Main Street Backs Regulatory Relief Bill

This week, S-Corp joined more than 70 trade associations in urging House leadership to advance meaningful regulatory relief for Main Street employers.

The effort was led by the National Federation of Independent Business. It backs the Prove It Act (HR 1163), legislation that would strengthen the Regulatory Flexibility Act, a 1980 law that requires federal agencies to analyze the impact of proposed regulations on small businesses and consider less burdensome alternatives. Despite being on the books for 45 years, agencies have routinely found ways to sidestep these requirements.

The letter notes the dramatic regulatory shifts of recent years and the urgent need for Congressional action:

In one four-year term, the Biden Administration finalized an unprecedented $1.8 trillion in new regulatory compliance costs and added 356 million in paperwork hours…However, without Congressional action, this relief will only be short term, and small businesses will suffer from the regulatory pendulum swings that make long-term planning and investments so difficult.

Multiple reports from NFIB, the House Small Business Committee, and SBA’s Office of Advocacy have documented widespread agency noncompliance with the RFA. They find that agencies frequently certify that new rules won’t significantly impact small businesses without properly analyzing the costs, undermining the law’s intent.

This message should find a welcome audience with the Trump administration. President Trump has overseen a massive reduction in regulatory costs to the economy (to the tune of over $128 billion), and making permanent rules to protect Main Street from unelected bureaucrats is squarely in their wheelhouse.

The bill cleared the full House in 2024 but stalled in the Senate. Since the new Congress convened last year a new version of the bill has been approved by both the House Judiciary and Small Business committees. More to come on this front.

OB3 Refund Story Includes Main Street

In October we chatted with Piper Sandler’s Don Schneider to preview what the One Big Beautiful Bill would mean for tax season. Don forecast one of the largest refund seasons in history, with the typical refund level expected to grow by nearly $100 billion.

Now the firm is out with new analysis confirming those predictions. It also details how Main Street businesses can expect to benefit.

Based on the latest numbers, Main Street business owners will receive an estimated $27 billion in additional tax refunds during the 2026 filing season. These immediate savings stem from the restored bonus depreciation, immediate expensing, and expanded interest deduction limits made effective starting last year.

This chart is a nice illustration of how Main Street will benefit from the tax bill this spring, with the orange bars representing pass-through business relief. While the business component is concentrated at the upper end, that’s the natural consequence of a tax system where business income is reported on individual returns, and where higher investment levels translate into higher deductions. (Curious about the lack of relief in the 80th-90th percentile bar, though?)

The table also makes clear that the OB3 provided broad-based tax relief to Americans across the income spectrum, with the vast majority of the tax relief this year (83 percent) going to families, and most of that going to the bottom 90 percent of taxpayers.

Finally, these numbers reflect the pending refunds coming this year, but that’s not the whole picture. OB3 made permanent many provisions benefiting families and Main Street businesses – bigger child tax credits, larger standard deduction, 20 percent small business deduction, increased expensing, etc. — and those provisions will keep taxes low for years to come.

As we’ve said repeatedly, tax cuts don’t sell themselves. Taxpayers need to be reminded that they are paying less due to the action Congress took last summer. These pending refund checks are as tangible as tax policy gets, and they are a great opportunity for proponents of the tax bill to help Americans connect the dots on tax policy.

Talking Taxes in a Truck Episode 47: Jared Walczak on the Wealth Tax Proposal That’s Forcing Californians to Flee

On the latest episode of Talking Taxes in a Truck, we’re joined by Jared Walczak, Senior Fellow at the Tax Foundation, to unpack California’s proposed wealth tax and what it signals for state tax policy nationwide. Walczak explains why the unprecedented 5 percent tax – particularly its aggressive valuation rules for founders with super-voting shares – could dramatically overtax entrepreneurs, invite serious legal challenges, and accelerate capital and job flight. Jared also zooms out to talk national migration patterns, as many states move to cut taxes and boost competitiveness while a small number double down on higher taxes, intensifying interstate tax competition and taxpayer mobility.

Tax Cuts Don’t Sell Themselves (But Big Refunds Help)

As tax season progresses, supporters of the Working Families Tax Relief Act are highlighting the provisions that made it possible.

That’s good news because tax cuts don’t sell themselves. As our friend David Winston pointed out in a recent op-ed, convincing Americans they benefited from tax legislation is often harder than passing it in the first place. Absent a concerted effort, the big refunds that are set to hit bank accounts in the months ahead won’t be connected back to the tax bill passed last summer.

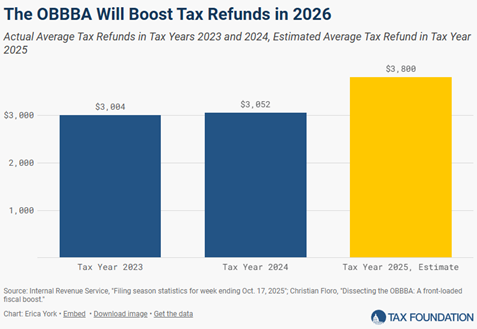

Just to be clear – there’s lots to sell. Tax filing season is officially underway, and by all accounts American families and businesses are in for a pleasant surprise. According to a new analysis from the Tax Foundation, the One Big Beautiful Bill is likely to deliver the largest tax refund season in modern history. Here’s the key chart:

That boost is thanks to the tax bill’s provisions aimed directly at individuals and families, including a more generous child tax credit and standard deduction, increased SALT cap, and new deductions for tips and overtime, among others. The relief was also enacted on a retroactive basis to the start of 2025, so taxpayers will see a full year’s worth of benefits when they file this spring. We previewed this dynamic back in October. As the report reads:

Tax Foundation estimates that, altogether, these seven provisions cut individual income taxes by $129 billion in 2025. In each of the past two tax years, more than 100 million taxpayers have received refunds averaging around $3,000, totaling more than $300 billion in each tax year. Private-sector economic analysis suggests the OBBBA will result in up to $100 billion in higher refunds in 2026 overall, with average refunds up between $300 to $1,000 compared to a typical year.

