The buzz on K Street is that the White House has resumed its push for Congress to raise the top tax rate as part of the upcoming tax package. If you’re confused by this (possible) development, so are we. Just a couple of weeks ago, the President signaled his opposition to rate hikes. Now they might be back on the table.

While that may be the case, it’s hard to envision a world in which a rate hike can pass either the House or the Senate this year. Most Republicans vigorously oppose such a move, as does Main Street. Our recent letter – signed by 90-plus national trade groups – outlines the challenges:

Pass-throughs comprise over 95 percent of all businesses and employ 62 percent of the nation’s workforce. Most pass-through business income is taxed at the top rates, so raising these rates would harm Main Street businesses engaged in just about every aspect of the economy. They are responsible for employing millions of Americans, driving investment, and supporting local economies nationwide.

The so-called “millionaire tax” in question – which actually kicks in at income around $620,000 – would saddle them with a tax hike that offsets about half the tax benefit of extending the Section 199A deduction. Coupled with the Net Investment Income Tax and state and local taxes, the proposal would impose marginal rates exceeding 40 percent on businesses that receive the full Section 199A deduction, or twice the rate paid by C corporations.

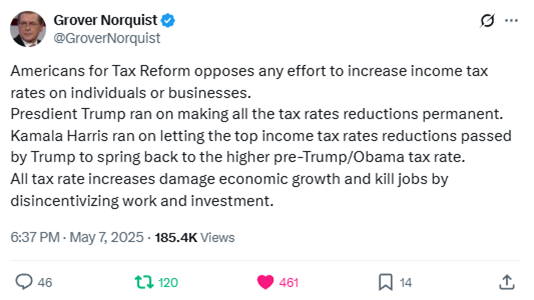

ATR president Grover Norquist understands the danger of higher rates. Here’s what he had to say:

What about increasing 199A to offset the tax hike? That won’t work either:

Certain industries are precluded from Section 199A, however, as is foreign-sourced income and Section 1231 gains. So-called “guardrails” tied to wages, capital investment, and taxable income reduce the value of the deduction for many more. Businesses ineligible for the full 199A deduction would face combined marginal rates above 50 percent. Rates that high are simply not sustainable.

For those businesses who don’t get the full 199A, this plan would simply be another tax hike as the rate hike would apply to ALL pass-through income over the threshold, while 199A only applies to some income.

Finally, a rate hike will not blunt criticism that the pending bill benefits the rich. No matter how high rates get, critics will always claim fairness demands that they be higher.

If this idea does gain traction in Congress, expect to see vigorous opposition from the Main Street community and many members of Congress. With the economy slowing and supply chains in jeopardy, Main Street needs tax relief and certainty right now, not more tax confusion.