The Economic Risk of Cliff Diving

A key paragraph from today’s Politico Tax highlights a critical issue for Main Street businesses:

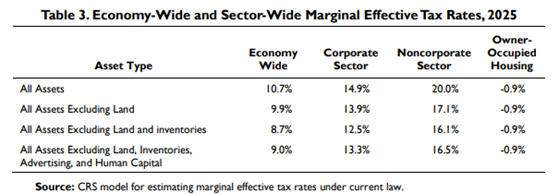

A good number of economists already say that extending the expiring TCJA individual provisions wouldn’t do much to further spur the economy. That’s part of the reason that Trump and his team are plugging some of his more targeted tax cut ideas, while other key Republicans are talking up key tax breaks for businesses, like full expensing for capital investments.

But that focus misses the point entirely. The question isn’t whether extending current policy would provide a bump– it’s whether allowing a massive tax hike to …

(Read More)