Section 199A Reality Check

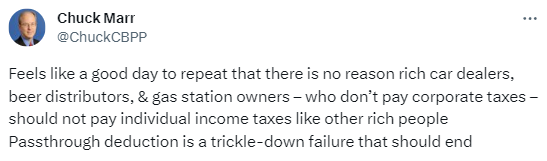

Chuck Marr, who heads up tax policy at the Center on Budget and Policy Priorities, took to Twitter recently to slam the Section 199A deduction. It’s a perfect example of the empty rhetoric deployed by critics of the provision:

There’s a lot to unpack here so we’ll start from the top. First, Marr is correct that pass-through businesses do not pay the corporate tax – they pay tax at individual rates.

These days, that’s a critical distinction, as the 37-percent top individual rate is well above the 21-percent corporate rate. So are …

(Read More)