As we wrote recently, there’s lots to like about the House reconciliation package, but a dramatic expansion of B-SALT continues to give Main Street heartburn.

A new piece in Tax Notes lays out just how much pain the new regime would cause. Appropriately titled, “More SALTy Than Sweet?” the article beings:

Perhaps most importantly, the new SALT regime would allow for the continued viability of PTET regimes only in certain circumstances. However, PTET regimes would no longer be available in a variety of circumstances, and those circumstances are broader than an initial read might suggest.

Translation? Under the House bill, hundreds of thousands (millions?) of family-owned businesses would lose their SALT parity deductions. The article continues:

The proposed definition of qualifying entity contains many ambiguities and uncertainties and would place many administrative burdens on taxpayers… Perhaps most importantly, the qualifying entity definition does not appear to serve a clear policy purpose.

This is a core concern: the B-SALT rewrite is so complex that even top tax experts can’t figure out how it would work. The provision’s ambiguous definitions would force Main Street businesses to become tax policy sleuths just to determine if they qualify.

Is there a point to all this complexity? As the article notes:

It is unclear what pressing policy objectives are served by having both [the QTB requirement and the qualifying entity test] in the OBBB.

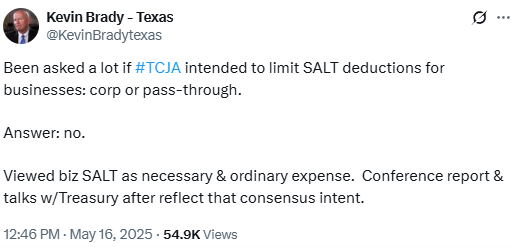

According to former Ways & Means Chairman Kevin Brady, none of this was part of the plan:

So why are we doing this? At a time when lawmakers are promising simplification and tax relief, the B-SALT expansion represents the opposite: a remarkably complex set of new rules and a massive, $80 billion tax hike on a significant part of the economy.

There’s still time for the Senate to fix this. As Tax Notes concludes:

Prompt feedback to policymakers is vital — extra cooks and taste testers may make the regime slightly less SALTy.

We agree. If lawmakers are serious about enacting pro-growth policies, they need to scrap this half-baked B-SALT expansion and focus on delivering much-needed relief for Main Street.