As tax season progresses, supporters of the Working Families Tax Relief Act are highlighting the provisions that made it possible.

That’s good news because tax cuts don’t sell themselves. As our friend David Winston pointed out in a recent op-ed, convincing Americans they benefited from tax legislation is often harder than passing it in the first place. Absent a concerted effort, the big refunds that are set to hit bank accounts in the months ahead won’t be connected back to the tax bill passed last summer.

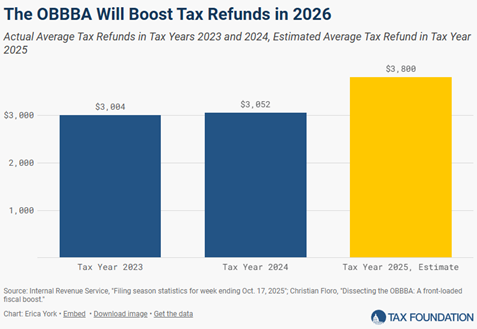

Just to be clear – there’s lots to sell. Tax filing season is officially underway, and by all accounts American families and businesses are in for a pleasant surprise. According to a new analysis from the Tax Foundation, the One Big Beautiful Bill is likely to deliver the largest tax refund season in modern history. Here’s the key chart:

That boost is thanks to the tax bill’s provisions aimed directly at individuals and families, including a more generous child tax credit and standard deduction, increased SALT cap, and new deductions for tips and overtime, among others. The relief was also enacted on a retroactive basis to the start of 2025, so taxpayers will see a full year’s worth of benefits when they file this spring. We previewed this dynamic back in October. As the report reads:

Tax Foundation estimates that, altogether, these seven provisions cut individual income taxes by $129 billion in 2025. In each of the past two tax years, more than 100 million taxpayers have received refunds averaging around $3,000, totaling more than $300 billion in each tax year. Private-sector economic analysis suggests the OBBBA will result in up to $100 billion in higher refunds in 2026 overall, with average refunds up between $300 to $1,000 compared to a typical year.

On Main Street, the bill prevented a massive tax hike on tens of millions of pass-through businesses by making permanent the critical Section 199A deduction, locking in the fair treatment of pass-through SALT payments, and avoiding treating pass-through losses worse than any other form of loss. Those provisions add up to more than $100 billion a year in savings for Main Street employers. That’s real money they can invest right now in new equipment, new workers, and higher wages.

S-Corp and its Main Street Employers Coalition allies championed these policies from the start. We educated stakeholders about why Section 199A matters, hosted several roundtables bringing together experts from across the tax policy world, commissioned economic studies demonstrating the jobs and growth supported by 199A, and built a broad coalition of hundreds of trade associations backing permanence.

Now it’s time to follow through. That means telling the story of Main Street businesses using their tax relief to support their workers and their communities. It also means connecting the dots between the refunds people see this spring and the policies that made them possible. That’s going to be our focus for the next several months.