Earlier today S-CORP President Brian Reardon was on Capitol Hill to brief members of the Main Street Tax Team on our new study that quantifies the economic footprint of the Section 199A deduction.

Congressman Lloyd Smucker, Chair of the Main Street Tax Team and lead sponsor of our 199A permanence bill in the House, led the meeting and was joined by Representatives Ron Estes of Kansas, Greg Murphy of North Carolina, and Kevin Hern of Oklahoma. Representative Murphy recently hosted us for a roundtable event in his home state of North Carolina while Kevin Hern is a former business owner and employer, so the group was well prepared to hear the details of the new study.

In addition to the S-Corp testimony, Members and staff heard from other business groups, including the American Council of Engineering Companies, Nareit, and the Energy Infrastructure Council, all representing critical industries that support making Section 199A permanent.

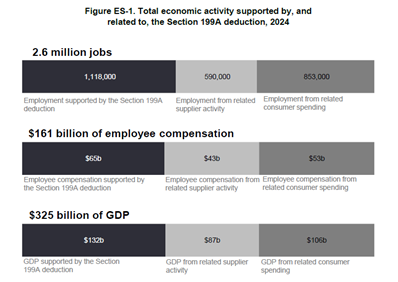

The S- Corp study conducted by EY demonstrates that the total economic activity supported by the deduction is broad and meaningful. The numbers are staggering – the study found that Section 199A supports 2.6 million jobs, contributes $161 billion to employee compensation, and adds $325 billion to GDP.

With the Section 199A deduction scheduled to expire at the end of next year, the threat is clear. All those jobs will be put at risk if Congress fails to act and sends us over the fiscal cliff. The result would be less employment, lower wages, and a smaller economy.

Thank you to Chairman Smucker and the Members and staff who gathered today to hear this important message, and we look forward to working with you to get the word out on the importance of Section 199A.

Click here to download the full study