Video on Main Street Employers’ Briefing

In case you missed it, S-Corp has posted video of its October briefing on Main Street tax issues on its website. The briefing, which took place in the historic Senate Russell Caucus Room and was hosted by the Parity for Main Street Employers coalition, featured Senator Steve Daines (R-MT), Martin Sullivan (Tax Analysts), Bob Carroll (EY), David Winston (The Winston Group) and Chris Smith Parity for Main Street Employers).

It also featured new work from EY and the Winston Group focused on the challenges individually and family-owned businesses face in the post-tax reform world. You can watch the whole briefing on S-Corps YouTube channel and access the new reports by clicking on the links below:

Key takeaways from the briefing:

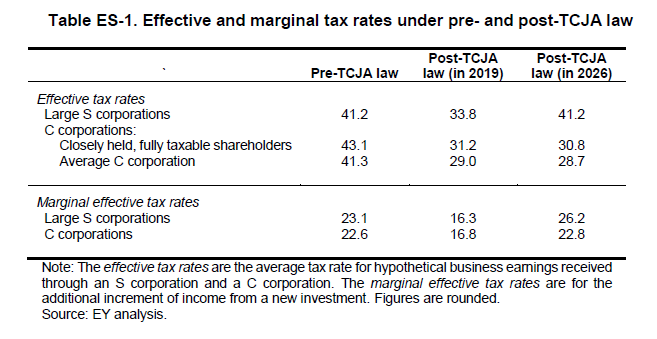

Section 199A the Key to Pass-Through Tax Parity: In terms of both effective and marginal tax rates, EY’s analysis shows that prior to TCJA, large S corporations and C corporations faced similar tax rates. Rough parity remained following enactment of the TJCA. However, the sector will face significantly higher tax rates in 2026 than C corporations with the expiration of key TCJA provisions, such as the 20% Section 199A deduction for qualified business income.

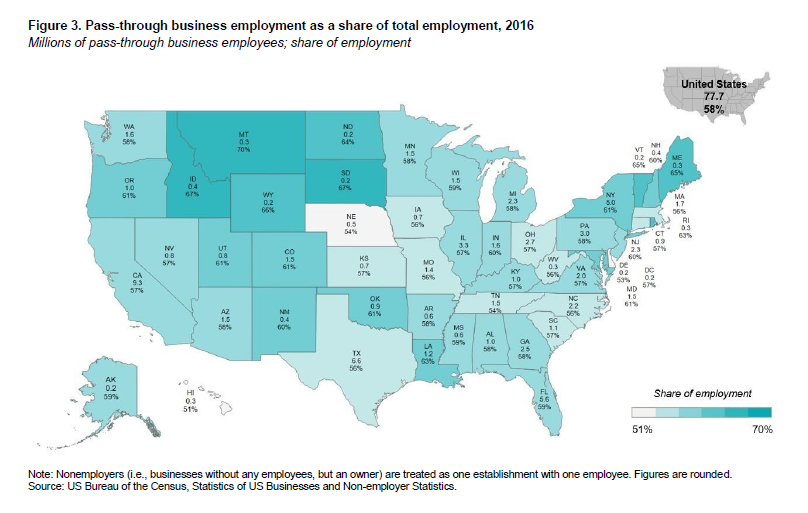

Pass-Through Businesses Employ Most Workers: Looking at the latest data available (2016), EY estimates that the pass-through sector (S corporations, partnerships, and sole proprietorships) employed 58 percent of the private sector workforce, up several percentage points from our last estimate. Large S corporations, defined as those with 100 or more workers, employed 13.1 million workers, or 10% of the 133 million private sector workers in 2016. States with the highest levels of pass-through employment include 1) Montana (69.7%), 2) South Dakota (67.4%), 3) Idaho (67.2%), 4) Wyoming (65.6%), and 5) Vermont (64.9%).

Pass-Through Businesses Pay the Most Taxes: EY found that in 2018, individual owners of pass-through businesses paid 51% of federal business income taxes ($326 billion), while C corporations and their individual shareholders paid 49% ($316 billion). The $131 billion in individual income taxes paid by owners of S corporations in 2018 comprised 20% of all business taxes and 40% of pass-through business taxes.

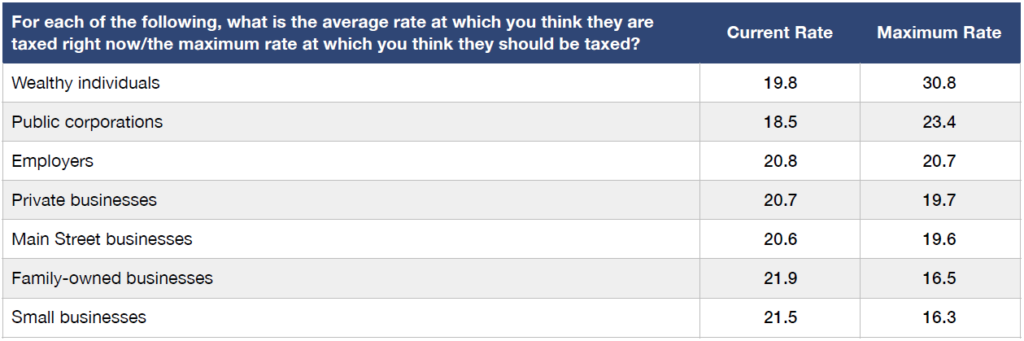

Voters Support Reasonable Top Rates: The Winston Group survey found voters support moderate rates of taxation, even for the wealthy and big business. When asked what the maximum acceptable rate should be for a list of taxpayers, voters responding with rates well below those that are being debated today. Moreover, for all the entities listed, the maximum acceptable rates for each entity was well below the top tax rate many already pay.

Voters Oppose Double Taxation: The Winston Group survey found voters overwhelmingly agree that it is unfair to tax the same business net income twice (77-7 percent agree-disagree). They also believe that a business should be allowed to grow as much as it can and still retain its pass-through status. Some 46 percent believe that once established, pass-through businesses should be able to grow without restriction and be taxed on their net income (46-20 percent believe-do not believe).

Voters Support Main Street: Voters have favorable views of the private sector (59-20 percent favorable-unfavorable), seeing it as more nimble than government and more responsive to consumer needs. Voters believe that small, private, and new business owners face serious competition from large corporations. Some 73 percent believed the statement, “Someone who wants to start their own business will have a hard time competing with large corporations” (73-15 percent believe-do not believe). Another 64 percent believed that “excessive taxes on businesses make it difficult for average Americans to start their own businesses” (64-20 percent believe-do not believe).

The bottom line for S-Corp is that tax reform succeeded in maintaining rough tax parity between large pass-through businesses and large C corporations, but only if the 199A is in effect and only if it’s made permanent. Meanwhile, voters support a tax system that is fair for all types of businesses and encourages the establishment and growth in all types of businesses, and believe that the pass-through structure helps achieve these goals.