Only a couple of days into the new Congress and they’re ready to throw hands!

The Chairman’s frustration is justified. The obsession with process over policy is getting old. As Senator Bob Dole used to say, you should talk about your accomplishments, policies, and facts first. If you don’t have any of those, then fall back on process. “You can always talk about process.” Focusing on process exclusively shifts attention away from the underlying policies and their real-world consequences for Main Street and elsewhere.

It’s also a waste of time. At the end of the day, the reconciliation bill(s) will include whatever magic mixture of policies gets to a majority. If that’s one big omnibus, great. If it’s several smaller bills, that’s fine too. Donald Trump appears to understand this. With just a 2-vote margin in the House, it’s also reasonable to expect the path to finding that magic mixture will be messy, so buckle up.

For Main Street, the key is to ignore all the process talk and keep focused on the goal – building maximum support for 199A permanence so when Congress does take up the tax bill, we’re ready.

Tax Hearing & Timing

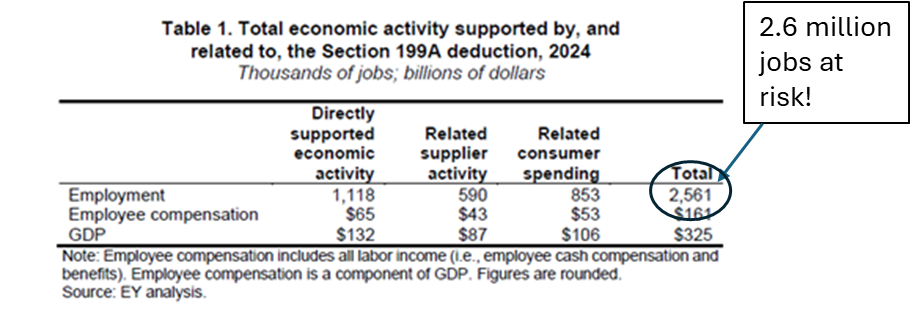

Speaking of buckling up, the Ways and Means Committee is hitting the ground running. It will hold a hearing on the expiring tax provisions next Tuesday, January 14th. Word is at least two of the witnesses will focus on 199A and its importance to the economy and jobs. Have we mentioned 63 percent of workers are employed by pass-through businesses? (Download the S-Corp Jobs App here!)

In terms of overall timing, House leadership has been signaling for months they wanted to move quickly to address the fiscal cliff. Just this week, Speaker Johnson said he wants to adopt a budget in March to tee up House consideration of a reconciliation bill in April. Worst case scenario, he said, is a bill on the President’s desk before Memorial Day. Is that possible?

Yes, it is. President Bush announced his Jobs and Growth tax package on January 7, 2003 and signed it into law on May 28th. Majorities were tight back then too, with both the budget and resulting reconciliation bill getting the bare minimum 50 votes in the Senate, with the Vice President breaking the ties.

The difference this time around is the nature of the challenge. The 2003 bill was an effort to boost the economy by accelerating the tax benefits of the 2001 tax bill. Today’s challenge is more serious — how to avoid a massive tax hike on Main Street businesses that puts millions of jobs at risk.

The fact that we’re talking about this challenge Day 1 is helpful and a strong signal that the Congress is serious about avoiding those tax hikes. Much more to come.