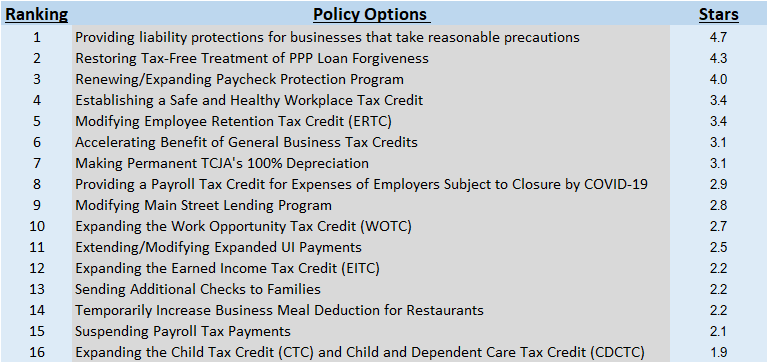

S-Corp Protests PPP Loan Forgiveness Form

The Paycheck Protection Program has been one of the Federal government’s most successful responses to the COVID-19 pandemic, but it’s effectiveness has been hamstrung from the outset by the SBA and Treasury Department.

Today, the S Corporation Association joined 75 other trade groups in objecting to the latest misstep by the agencies – an intrusive and legally dubious 9-page “Loan Necessity Questionnaire” (Forms 3509 and 3510) that larger PPP borrowers would need to fill out in order to have their loans forgiven. The forms demand information not previously required from borrowers and raise new challenges to extending and improving …

(Read More)