When Norway recently enacted a new wealth tax, it was billed as an easy way to make the rich “pay their fair share.” They packed their bags instead.

Within a year, hundreds of high-net-worth Norwegians fled the country, taking with them billions in capital, thousands of jobs, and a massive portion of the tax base. The exodus has been so severe that government revenue declined, serving as a case study in the inevitable response to bad tax policy.

Learning nothing, California is flirting with the same economic poison. A proposed “billionaire tax,” backed by the regional SEIU union, would impose a five percent levy on individuals and trusts with a net worth over $1 billion. While it’s billed as a one-time stopgap emergency measure to bolster safety net services, the proposed initiative is already hurting the California economy. As the New York Post reports:

The threat of a steep new wealth tax in California has reportedly prompted at least six billionaires including Larry Page and Peter Thiel to cut their ties with the state — and as many as 20 others could be heading for the exits.

The half-dozen billionaires made their moves before New Year’s Day — the cutoff date to avoid a potential one-time tax of 5% on fortunes exceeding $1 billion — which California residents will vote on in November, according to Bloomberg News.

David Lesperance, a tax adviser who specializes in relocating ultra-wealthy clients out of high-tax jurisdictions, told the outlet he personally helped four billionaires end their California residency before the proposal’s Jan. 1 cutoff date.

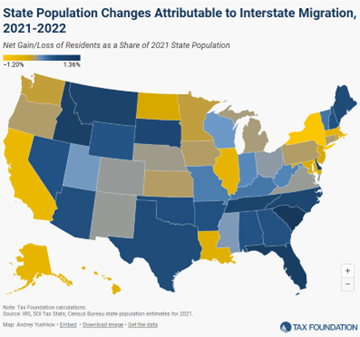

This exodus of capital and tax revenue comes on top of the outmigration of taxpayers already taking place in California. Over the past three decades, California has lost an eye-popping number of employers and businesses seeking to escape the state’s highest-in-the-country tax rates and general hostility to businesses and investment.

The result of these destructive policies is California is now the most economically imbalanced state in the country – lots of poor people, some very, very rich people, and a disappearing and distressed middle class. If this wealth tax moves forward, say goodbye to the wealthy, more angst for the middle, and more poverty for everybody else.

The shortsighted allure of easy revenue is not confined to The Golden State. Illinois recently considered going down this same road, floating a “tax on unrealized gains” that would have hit businesses and investors alike. The idea was ultimately shelved, but only after loud opposition.

Two years ago, we saw coordinated campaigns in Washington, New York, and other states where legislators introduced copycat wealth tax proposals aimed squarely at family businesses. As we warned at the time, it is as if they were intentionally trying to drive high-wealth taxpayers out of their states.

Just ask Connecticut, New Jersey, or New York, where each has seen an outmigration of high earners and business investment following their adoption of anti-investment policies.

The broader lesson is simple — there’s a reason our tax system focuses on taxing income, not wealth. Wealth taxes punish savings, the very fuel that drives innovation, creates jobs, and sustains communities. As we wrote a few years back, taxing wealth isn’t just bad economics – it’s administratively unworkable, constitutionally dubious, and economically destructive.

High-income entrepreneurs and investors in California already face the highest combined federal and state tax burden in the nation. Add a wealth tax to the mix, and more California taxpayers will do what the Norwegians did – move.

In the end, it won’t be the billionaires who pay the price. The businesses they finance, the workers they employ, and the communities they support will all feel the loss. California would do well to study Norway’s experience before repeating it. It is a really bad idea.