A key paragraph from today’s Politico Tax highlights a critical issue for Main Street businesses:

A good number of economists already say that extending the expiring TCJA individual provisions wouldn’t do much to further spur the economy. That’s part of the reason that Trump and his team are plugging some of his more targeted tax cut ideas, while other key Republicans are talking up key tax breaks for businesses, like full expensing for capital investments.

But that focus misses the point entirely. The question isn’t whether extending current policy would provide a bump– it’s whether allowing a massive tax hike to happen would deal a significant blow to the economy and millions of Main Street employers?

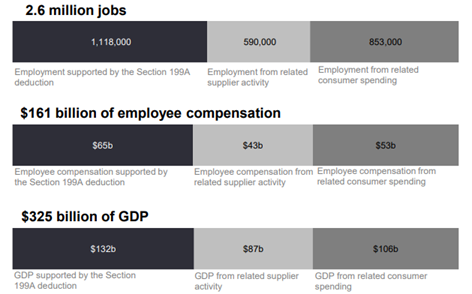

The answer is a clear “Yes”: Failure to act means higher taxes, fewer jobs, and lower growth. Our recent EY analysis of the Section 199A deduction shows that as many as 2.6 million jobs, $161 billion in wages, and $325 billion of national income are at risk if Congress fails to extend current tax rates and we ultimately go over the fiscal cliff.

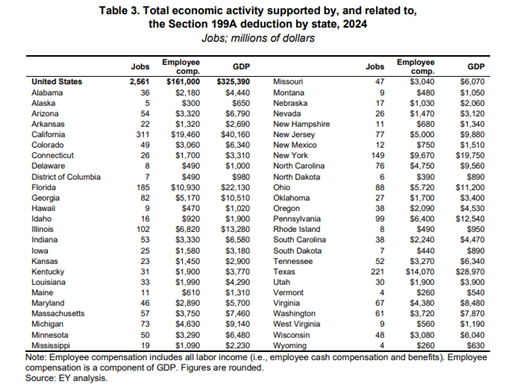

Every state in the country would be adversely affected:

As we’ve written many times before, 199A was enacted to 1) encourage job creation and economic growth, 2) help restore tax parity between pass-throughs and the 21-percent corporate rate, and 3) prevent a massive tax hike on millions of employers.

That last point deserves to be emphasized – the TCJA included revenue raises in addition to tax cuts. Many of those policies – like the cap on interest deductions and R&E amortization – are permanent and apply to pass-throughs just the same as C corporations. They would remain in place even if we go over the fiscal cliff and the 199A deduction is allowed to expire.

That’s may be good news for the Fortune 500, but it’s bad news for the communities and workers who rely on private and family-owned companies.

Fortunately, lawmakers understand the gravity of the situation and are moving quickly on a tax package. The House and Senate have coalesced around a single-bill strategy and we could see a Senate budget vote as early as this week. The stakes are high but recent movement gives us confidence that a favorable outcome is still possible. For the Main Street community, now is the time to connect with your Senator and Representative and make sure they understand the importance of 199A to your business, your employees, and your community. It’s now or never.