Washington Wire

Tax Nerds Gone Wild

Main Street supports the tax bill adopted by the Ways and Means Committee this week, but not all the bill’s provisions are worth keeping. The House provision limiting SALT deductions on pass-throughs is a good example of why the “experts” need close supervision. These provisions are hopelessly complicated and will hurt members of the very Main Street business community this bill is supposed to help.

First, some history. The TCJA imposed a new $10,000 cap …

(Read More)

Main Street Backs Tax Package

More than ninety trade associations came out in support of a broad tax package before the House Ways & Means Committee later today. The legislation builds on the TCJA by making permanent and expanding several key provisions important to America’s pass-through community.

As the letter reads:

This legislation would provide certainty to the more than 95 percent of all American businesses structured as S corporations, partnerships, and sole proprietorships. These pass-through businesses employ 62 percent of the …

(Read More)

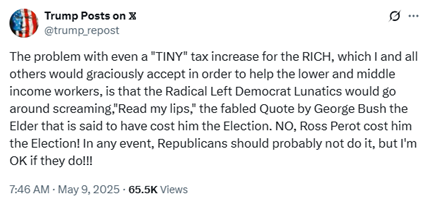

Rate Hikes Still in Play

The White House as recently as yesterday was actively pushing lawmakers to include a rate hike in Tuesday’s Ways & Means markup, with Commerce Secretary Howard Lutnick telling reporters the rate hike was a “smart” move. Then this morning President Trump appeared to back off the effort, posting the following:

An hour later NEC Director Kevin Hassett appeared on CNBC and when asked about …

(Read More)

Main Street (Still) Opposes Rate Hikes

The buzz on K Street is that the White House has resumed its push for Congress to raise the top tax rate as part of the upcoming tax package. If you’re confused by this (possible) development, so are we. Just a couple of weeks ago, the President signaled his opposition to rate hikes. Now they might be back on the table.

While that may be the case, it’s hard to envision a world in which …

(Read More)

Talking Taxes in a Truck Episode 42: Joe Lieber – Bullish on A Tax Deal

Joe Lieber is a founder and co-managing partner of Capitol Policy Partners, a veteran DC insider and a three-time TTT podcast guest! Joe kicks things off with an overview of the tariff debate and where he thinks things are headed, how the bond markets will react, and whether the levies can be rolled into the budget reconciliation package. We then turn to tax policy, where Joe gives his bull case for the massive tax …

(Read More)

Business Community Rallies Against B-SALT Proposals

The closer we get to a real tax bill, the louder the opposition to a possible B-SALT cap becomes. That’s a good thing, because the threat is real.

First, an explainer – lots of folks are talking about C-SALT (state and local taxes paid by corporations) deductions these days, but that’s a misnomer. There is no separate corporate policy regarding SALT deductions. If Congress caps C-SALT, it caps deductions for S corporations and other pass-throughs too. …

(Read More)

Chairman Smith Quashes Tax Hike Rumors

Missouri Congressman Jason Smith, who heads up the tax-writing Ways & Means Committee, was on Mornings with Maria yesterday to talk all things tax policy. The Chairman was asked about a so-called “millionaire tax,” and his response should give comfort to millions of Main Street businesses that would see their taxes increased under the ill-conceived proposal.

Here’s the key excerpt:

What has been discussed by news media …

(Read More)

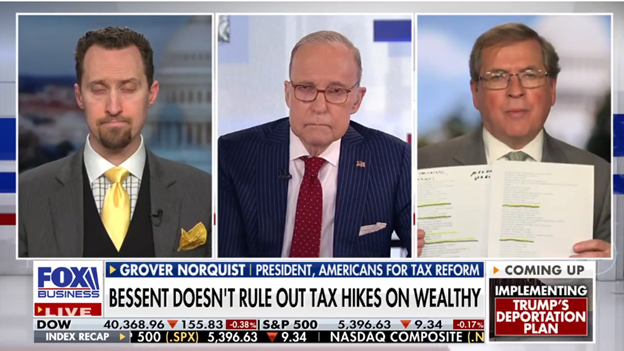

More Pushback on Rate Hikes

The Main Street Employers coalition organized a letter calling on tax-writers to reject rate hikes last week. More than 90 trades, including all our Main Street friends, signed on.

That effort caught the attention of Americans for Tax Reform’s Grover Norquist, who flagged it in a recent media appearance.

President Trump is not going to allow the top rate for income taxes to be increased. That …

(Read More)