On Main Street, the bill prevented a massive tax hike on tens of millions of pass-through businesses by making permanent the critical Section 199A deduction, locking in the fair treatment of pass-through SALT payments, and avoiding treating pass-through losses worse than any other form of loss. Those provisions add up to more than $100 billion a year in savings for Main Street employers. That’s real money they can invest right now in new equipment, new workers, and higher wages.

S-Corp and its Main Street Employers Coalition allies championed these policies from the start. We educated stakeholders about why Section 199A matters, hosted several roundtables bringing together experts from across the tax policy world, commissioned economic studies demonstrating the jobs and growth supported by 199A, and built a broad coalition of hundreds of trade associations backing permanence.

Now it’s time to follow through. That means telling the story of Main Street businesses using their tax relief to support their workers and their communities. It also means connecting the dots between the refunds people see this spring and the policies that made them possible. That’s going to be our focus for the next several months.

Wage Taxes are Destructive – Let’s Ditch Them

Last week’s circuit court decision on the meaning of “limited partner” has broad implications for S corporations in the coming tax battles. As noted in the court’s ruling:

This case turns on the meaning of “limited partner” in 26 U.S.C. § 1402(a)(13). The Tax Court interpreted “limited partner” to refer only to passive investors in a limited partnership. It therefore upheld the IRS’s upward adjustment of Sirius Solutions’s net earnings from self-employment. We disagree. A “limited partner” is a partner in a limited partnership that has limited liability. So we vacate and remand.

The court further noted:

So, to review, the pass-through share of partnership income (or loss) of a limited partner is not subject to Social Security and Medicare taxation; but neither does it count toward the Social Security benefits the person may receive later in life.

The ruling comes in the face of efforts by the IRS to expand payroll tax collections to include the pass-through earnings of limited partners, arguing that “that for purposes of the § 1402(a)(13) exception, the term “limited partners” only “refer[s] to passive investors.””

One little problem — that’s not the rule:

The sole issue on appeal is the meaning of “limited partner” in § 1402(a)(13). We hold that a “limited partner” is a partner in a limited partnership that has limited liability. This is confirmed by (A) the text, and (B) the Social Security Administration (“SSA”) and IRS’s contemporaneous and longstanding interpretation of the term.

As you can imagine, this is a critical distinction, and we’re glad the court sided with workers and employers. The effort to expand the payroll tax base to include business profits goes way back and, if successful, it would deepen the wedge between tax rates paid by pass-throughs and corporations. (See here, here, and here)

It also begs the question – why tax wages at all?

The simple reality is that wage taxes hurt workers. They lower real wages, reduce employment levels, and impose expensive complexities on employers. Not convinced? Here’s a sample of recent economic literature highlighting the damage wage taxes inflict on the economy:

- Gruber (1997), The Incidence of Payroll Taxation: Evidence from Chile: Finds the full cost of wage taxes falls on workers through lower pay

- Kugler & Kugler (2008/2009), Labor Market Effects of Payroll Taxes in Developing Countries: Evidence from Colombia: Finds a 10 percent rise in payroll taxes reduced wages between 1.4 and 2.3 percent and employment by between 4 and 5 percent.

- Anderson & Meyer (1997), The Incidence of a Firm-Varying Payroll Tax: Uses firm-specific unemployment insurance tax variation to show that workers bear most of the tax but there is employment reallocation.

- Antón (2014), The Effect of Payroll Taxes on Employment and Wages under High Labor Informality: Finds that reforms reducing payroll taxes increased formal employment and wages.

What would be better than wage taxes? How about a VAT or border adjusted tax? Replacing a wage tax with a VAT could help address Social Security’s pending insolvency, increase wages, increase employment, and actually benefit the economy as a whole. Here’s a sample of the literature exploring the value of such a swap:

- Laszlo Goerke (1999), Value-Added Tax Versus Social Security Contributions: A budget-neutral shift from payroll taxes to a VAT can increase employment.

- OECD Taxation Working Paper (2012): Shifting from Social Security Contributions to Consumption Taxes: Shifting social security contributions toward VAT in European countries could increase work incentives for low-income workers at both participation and hours-worked margins.

- Toder & Rosenberg (2010) Tax Policy Center / Urban Institute (2016), Swapping the Employer Share of the Payroll Tax for a Consumption Tax: A detailed analysis of the efficiency gains of replacing the employer payroll tax with a VAT/GST. All but the highest earners benefit.

- Nunns & Rosenberg (2016) Urban Institute / Tax Policy Center, A Federal Consumption Tax as Replacement for the Employer Payroll Tax: Explores why a consumption tax base is well-suited to replace employer payroll taxes and how it interacts with the labor market and existing tax system.

So definitely something to think about.

But don’t expect a whole lot of thoughtful analysis in response to last week’s court decision. The pro-tax crowd will ignore the law and complain that their efforts to “tax the wealthy” are being thwarted, while the anti-tax crowd will reflexively reject VATs, ignoring their relative superiority to existing payroll taxes. In the meantime, Social Security will continue its inevitable march towards insolvency.