199A EY Study: Briefing Recap & Recording

Earlier this week S-Corp hosted a briefing to present the results of its latest study, which illustrates just how much economic activity is supported by the Section 199A deduction. The event featured Bob Carroll, Co-Director of EY’s US National Tax Quantitative Economics and Statistics Group (QUEST) and author of the new report, who walked through his findings. (Click here to watch a replay of the briefing.)

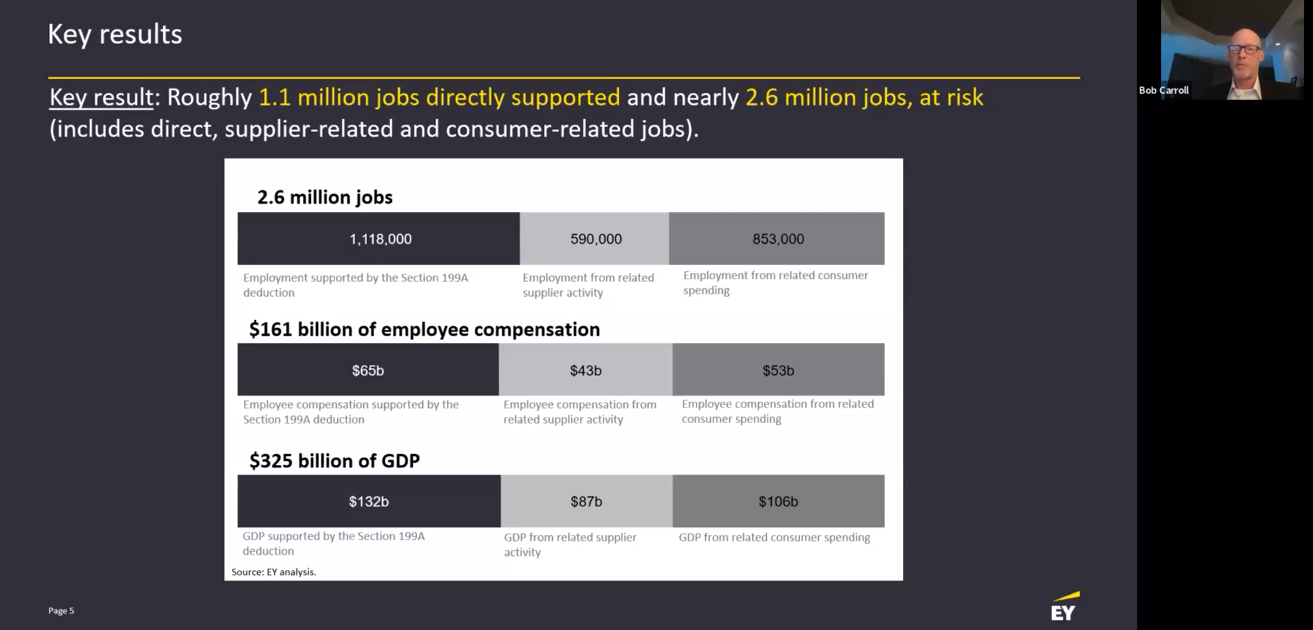

The key takeaway is that Section 199A supports 2.6 million jobs, drives $161 billion of employee compensation, and is responsible for $325 billion of …

(Read More)