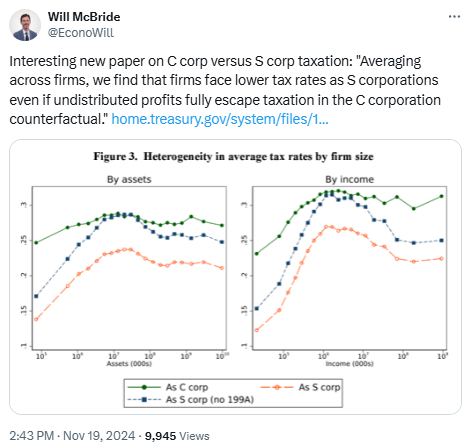

This reality is lost, once again, on the tax experts. For example, several economists at Treasury are out this month with a new paper on business tax rates and our friends at the Tax Foundation have already flagged it with misleading tweets:

A casual reader would conclude the Treasury paper demonstrates that S corporations pay less than their corporate competition, even when looking at larger businesses. Not so.

Instead, the paper looks at the same “horizontal” equity trap as previous works. Horizontal equity is where you measure how similar firms are treated under the Tax Code, depending on how they are organized. So a particular firm might pay one tax level as an S corporation, and another level as a C corporation. For example, the paper states:

Furthermore, we find spikes in mass around 11 percentage points (Panel A) and 9 percentage points 10 (Panel C), corresponding to the set of firms whose owners are in the 12% ordinary income tax bracket – e.g., joint filers in 2018 with ordinary taxable income between $19,050 and $77,400. For these firms, the S corporation ATR is 12% without Section 199A and 9.6% under current law, while the C corporation ATR is often exactly 21%, as these firms typically do not have GBCs, and their owners face a zero marginal tax rate on long-term capital gains and qualified dividends. Given that these firms tend to have relatively low income, these spikes do not appear nearly as visibly in the dollar-weighted panels.

Translated, small business owners in the 12-percent tax bracket pay less as an S corporation than as a C corporation. But everybody knows that, and it has nothing to do with the tax debate.

The real question is: Can family businesses compete with public C corporations when the corporate rate is 21 percent? Horizontal equity doesn’t apply here for the simple reason that family businesses can’t become public companies, as that would require them to sell the business. Lots of S Corp members have done just that in recent years, with the result that they are no longer family-owned businesses.

For an answer to that question, our EY study continues to be the best resource. It shows rough parity between large S corporations and public companies with 199A in place, but no parity without it.

Adverse Selection: The paper looks at the taxes paid by S corporations, and then measures what they would pay as C corporations. Not surprisingly, the study finds that most – not all – businesses currently organized as S corporations would pay more if they converted. But what if the authors started with the private C corporations and measured how much they would pay if they converted to S corporations? If they pay less, why are they C corporations?

ESOPs: The study includes ESOPs in its averages, which drives down the averages for S corporations and C corporations alike: “If there is no match to any of these tax returns, we assume that the owner is an employee stock ownership plan (ESOP)…. We assume income flowing to ESOPs is entirely untaxed (whether the firm is a C corporation or an S corporation).”

Behavioral Changes: We have long argued that 199A revenue estimates need to include significant behavioral adjustments. The authors agree: “[I]f the law were to change such that all large S corporations were now taxed as C corporations, there would be substantial behavioral effects given the new tax regime, including businesses re-structuring, changes in payout rates, and potentially changes in the wages paid to owners. We have abstracted away from such matters, for the most part. Therefore, our estimates do not correspond to revenue estimates for such a policy change.”

Finally, there is this:

To some extent, these findings depend upon the values of the payout rate () and the deferral/avoidance parameter () that affect the C corporation counterfactual. On the one hand, a simple average across firms results in lower ATRs for S corporations relative to the C corporation counterfactual, regardless of the values of and and regardless of Section 199A. On the other hand, if we give more weight to higher-income firms, reflecting their greater economic importance, then there are some values of and that yield lower ATRs in the C corporation counterfactual. Relative to current law, only values of and quite close to zero would suffice (see Figure 8). Relative to the no-199A counterfactual, if we set = 0.28 (the average payout rate for similarly sized C corporations), then retained earnings would need substantial benefits from deferral to result in lower ATRs in the C corporation counterfactual. [Emphasis added.]

Translated, they are saying 1) smaller S corporations drive down all their averages and 2) larger pass-through businesses that pay out 28 percent or more of their after-tax profits are screwed regardless of how they are organized. We’ve been making that point repeatedly as well.

How to conclude? “Get ready” is what we say. The Corporate Tax Industrial Complex (CTIC) is in full swing and you can expect many more studies like this, coupled with sounding board tweets, panels, webinars, etc. As noted, this study says little to nothing about the debate before Congress, but that won’t stop them from trying to make you think it does.

Event Spotlights Section 199A Permanence

Earlier today our friends at NFIB held an event on Capitol Hill focused exclusively on the looming expiration of the Section 199A deduction, and what it means for the Main Street business community.

