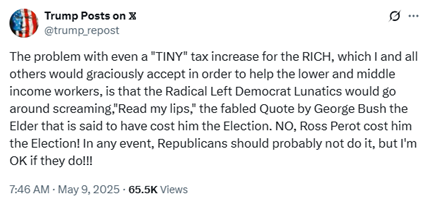

The White House as recently as yesterday was actively pushing lawmakers to include a rate hike in Tuesday’s Ways & Means markup, with Commerce Secretary Howard Lutnick telling reporters the rate hike was a “smart” move. Then this morning President Trump appeared to back off the effort, posting the following:

An hour later NEC Director Kevin Hassett appeared on CNBC and when asked about the proposal said the President is “not thrilled about it…it’s not high on the President’s list.”

So it’s anyone’s guess where things stand over at the Administration, but we do know that Main Street remains staunchly opposed to rate hikes. As our trade association letter signed by more than 90 of our allies made clear, the proposal would be devastating for millions of pass-through businesses:

The so-called “millionaire tax” in question…would saddle Main Street with a tax hike that offsets about half the tax benefit of extending the Section 199A deduction. Coupled with the Net Investment Income Tax and state and local taxes, the proposal would impose marginal rates exceeding 40 percent on businesses that receive the full Section 199A deduction, or twice the rate paid by C corporations.

Is there broad support in Congress for tax hikes? Absolutely not. As chronicled by ATR in their latest release – there is simply no way a rate hike passes this Congress.

That said, we’re not taking any chances. S-Corp is reaching out to all lawmakers on Capitol Hill to remind them just how bad this idea is. Our members are already confronted with a shrinking economy, unprecedented tariffs, supply chain disruptions, and a pending fiscal cliff. Tossing a rate hike into the mix is economic malpractice that will cost jobs and slow the economy further.

Main Street businesses need to reach out to their representatives now, and Members of Congress need to make public their opposition to rate hikes.