The battle over the Budget Resolution is a spending fight, not a tax fight. There is broad agreement over how to extend the expiring individual and pass-through tax policies, whereas there are significant differences when it comes to spending reductions. The problem for Main Street is some members apparently don’t know the difference.

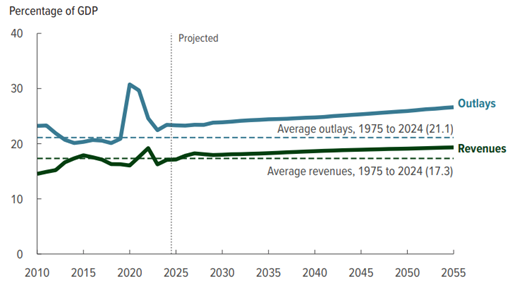

This chart from CBO tells the whole story. Revenues into the federal government are well above historic norms and rising. Spending, meanwhile, is simply out of control. The federal government used to spend one out of every five dollars as recently as 2019 – it is now one out of four and rising.

One would think any rational policymaker would take a look and conclude that they need to focus on spending, not taxes. One would be wrong. A recent Bloomberg article quotes at least two Republicans open to raising the top individual (and pass-through) rate to 40 percent. According to the piece:

House Freedom Caucus Chairman Andy Harris says he is open to the creation of a new 40% tax bracket for those earning $1 million or more, lending credence to an idea Republicans are considering as a way to offset some new tax cuts.

Harris said in an interview on Monday that he views the millionaires’ tax rate as a “reasonable way to pay for” President Donald Trump’s campaign pledge to eliminate levies on tipped wages.

“You are only raising it a couple of points,” the Maryland Republican added. The current top tax rate is 37% for individuals earning more than $626,350 a year.

The Representative is wrong that it’s a small increase – a top rate of 40 percent would be the highest level since Reagan cut rates back in 1986 – almost 40 years! It would also eliminate about half the benefit of the 199A deduction for affected businesses, assuming they actually get the deduction. For those that don’t, it’s just a tax hike.

The good news is these suggestions were quickly shot down by House leadership, who clearly have no interest in making rate hikes part of their effort to extend the TCJA provisions.

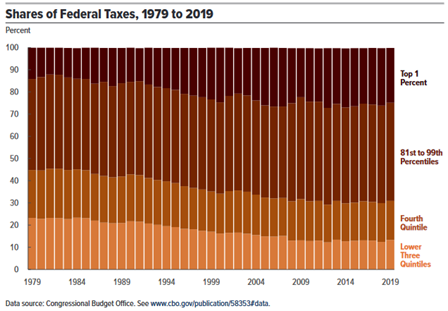

Nonetheless, the Main Street community needs to respond to these suggestions. Taxpayers paying the top rate – including about a million pass-through business owners – represent just 1 percent of all income earners but pay a remarkable 25 percent of all federal taxes.

Moreover, their share of total tax payments is large and rising, even as the top rate has come down. In 1979, the top marginal rate was 50 percent and the top one percent paid 14 percent of all taxes. Today, the top rate is 37 percent and the top one percent pay 25 percent.

Any suggestion these taxpayers are “under-taxed” is laughable.

So is the idea that our Tax Code is anything but progressive. Notice how all the dark areas in the graph reflecting higher income taxpayers is growing, while the lighter areas reflecting lower-income taxpayers has shrunk? That’s a representation of how our Tax Code has gotten more progressive over time.

We expect Congress to work out their differences on spending. We also expect them to reject calls to raise marginal rates. But the Main Street Community needs to beware. The premise that Republicans are unified in opposing rate increases is no longer valid, and we need to work to restore it.