The event kicked off with a discussion featuring Ways and Means members Lloyd Smucker (R-PA) and Brad Schneider (D-IL). S-Corp readers will recognize Smucker as the lead sponsor of our Main Street Certainty Act in the House, which now has 192 cosponsors!

A couple highlights – first, Representative Smucker discussed the importance of making 199A permanent:

As head of the Tax Team specifically focused on small business finance and tax structure, we’ve held multiple roundtables and heard from small business owners that those additional dollars back in their pockets allowed them to reinvest in their businesses, their workers, and their communities. If we allow [199A] to expire, and the individual rates to expire, it’ll be the largest tax increase in our history. So our goal is to make this permanent to provide the predictability that small business owners want to see. It’s a key provision of our agenda in terms of what this tax package should look like. As you mentioned [my 199A permanence bill] has 192 cosponsors now, including some Democrats, so there’s bipartisan support for the idea. Because people see the impact of these businesses on their communities, and how the health of these businesses is critical to the health of these communities.

Congressman Schneider then hit on an important theme we’ve made in the past – that family businesses need a viable pass-through structure in order to compete with larger public companies:

There is a difference between C corporations and large multinationals, and small businesses – whether they’re family owned or privately owned….

For the closely-held and family-owned businesses, they don’t have access to the same capital markets. So for a small business, the key things they require are access to capital, access to talent, and access to a stable political environment. And they don’t have the same way of going to market for capital; they’re either going to family and friends, maybe their local community bank, whose presence is shrinking. Their opportunities are less….

So maintaining that ability to be an LLC, S corporation, partnership, and keep that closeness, to access that capital, and invest in their people and products, and doing it in a way that’s very different than these large companies. That’s why it’s so important that we have a Main Street strategy.

Exactly. Family-owned businesses may be the economic cornerstone of most communities, but they face specific challenges not shared by public corporations. The Tax Code should not add to those challenges by taxing them at higher rates.

That’s where Section 199A comes in. It ensures the rates paid by local, family-owned businesses are not 50 or 100 percent higher than the public company they compete with. Congress is poised to make sure 199A remains in the Tax Code next year, and we’re going to do what we can to support that effort. Today’s briefing by NFIB was a big help.

CTA Update | November 13, 2024

Notable Developments

- Lawmakers ramp up pressure on FinCEN

- Revisiting compliance cost estimates

- Trump officials slam CTA

- FinCEN offers limited filing relief

- Physicians join the legal fight

* * *

Legislative Update

Last week more than 40 lawmakers sent a letter to FinCEN requesting a one-year delay of the CTA’s fast-approaching reporting deadline. The effort was led by Congresswoman Lisa McClain (R-MI) and cites ongoing concerns over the lack of awareness among affected businesses when it comes to their new compliance obligations, the confusion surrounding several ongoing legal challenges, and other critical issues.

As we wrote in a recent post, the letter helps put this issue back on the forefront of lawmakers’ minds as they enter the lame duck session. So while time is quickly running out, we still have some viable legislative paths to enact a delay.

* * *

Regulatory Update

One aspect of the CTA debate that’s largely gone ignored by policymakers is the estimated cost burden on the small business community.

How much will affected entities spend to comply with the new regulatory regime? Per FinCEN’s own estimates, the first year cost is a whopping $21.7 billion, and $3.3 billion each year going forward.

But that’s likely on the low end, given the analysis was based on a traditional understanding of “owner,” rather than FinCEN’s far more complex definition of “beneficial owner.” Per the agency’s analysis in its final rule, the range of total estimated costs – depending on complexity – reaches $85.1 billion on the upper end in Year 1, with an additional $13.1 billion each subsequent year. That’s a staggering figure and amounts to a massive backdoor tax on the Main Street business community.

* * *

Political Update

A recent tweet from our friend and ally Carol Roth highlights opposition to the CTA from key members of the incoming Trump administration. The first comes from former SBA Administrator Linda McMahon, who is running the Trump transition team and is slated to become the next Commerce Secretary:

It also serves as a useful reminder that Vice President-elect JD Vance is no fan of the CTA either:

As the transition continues we remain hopeful for a more definitive signal from the Trump administration that they will bury this ill-conceived law.

* * *

Regulatory Update (Part 2)

FinCEN has previously signaled that it will not act unilaterally to delay the CTA’s filing deadline, citing a lack of statutory authority. That flies in the face of the ongoing 1099-K threshold saga, which Treasury has delayed for years now, as well as a recent announcement from FinCEN that it would provide relief from the CTA for entities impacted by recent natural disasters:

The U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) has announced that certain victims of Hurricane Milton, Hurricane Helene, Hurricane Debby, Hurricane Beryl, and Hurricane Francine will receive an additional six months to submit beneficial ownership information reports, including updates and corrections to prior reports.

