Tuesday’s election results underscore the importance of redoubling efforts to help voters understand the benefits delivered to them by the One Big Beautiful Bill (OB3).

It’s not like we don’t have lots to work with here. For example, our friends at EY recently broke out revenue estimates of the bill’s major provisions in a Tax Notes article. Their findings support S-Corp’s observation that most of OB3’s benefits went to middle-income families and family-owned businesses engaged in traditional Main Street industries.

Here’s the report:

Of the estimated net $4.5 trillion decrease in taxes from 2025-2034, this analysis estimates that OBBBA provisions will reduce business sector taxes by $1.8 trillion (approximately 40 percent of the net tax reduction), with the remaining reductions generally affecting nonbusiness individual income taxes.

So 60 percent of OB3’s benefits went to individuals and families, not the business community. What OB3 provisions benefit families? The lower individual tax rates, the larger child-tax credit, the larger standard deduction, no tax on tips and overtime, a new deduction for seniors, and enhanced credits for childcare and dependent care. With the exception of the lower rates, all these provisions are explicitly designed to benefit families making less than $400,000.

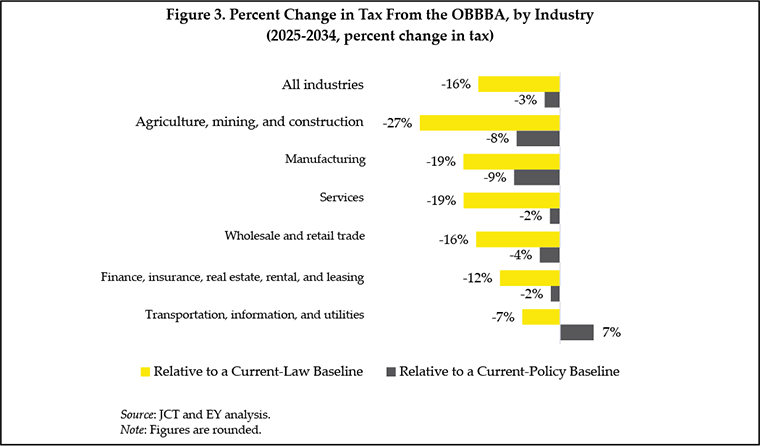

What about the other 40 percent? Turns out the biggest winners on the business side aren’t exactly Wall Street types – they’re farmers, miners, contractors, and manufacturers:

So the main benefits of OB3 go to middle-income families and Main Street businesses. Those groups happen to be very popular with voters too, so this should be an easy sell.

We just have to go out and do it.