Ways & Means Chairman Jason Smith recently told reporters that Section 199A permanence is at the top of his priority list. Yet some in the DC Tax Community continue to crusade against this provision that directly benefits the vast majority of businesses in this country.

A good example is a recent Tax Notes panel on the 2025 tax outlook. During a discussion on Section 199A, Bill Gale of the Brookings Institute commented:

I mean, it’s well known to be expensive, to be extremely regressive, and not to have had anywhere near the desired impact on either investment or hiring etc. It was created for equity for passthrough owners given that the corporate tax was being cut.

We previously addressed the questions of cost and economic growth here and here. In this post, we will address the question of whether 199A reduces the progressivity of the Tax Code.

Regressive? Hardly

A recent CRS report flatly states that the 199A deduction is neutral regarding progressivity — “The Section 199A deduction appears to have little effect on vertical equity, as it does not appear to diminish the progressivity of the federal income tax.” As the report explains:

The deduction has little effect on vertical tax equity. In theory, it reduces statutory marginal tax rates by the same factor (20%), leaving a progressive rate structure intact for pass-through business owners.

Nonetheless, available evidence indicates that high-income taxpayers might capture much of the Section 199A deduction’s overall benefit. Such an outcome would be consistent with what is known about the income distribution of pass-through business profits.

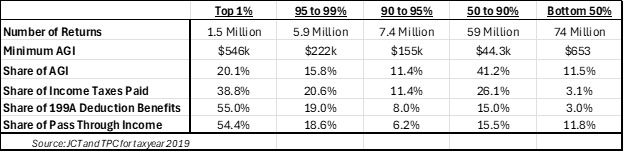

We put together this table to illustrate what the CRS report is talking about. As you can see, in 2019 the top 1 percent of taxpayers earned 54 percent of pass-through income and received 55 percent of the 199A deduction benefits:

This neutrality occurs despite the fact that, as a deduction, Section 199A benefits are tied to the marginal tax rate paid by the owners. The higher the rate, the higher the ultimate benefit. Given that, you’d expect the tax benefits of upper income taxpayers to exceed their income shares, but the table above shows they are consistent with income. What gives?

The reality is that large pass-throughs get the 199A deduction, but only if they employ lots of people or make significant investments. That’s because 199A imposes so-called guardrails on large pass-through businesses so, for example, they only get the deduction up to 50 percent of the W-2 wages they pay, or a similar cap tied to capital investments. A Treasury study shows how these guardrails exclude about 40 percent of pass-through income from the 199A benefit, all from business owners making more than $400,000.

Finally, it is important to remember that Section 199A was not enacted in a vacuum – it was part of a package that included many tax hikes. These included the caps on SALT deductions, excess loss deductions, interest deductions, amortization of R&E expenses, etc. Many of these provisions are permanent and all of them raise taxes on pass-through businesses, primarily larger ones.

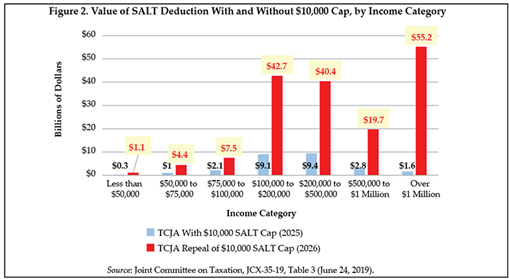

For context, consider this table from Tax Notes. It shows the SALT cap will impose around a $50 billion tax hike on taxpayers making more than $1 million next year. That amount is almost the entire tax benefit of the Section 199A deduction. Obviously, pass-through owners make up just a subset of all taxpayers, but if the concern is progressivity, it’s clear the combined individual and pass-through provisions in the TCJA made the Tax Code more progressive, not less.

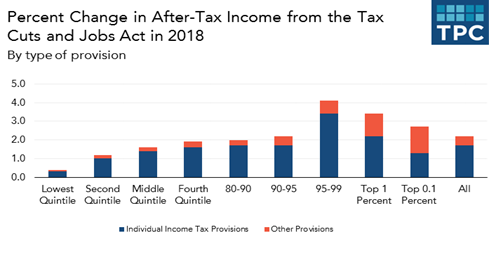

The same cannot be said for the corporate rate cuts. Critics argue that the TCJA primarily benefited wealthy taxpayers, but that is mostly due to the corporate rate cuts. This table from the Tax Policy Center shows that as income rises, so does the benefit from the corporate rate cuts.

Corporate rate cuts don’t benefit pass-through business owners, but it doesn’t stop the critics from blaming 199A anyway.

Corporate rate cuts don’t benefit pass-through business owners, but it doesn’t stop the critics from blaming 199A anyway.

Where the Pass-Through Jobs Are

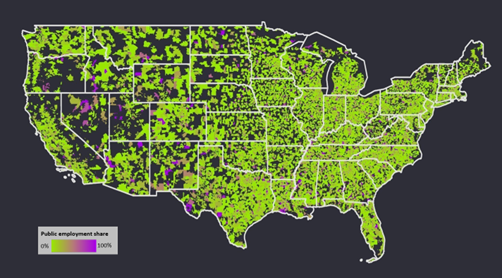

So the experts are wrong again. The Section 199A deduction does not reduce the progressivity of the Tax Code. That’s good for the parts of the country that spoke loudest last month. Those areas rely heavily on pass-through businesses for their jobs and growth (all that green), and those are the areas that have the most at stake when Congress tackles the TCJA sunsets next year.

Ultimately, making Section 199A permanent is not just about fairness and parity — it’s about safeguarding the economic vitality of the communities that rely on pass-throughs. These businesses are the backbone of the American economy, particularly in regions that have been left behind in the modern economic landscape. Section 199A ensures these job creators have the resources to reinvest in their operations, hire more workers, and contribute to local economies.

As Congress looks ahead to addressing the TCJA sunsets, it should recognize the critical role Section 199A plays in sustaining economic opportunity for literally every community across the country.