199A Takes Center Stage

As we wrote earlier this week, it’s a busy April for tax policy. The packed agenda kicked off Tuesday with a hearing at the House Small Business Committee entitled, “Exploring the Adverse Effects of High Taxes and a Complex Tax Code.” It was the perfect opportunity to highlight the tax priorities that are top of mind for the Main Street business community and did not disappoint.

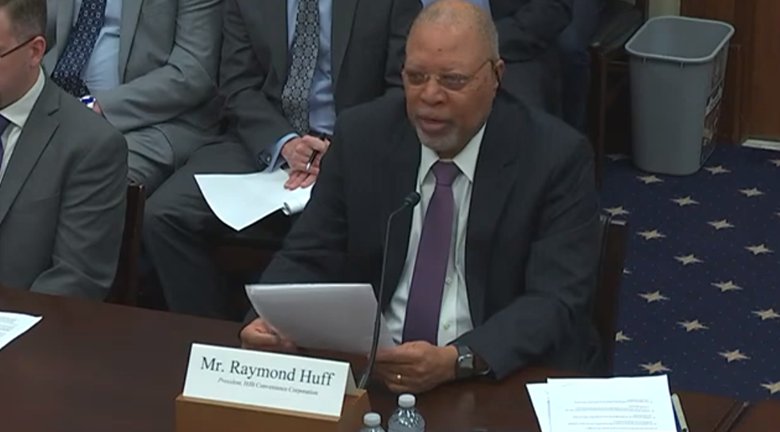

The hearing had a number of high points but we’ll flag just a few, starting with witness Raymond Huff, President of HJB Convenience Corporation based in Denver, CO.

…

…