FinCEN has issued five Notices extending the filing deadlines to for reporting companies that 1) have an original reporting deadline beginning one day before the date the specified disaster began and ending 90 days after that date, and 2) are located in an area that is designated both by the Federal Emergency Management Agency as qualifying for individual or public assistance and by the Internal Revenue Service as eligible for tax filing relief.

* * *

Legal Update

On October 28th four individual plaintiffs joined with the Association of American Physicians & Surgeons in suing FinCEN in the US District Court for the Northern District of Texas.

As a reminder, there are now ten cases in various courts across the country challenging the validity of the CTA. Here are the links:

- Alabama (appealed): NSBA et al v. Yellen (11/15/2022)

- Ohio: Robert J. Gargasz Co., L.P.A. et al v. Yellen (12/29/2023)

- Michigan: Small Business Association of Michigan et al v. Yellen (3/1/2024)

- Maine: William Boyle v. Yellen (3/15/2024)

- Texas: NFIB et al v Yellen (5/28/2024)

- Massachusetts: BECMA et al v Yellen (5/29/2024)

- Oregon: Firestone v Yellen (6/27/2024)

- Utah: Taylor v Yellen (7/29/2024)

- Virginia: Community Associations Institute v. Janet Yellen (9/10/2024)

- Texas: Association of American Physicians & Surgeons et al v Yellen (10/28/2024)

Lawmakers Renew Push for CTA Delay

Here’s a bit of good news on the Corporate Transparency Act front. More than three dozen lawmakers have sent a letter to the Financial Crimes Enforcement Network requesting a one-year delay of the CTA’s fast-approaching reporting deadline.

The effort was led by Congresswoman Lisa McClain (R-MI) and cites ongoing concerns over the lack of awareness among affected businesses when it comes to their new compliance obligations, the confusion surrounding several ongoing legal challenges, and other critical issues. The letter was signed by 44 House members, including Majority Whip Tom Emmer (R-MN) and Financial Services Committee Vice Chair French Hill (R-AR).

With time running out before the year-end reporting deadline, the potential for a delay comes as welcome news to the 33 million entities who would directly benefit from the relief. It’s also clear from our discussions with legislators and staff that the renewed focus on the CTA is no coincidence. The more small business owners learn about the new requirements, the louder their voices become in asking elected officials for help.

The call in the letter for a 1-year delay was echoed by business advocates on “X”, including numerous trades and Carol Roth:

This dynamic also helps explain recent legislative efforts to implement either a delay or the wholesale repeal of the CTA. For example, the Protect Small Business and Prevent Illicit Financial Activity Act (H.R. 5119) passed the House in a near-unanimous vote last year but has remained stalled in the Senate over opposition from Senate Banking Committee Chairman Sherrod Brown (D-OH). The bill’s sponsor, Congressman Zach Nunn (R-IA) also recently introduced a similar delay bill (H.R. 9278) which enjoys support from both sides of the aisle.

Meanwhile, Senators James Lankford (R-OK) and Tim Scott (R-SC) introduced amendments to this year’s National Defense Authorization Act (NDAA), the annual spending package that is one of this year’s few remaining must-pass bills. Finally, the bicameral Repealing Big Brother Overreach Act (H.R. 8147 / S. 4297) remains pending in both chambers, with support growing by the week.

The bottom line is that, even with two months to go before the year-end filing deadline, a delay attached to the NDAA, the government funding bill, or another legislative vehicle is still possible. So a big thank you to Congresswoman McClain and the other signatories and a general call to the business community – now is the time to weigh in with your lawmakers. If we are going to succeed in delaying this reporting deadline, Main Street needs to be heard!

Congressman Hern Hosts 199A Roundtable

The Main Street Employers Coalition gathered in Oklahoma City earlier today for a roundtable discussion with Congressman Kevin Hern, himself a former pass-through owner and an original cosponsor of our 199A permanence bill.

It was a perfect venue for the gathering. Nearly two out of every three private sector jobs in Oklahoma are supplied by pass-through businesses who rely on 199A to reinvest in their workers and their communities, all while remaining competitive with larger publicly traded companies.

It’s the sixth event the group has helped organize over the past few months (see here, here, here, here, and here), all with the goal of spreading the word about the importance of making permanent the Section 199A deduction.

Congressman Hern set the tone of the meeting early, referencing his own experiences as a business owner and the challenge the Main Street community faces with the looming expiration of the 199A deduction and accompanying lower rates.

On hand were 25 owners and representatives from local establishments operating in many industries, including banking, retail, restaurant, manufacturing, engineering, farming, and contracting. The diverse attendance was yet another reminder that private and family-owned companies are the heart of local economies in Oklahoma and nationwide.

Despite the outsized positive impact Section 199A has on these employers, the deduction is scheduled to expire at the end of next year. The roundtable was organized to highlight this challenge and provide real-world examples of what the deduction means for these companies, and how it has helped them in an increasingly difficult period.

S-Corp is grateful to Congressman Hern for leading this event and we look forward to continuing to work with him to see this important legislation enacted.