Missouri Congressman Jason Smith, who heads up the tax-writing Ways & Means Committee, was on Mornings with Maria yesterday to talk all things tax policy. The Chairman was asked about a so-called “millionaire tax,” and his response should give comfort to millions of Main Street businesses that would see their taxes increased under the ill-conceived proposal.

Here’s the key excerpt:

What has been discussed by news media – not within Congress but by news media – is that we might increase the top tax rate. What I’ve said all along is that we’re looking at every tax provision – every single provision – and we’re looking at what makes the tax code pro-growth, pro-worker, pro-family.

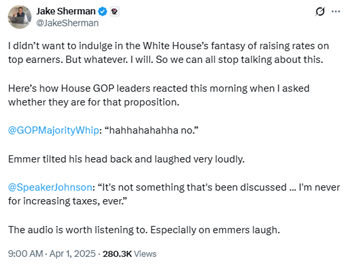

Chairman Smith’s response here mirrors that of other Republicans, including Speaker Johnson and Whip Emmer:

As we’ve discussed before, the proposal aims to raise top marginal tax rates to roughly twice what public C corporations pay. While it’s being labeled a “millionaire’s tax,” the reality is it would primarily impact Main Street businesses, pushing their rates to levels not seen in nearly 40 years.

How did this rumor get started? On Squawk Box earlier this month, CNBC’s Robert Frank revealed that it stems from an offhand comment made by the President. Asked if he’d ever heard President Trump explicitly say he favored letting the top rate go back to 39.6 percent, Frank replied:

No – according to two reports, at a meeting with Republicans [Senator] Lindsay Graham asked, “you said everything’s on the table – would you support raising rates on top earners?” And Trump said, “yeah I’d consider that, I consider everything.”

So the current news cycle is being driven by nothing more than semantics, but as we’ve said before no bad idea ever truly dies in Washington, DC. That’s why S-Corp led a trade association letter last week calling out the proposal, and continues to educate lawmakers on its harmful effects. The “millionaire tax” may be more media hype than legislative reality at the moment, but it’s critical that lawmakers understand who would actually bear the burden of this policy.