Today, S-Corp released its latest study in support of the Section 199A deduction for small and family-owned businesses. Authored by Robert Carroll at EY, the study focuses on the economic footprint of the 199A deduction and answers the question: “Just how much economic activity is supported by Section 199A?”

You can access the full report here: As it states:

This report estimates the US economic activity – jobs, employee compensation, and gross domestic product (GDP) – supported by the Section 199A deduction in 2024. Specifically, this analysis provides a snapshot of the economic activity supported at businesses directly benefitting from the 199A deduction, as well as the economic activity connected to this economic activity (i.e., related supply chain activity and consumer spending).

What did EY find?

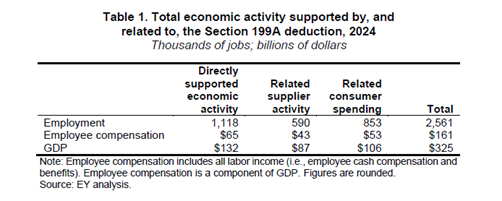

According to EY, Section 199A supports 2.6 million jobs, contributes $161 billion to employee compensation, and adds $325 billion to the national economy. This table summarizes the study’s findings:

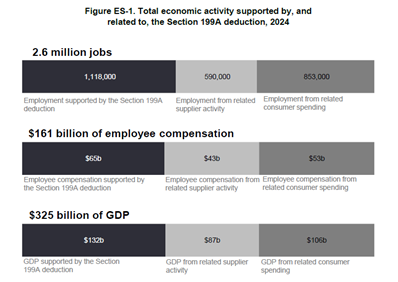

Regarding jobs, the study finds Section 199A supports 1.1 million jobs directly, 590 thousand jobs through increased employee compensation, and another 853 thousand jobs from related consumer spending increases:

These results highlight the importance of Section 199A and how the expiration of the deduction threatens these jobs. Absent congressional action, 2.6 million jobs will be at risk.

To put these numbers in perspective, there are 140 million private sector jobs, of which 88 million (or 62 percent) are located at pass-through businesses (the businesses eligible for Section 199A). Allowing Section 199A to expire would put more than three percent of all pass-through jobs and nearly 2 percent of all private-sector jobs at risk.

Bottom Line:

- The Section 199A small and family business deduction supports 2.6 million jobs in the United States.

- Allowing 199A to sunset puts all those jobs at risk, resulting in less employment, lower wages, and a smaller economy.

- Congress needs to protect Main Street and the people who work there by adopting the Main Street Certainty Act and make permanent the 199A deduction.

These results will become a key part of our 199A advocacy campaign moving forward as Congress works to avoid next year’s fiscal cliff.