The House Ways & Means Committee today kicked off the new Congress with a hearing focused on the family and business provisions included in the Tax Cuts and Jobs Act. But the topic that took center stage is one that’s near and dear to the hearts of millions of Main Street businesses nationwide – addressing the looming expiration of the Section 199A deduction.

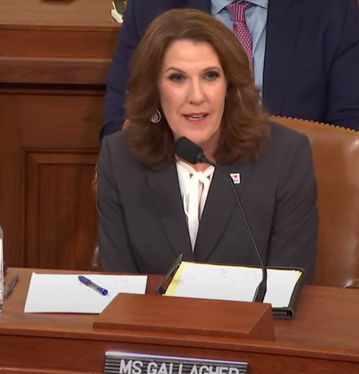

The panel first heard testimony from Michelle Gallagher, an S-Corp Advisor and accountant with decades of experience serving individual and family-owned businesses (and who can be seen sporting our “I Love 199A pin!”).

Her opening statement began by calling on lawmakers to not just extend 199A, but to do so swiftly:

The 199A deduction has been critical for businesses organized as [pass-throughs] which represent 99 percent of my business clients, and the vast majority of businesses in Michigan and nationwide. They also employ most of the country’s workers. 199A helped many small business clients stay competitive with large corporations on wages and hiring when inflation was skyrocketing…If the 199A deduction expires, the tax on pass-throughs will go up sharply, while C corps and publicly-traded companies will continue to enjoy their lower, 21-percent permanent rate. This simply is not fair to the Main Street businesses and farmers of our country.

Michelle wasn’t the only person in the room to bring up the importance of extending 199A and the Tax Cuts and Jobs Act. Throughout the course of the hearing, the issue was raised countless times by lawmakers and witnesses. Here’s Chairman Jason Smith (R-MO):

Small businesses are facing a 43.4 percent tax rate if the 199A small business deduction, as I refer to it, expires. This looming threat impacts decisions they’re making today about whether to invest, grow, hire…If Congress doesn’t act soon, family-owned farms and Main Street businesses will have to start calling estate planners and accountants to figure out how they navigate the potential increases in their tax burdens.

And Rep. Vern Buchannan (R-FL):

As chairman of the Florida Chamber I can tell you we had 130,000 businesses, 90 to 95 percent of them were pass-through entities. And you’re dealing with these potential tax hikes, that’s what scares a lot of people.

And Rep. Jodey Arrington (R-TX):

Everyone benefitted. And those on the lower income spectrum benefitted the most. Actually, the top 1 percent paid more. So we got more progressive in that sense. But all boats rose on the tide of prosperity as the result of good, low, competitive tax rates for our country and for our families.

And Rep. Kevin Hern (R-MO):

Certainty is important. And we’re getting ready to see the largest tax increase in American history starting January 2026 if we don’t do something…199A, it puts parity between small business pass-throughs and C corporations, and 99 percent of businesses in America are pass-throughs. Are there some larger than others? Absolutely. Are we going to be punitive to those who have fought, and grown their businesses as I did, from one person to 1,200 employees? Are we evil because we created jobs?

And Rep. Greg Steube (R-FL):

With many of the TCJA’s provisions expiring, it’s imperative that Congress act this year to ensure we continue to enact pro-growth policies that help American families. In my district the consequences of inaction would be devastating – my constituents on average would experience a 24 percent tax increase if the TCA is allowed to expire.

Finally, here’s Rep. Beth Van Duyne (R-TX) referencing the 199A roundtable we held with her last year:

As part of my work on the Main Street Tax Team we were able to get out of DC and talk to real business owners. We heard about the successes of policies such as Section 199A, which created over $66 billion in savings for Main Street businesses. One of the businesses I met with was Republic National Distributing Company, where I held a roundtable including 25 small businesses including roofers, community banks, and realtors. These are the businesses across the U.S. who are benefitting from this, and this is why Congress must act.

These excerpts are just a small snippet of the support for 199A heard throughout the hearing, and we urge readers to listen to the full recording to get the complete story.

The bottom line is that it’s hard to overstate the importance of making permanent the Section 199A deduction. As the testimony and comments from lawmakers in the hearing made clear, this deduction is a lifeline for millions of Main Street businesses that form the backbone of the American economy. Without it, these job creators face a starkly uneven playing field, with higher tax burdens that could hinder growth, investment, and job creation.

We look forward to working with our allies on Capitol Hill to ensure Section 199A is made a permanent fixture of the Tax Code and thank the members of the Ways & Means Committee for holding this important hearing.