The One Big Beautiful Bill is delivering real benefits for millions of small and family-owned businesses, but how many taxpayers know they benefitted, and how should Main Street advocates best communicate those benefits?

That was the central focus of our latest webinar featuring longtime allies David Winston and Myra Miller of The Winston Group, who walked through fresh national and Georgia-specific survey results focused on the new tax bill.

Key takeaways included:

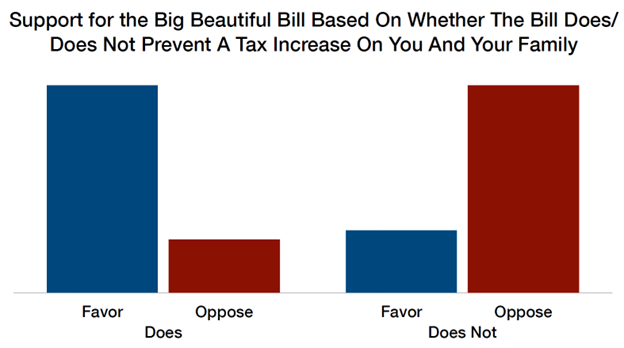

- Taxpayers strongly support the tax bill, but only when they understand how they benefit from its provisions. Main Street advocates need to discuss the specifics of the bill and avoid assuming their audience knows they saw tax relief.

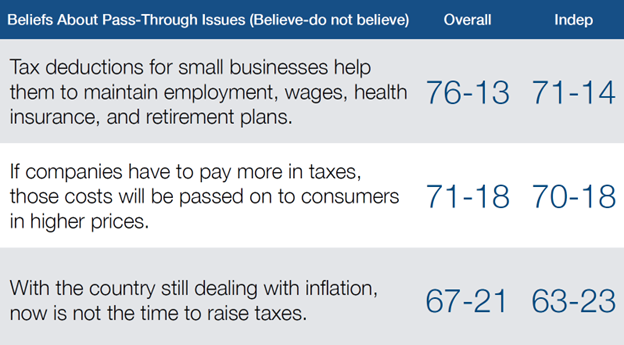

- Taxpayers responded most positively to the three core Main Street provisions – permanent Section 199A, preserving SALT parity, and avoiding rate hikes.

- Finally, while taxpayers are not convinced that inflation is under control, they do fear raising taxes on Main Street businesses would result in higher prices, as the cost of those tax hikes would be passed on to consumers.

So the big tax bill might be signed into law, but the debate over its merits has only begun. For Main Street advocates, you can’t assume business owners know they got a tax cut – you have to be specific and make the case. That’s exactly what we intend to do at S-Corp: highlight how the One Big Beautiful Bill is helping Main Street businesses invest, hire, and grow.

<A full recording of the webinar is available here>