Several months ago, we asked Penn Wharton to help us score some ideas on tax reform. They politely declined. Too busy analyzing the 199A deduction, apparently. Their new paper on the deduction makes two points — the first is wrong and the second, while interesting, is not particularly helpful.

Their first point is that “Section 199A provides a 20 percent reduction in the tax rate for qualified business income relative to ordinary income tax rates.” That’s wrong. The Section 199A deduction reduces a pass-through’s Qualified Business Income, not the tax rate. The deduction makes no claims on tax rates.

This mischaracterization enables the Wharton folks to identify a non-existent “excess” benefit that rhetorically strengthens their case for changing the policy. That was never the policy, however, so there’s no excess benefit and no underlying rationale for the changes.

The straw man gets even more itchy when you incorporate the revenue raisers included in the TCJA. Remember, Section 199A wasn’t just about parity. It was about avoiding a tax hike on Main Street businesses. To calculate the real 199A benefit, you would need to net out base broadeners like the SALT cap, 163(j), the excess loss deduction cap, the loss of the manufacturing deduction, the amortization of R&E expenses, among others.

Finally, Wharton ignores the 199A guardrails. Not everybody gets a 20 percent deduction because QBI excludes foreign income and 1231 gains. So is income excluded from QBI due to the SSTB designation and other guardrails. The result is many larger pass-through businesses see a significantly reduced 199A deduction, while others see no deduction at all.

Add those tax hikes and limitations back into the calculator, and Wharton’s excess benefit quickly becomes a deficit.

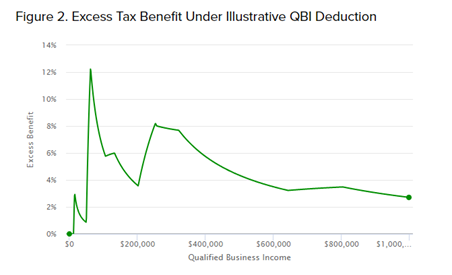

Wharton’s second point, meanwhile, is interesting, but not really all that important. They observe that the interaction of 199A and the progressive rate schedule means some business owners with incomes hovering around the bracket inflection points might see a tax benefit that exceeds 20 percent. Setting aside the above objections, what of it? Again, the deduction was set at 20 percent, not the tax benefit. By comparison, the C corporation rate reduction from 35 to 21 percent is 40 percent. Talk about excess benefits!

What’s interesting is that Wharton’s so-called “excess benefit” is concentrated among lower- and middle-income pass-through owners. Larger businesses don’t benefit from this dynamic because their income stays above the top rate threshold, even after the deduction.

So if policymakers follow the Wharton recommendation, smaller pass-through businesses would shoulder the bulk of the tax hike.

In other words, not much to see here, folks. If the Wharton folks wanted to be helpful in this debate, they could study how the double corporate tax distorts behavior and hurts job creation, or how most of the tax benefit of the TCJA went to regular families and small businesses rather than billionaires, or how tax revenues have been strong post-TCJA while spending has spun out of control, or how the tax code favors public companies at the expense of family businesses. Haha, we jest. That’s not going to happen. Might as well ask Jared Bernstein why the government needs to borrow money.

Congress is going to extend the 199A deduction this year, but it will have to be without the help of the experts and the academics.