For the Main Street business community, the benefits of the One Big Beautiful Bill (OB3) are clear – the bill kept our tax rates low, made permanent the 20-percent small business deduction, and retained full deductions for the state and local taxes we pay on our pass-through business income.

Cumulatively, these provisions will save pass-through business owners more than $100 billion a year. That’s real money they can invest right now in new equipment, new workers, and higher wages.

The case for family tax relief in OB3 is just as strong. As we’ve noted, provisions benefitting middle-income families – including the higher standard deduction, bigger child credit, and lower rates – represent a majority of the tax relief in OB3. When you add in revenue offsets that exclusively target upper-income taxpayers and, well, forget about it. Middle-income families were the big winners here.

And the news just gets better, as all this tax relief is coming sooner rather than later. As noted by our friends at Piper Sandler, many of these family-friendly provisions are retroactive to the beginning of 2025, meaning the relief starts as soon as they file their taxes next year.

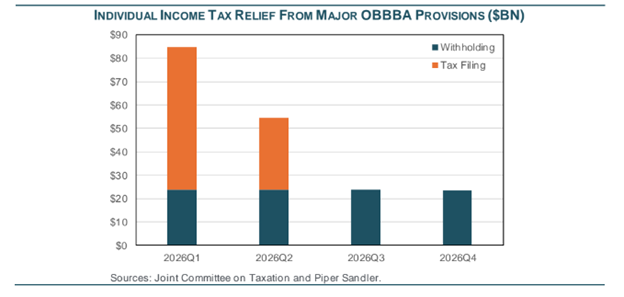

Here’s what it looks like on a chart:

And here’s the key graf:

The recent budget reconciliation bill… could deliver around $191 billion in net new individual income tax relief in calendar year 2026 (0.6% of GDP). Almost half of that relief is retroactive but it seems unlikely many people will adjust their withholding to claim benefits this year. Instead, they will be surprised by large refunds during the filing season next year. During the January to April filing season, we estimate tax filers will receive about $91 billion in additional refunds from the 2025 retroactive tax cuts plus another $30 or so billion from reduced withholding on 2026 taxes. The retroactive tax cuts could average about $1,000 per return though it will be substantially more for some filers.

So families and Main Street businesses were the big winners in OB3. That’s not what the DC media will tell you, but then we stopped listening to them a long time ago.