Webinar Replay: Midterms Recap

On Thursday S-Corp hosted a webinar to break down the results of the midterm elections, and explain what it all means for the S corporation business community.

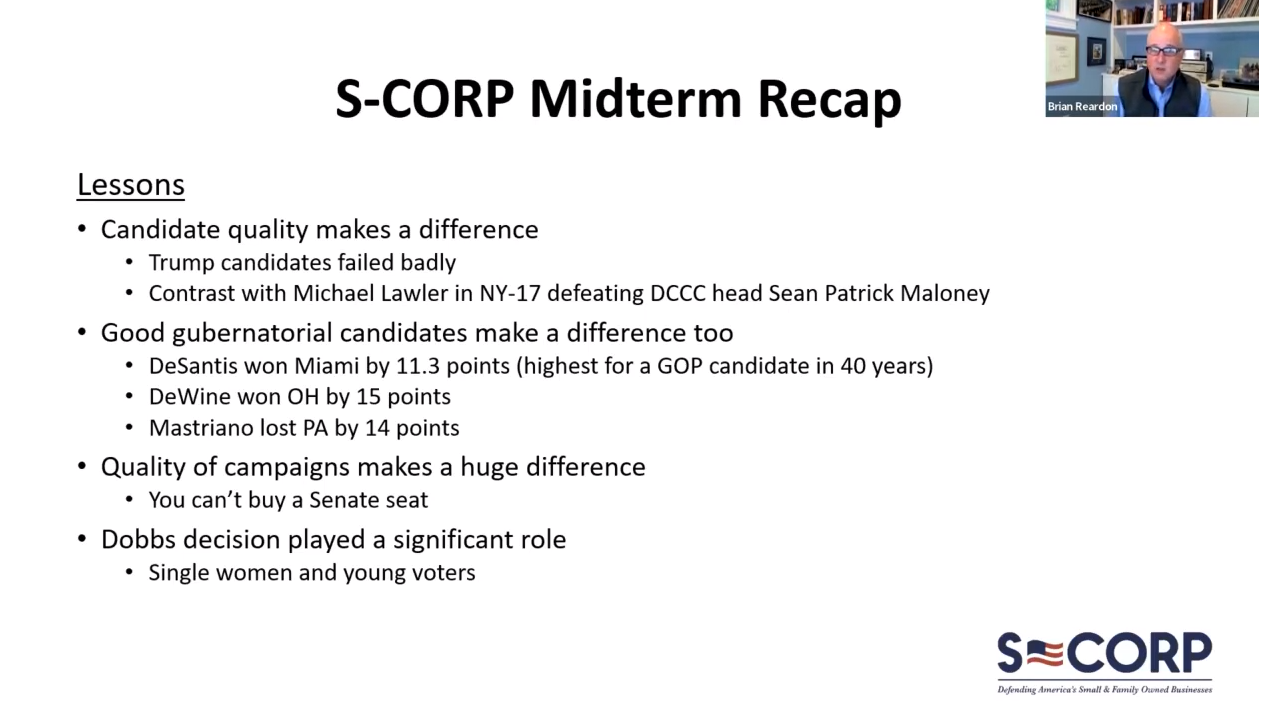

Hosted by S-Corp President Brian Reardon, the webinar laid out everything we know so far about the results, including why an expected “Red Wave” never actually reached the shore, the various scenarios that could still play out in the House and Senate, and the implications for tax policy in the lame duck and beyond.

A recording of the webinar can be accessed by clicking the image above, …

(Read More)