The House Ways and Means Committee on Monday released legislation aimed at paying for the Democrats’ $3.5 trillion spending package. Committee members are scheduled to begin marking up the package today and expect to finish on Wednesday. A summary document suggests the tax hikes would amount to some $2 trillion in new revenue, with an additional $200 billion in savings resulting from increased IRS funding.

Provisions Affecting Pass-Throughs

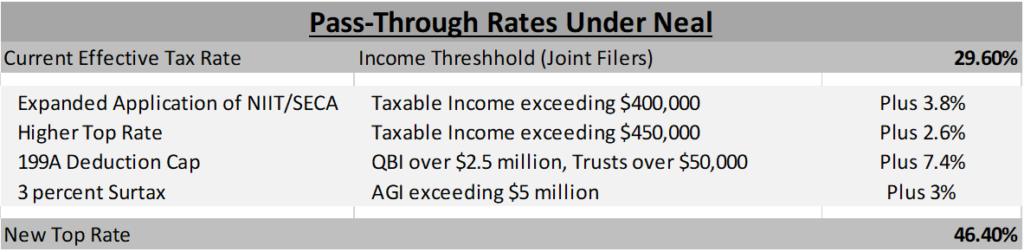

For private businesses, the Chairman’s mark is nothing short of a declaration of war. There’s a reason more than 120 groups wrote the Committee in opposition to the package last week. The bill would take the top pass-through rate of around 30 percent and increase it to over 45 percent (half again as much) and then apply that higher rate on broader base of income. It adds up to nearly $1 trillion in higher taxes on Main Street businesses over the next ten years, and includes:

- Increasing the top individual rate from 37 to 39.6 percent while lowering the bracket’s threshold to $450,000 for joint filers;

- Expanding the 3.8 percent Net Investment Income Tax to include all S corporation and partnership income above $400,000;

- Capping the maximum 199A deduction at $500,000 for joint filers and just $10,000 for ownership held by estates or in trusts;

- Imposing a new 3 percent surtax on individuals with incomes exceeding $5 million;

- Making significant changes to estate tax rules, including:

- Reducing the unified exemption to $5 million per spouse;

- Limiting the use of Grantor trusts; and

- Eliminating valuation discounts for assets not used in the active conduct of a trade or business.

- Increasing the top capital gains rate from 23.8 to 25 percent (not counting the 3.8 percent NIIT and the new 3 percent surtax) for taxpayers making more than $400,000;

- Tightening and making permanent the $500,000 loss limitation rules.

The cumulative effect of these numerous rate hikes is to take the top rate paid on S corporation and partnership profits from today’s 29.6 percent all the way up to 46.4 percent, or higher than the rates that existed pre-TCJA:

Combined with state and local taxes, large S corporations and partnerships will face marginal rates exceeding 50 percent under the committee draft. Even medium-sized S corporations and partnerships, those making between $450,000 and $5 million with ownership shares held in trust, will face marginal rates in the mid-40s, or about 13 percentage points higher than they face now.

These higher rates will apply against a broader income tax base. The Neal bill would expand and make permanent the loss limitation rules as well as tighten the cap on interest deductions. The loss limitation rule alone is projected to increase taxes on pass-throughs by $156 billion over just five years, from 2026 to 2031.

C Corporations

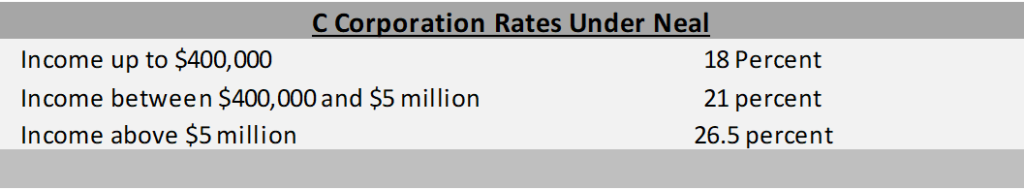

If the Committee was seeking to maintain some semblance of rate parity between pass-throughs and C corporations, it failed, at least as far as public C corporations go. As noted, the Committee draft would raise taxes sharply on pass-through businesses. It also would raise taxes on private C corporations, as those businesses would be subject to the corporate double tax and pay rates similar to pass-throughs.

As we have noted many times, however, public companies are different. Most of them don’t pay dividends and the majority of their shareholders pay little or no tax, as noted by the Tax Policy Center. So the higher dividend and capital gains rates will have little impact on their shareholders and their cost of capital.

Despite this reality, the Neal package would increase the rate on public corporations by just 5.5 percentage points, compared to the 16.8 percentage point increase that applies to S corporations and partnerships. The new rate schedule actually reduces rates on C corporations with incomes under $400,000, holds steady rates for those making up to $5 million, and increases rates on those with incomes exceeding $5 million to 26.5 percent or almost 20 percentage points less than the top pass-through rate.

So an S corporation with its ownership shares held in trust making $1 million a year would pay a top marginal rate of 46.4 percent on its income. If the company were organized as a C corporation, it would pay 21 percent initially, and then 28.8 percent on any dividends or capital gains. For a company paying out all its earnings, the combined rate would be 43.4 percent.

What about a public C corporation making billions? The S corporation is paying 46.4 percent while the C corporation pays just 26.5 percent. If the C corporation is typical, it doesn’t distribute all its earnings and 75 percent of its shareholders pay little or no tax, so the actual tax paid under the second layer is maybe one-quarter the advertised rate, or 8 percent. That equals a combined tax of 34.5 percent, or 11 percentage points less than the S corporation.

That’s not parity, and it means public C corporations like Amazon will continue to have a massive tax advantage over the private companies they compete with, regardless of how they are organized. The second layer applies to private companies, so they will pay similar high rates regardless of how they are organized, and that rate is significantly higher than the rate faced by public C corporations.

Entity Choice

As such, one would expect to see large pass-throughs convert to C corporation and then immediately change their behavior and engage in as much tax avoidance as legally possible. Pull out the old playbooks from pre-1986. The Committee draft would take us full circle on the tax reform life cycle and restore the C corporation as the tax avoidance vehicle of choice.

There’s also a mismatch between the higher rates on pass-throughs making between $400,000 and $5 million and the corresponding C corporation rate, as noted above. Pass-throughs in that income range will be able to cut their initial federal tax rate from 43.4 percent all the way down to 21 percent by converting. That’s going to be tough to pass up on, even if it does buy them into the double tax on some of their remaining income.

Finally, there is something going on between S corporations and partnerships in the Neal bill. The draft contains an odd provision allowing for tax-free conversions of some S corporations into partnerships. According to the summary:

Temporary Rule to Allow Certain S Corporations to Reorganize as Partnerships Without Tax. This provision allows eligible S corporations to reorganize as partnerships without such reorganizations triggering tax. Eligible S corporation means any corporation that was an S corporation on May 13, 1996 (prior to the publication of current law “check the box” regulations with respect to entity classification). The eligible S corporation must completely liquidate and transfer substantially all of its assets and liabilities to a domestic partnership during the two-year period beginning on December 31, 2021.

Why are S corporations converting to partnerships? Not clear, but something is up.

How Many Businesses? How Many Jobs?

One question we often get is how many businesses would be affected by the tax hikes in the Neal draft. As the above table highlights, the bulk of the rate hikes are targeted at pass-through businesses earning above $400,000, although family businesses with their ownership held in trusts will be hit at almost any income level.

A recent Treasury study shows that about 1.6 million business owners will be subject to the higher individual rates. 100,000 or so make enough to run up against the 199A cap in the bill, representing about 20 percent of all pass-through income. Another 12 million are at risk of the cap on 199A deductions if they hold their ownership interests in trust. How many is that? Hard to say.

Same goes for the 3 percent Surtax. The headline says the Surtax applies to incomes exceeding $5 million, but the details say it also applies to pass-through ownership held in trust at just $100,000. Trusts are common, but it is not immediately clear how many businesses that provision will impact. What is clear is that an S Corporation with trusts and income exceeding $450,000 will pay top rates over 46 percent.

So at least 1.6 million pass-through owners will see their taxes go up. For those that hold their ownership in trust, their rates will rise once they exceed $50,000. Businesses facing a tax hike represent about half of all pass-through income, and they employ tens of millions of workers.

Trusts and Estates

As noted above, the 199A deduction cap and 3 percent Surtax would apply to pass-through business owners with incomes much lower than the headline thresholds if they use trusts. For pass-through ownership in trusts or estates:

- The cap on total 199A deductions would be $10,000, not $500,000. That would affect an owner with as little as $50,000 of qualified pass-through income.

- The threshold for the 3 percent Surtax would be $100,000, not $5 million.

Using trusts is a common practice for established family businesses, and not something necessarily tied to tax strategies, so it is unclear why the Committee (and the JCT) is targeting them. If they are concerned about gaming, why not just impose attribution rules for the beneficiaries of trusts holding pass-through ownership shares? And why estates? Having ownership shares held by an estate is not exactly a choice.

Effective Dates

For those worried about effective dates, the increase in the capital gains rate would apply to “taxable years ending after September 13, 2021.” A section-by-section circulated by the Committee states:

A transition rule provides that the preexisting statutory rate of 20% continues to apply to gains and losses for the portion of the taxable year prior to the date of introduction.” The section-by-section also makes clear any capital gains realized after the date of introduction but arising from transactions entered into before the date of introduction pursuant to a written binding contract are treated as occurring prior to the date of introduction.

We believe “date of introduction” in this case means September 13th. Most of the estate tax changes would take effect 1/1/22. The limitations on Grantor trusts, however, would take effect on date of enactment.

SALT

Notably missing from the Neal package was any solution on SALT. We expect to see a SALT amendment offered in committee, so stay tuned. Any amendment would need to be offset with corresponding tax hikes, and SALT relief is expensive. Full repeal would reduce revenues by $300-$400 billion.

Outlook

Where is all this headed? Nobody knows. The public goal for both the House and the Senate is to adopt this package this month, but as Politico’s Brian Faler points out, “though lawmakers have been working behind the scenes to narrow their differences, it’s clear the [Senate and House] are on a collision course on several fronts.”

For his part, Finance Chair Ron Wyden continues to release new legislative proposals, including as recently as Friday, and will want to leave his mark on the final product.

Meanwhile, Senator Joe Manchin said in no uncertain terms on Sunday he will not support a legislative package with a $3.5 trillion price tag:

“(Senate Majority Leader Chuck Schumer) will not have my vote on $3.5 (trillion) and Chuck knows that, and we’ve talked about this,” the West Virginia senator [said].

…”We’ve already put out $5.4 trillion and we’ve tried to help Americans in every way we possibly can and a lot of the help that we’ve put out there is still there and it’s going to run clear until next year, 2022, so what’s the urgency? What’s the urgency that we have?” Manchin said. “It’s not the same urgency that we had with the American Rescue Plan. We got that out the door quickly. That was about $2 trillion.”

Manchin went on to say that “there’s no way” Congress can meet the timeline set by House Speaker Nancy Pelosi to pass it.

Conclusion

So the Ways and Means Committee is pressing ahead with a massive tax hike on private businesses right on the tail end of the pandemic.

The bill rolled out this week doesn’t appear to be viable in the Senate and may not have the votes to pass the House either. The Speaker would like to get this done by the end of the month, so the House can adopt both the reconciliation bill and the bipartisan infrastructure package at the same time but, given the size and array of issues under consideration, its hard to imagine how that might happen.

The best thing the business community can do is to 1) read the bill, 2) assess how it will harm your business, and 3) communicate that reality to your elected officials. This is one of the biggest tax hikes ever considered, its being considered in a rush, and it has the potential to completely alter the business and employment landscape of the country for the worse. Rank and file members of the House and Senate need to understand that.