SALT Parity Certainty

It’s been seven years since the first state enacted our SALT Parity legislation restoring the SALT deduction for pass-through businesses.

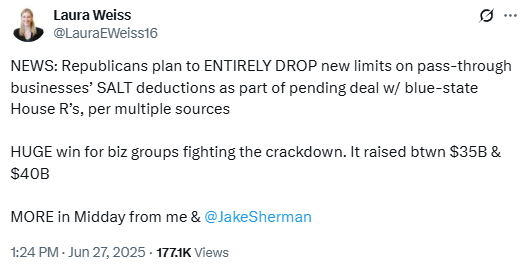

Since that time, thirty-five other states have followed suit, the IRS issued Notice 2020-75 in support of the state laws, and Congress considered but rejected several efforts to repeal or otherwise limit the deduction for pass-throughs. (As always, C corporations continue to deduct their SALT without limitation or debate.)

After all that, you’d think the tax community would accept that our SALT Parity laws are in good standing. You’d be wrong.

The latest example of hand-wringing comes from a recent …

(Read More)