Main Street 199A Resources

Latest update on all the studies, data, and other information S-Corp has compiled in support of the 199A deduction – including the new CRS METR estimates we posted on Monday. The materials below span more than a decade of work and highlight the central role the pass-through sector plays in the American economy, and the importance of the Section 199A deduction to these businesses.

Rate Analysis Tells the Full Story

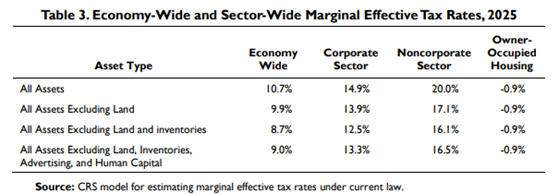

The Congressional Research Service is out with a new study that demonstrates precisely why Section 199A permanence needs to be part of the 2025 tax package. The chart below explains why: