S-CORP Testifies

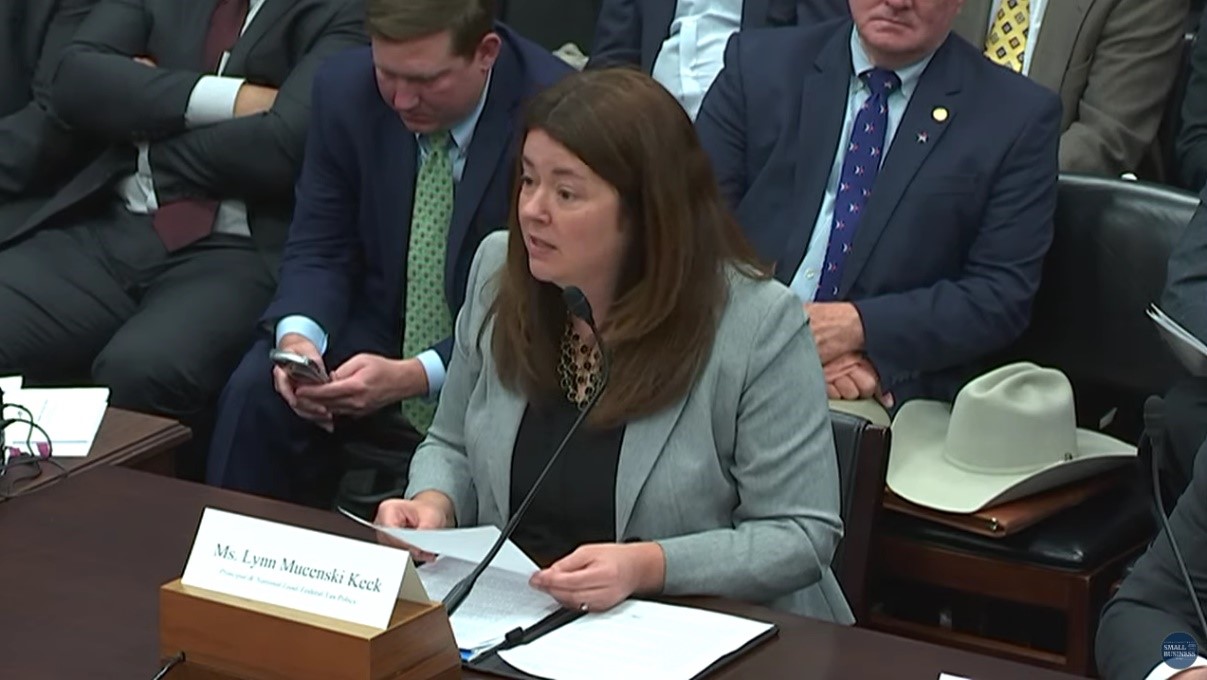

The S Corporation Association took center stage on Capitol Hill yesterday at a Tax Day hearing before the House Small Business Committee.

Lynn Mucenski-Keck, an S-Corp Advisor and Principal at the national accounting firm Withum did a great job representing the pass-through community at the hearing focused on business tax issues and the impact they have on the small business community.

As S-Corp readers know, Lynn is a long-time advocate for, and prolific writer on good tax policy. She is also a past (excellent) guest on our “Talking Taxes in …

(Read More)