Yesterday’s Senate Budget Committee hearing produced an interesting exchange that caught our attention. The hearing was entitled “Making Wall Street Pay Its Fair Share,” but when it came to defining exactly what “fair” means, the supposedly expert majority witnesses dissolved into an incoherent, dissembling mob.

It all started when Senator Ron Johnson (R-WI) posed the question to the first committee witness, Sarah Anderson from the Institute for Policy Studies:

Sen. Johnson: What percentage of an American’s income should the federal government be able to extract? What’s the maximum tax rate?

Anderson: I’d be happy to give you my preferred top marginal tax rate, once you close the loopholes that make a mockery of the top rate.

Sen. Johnson: Okay, let’s call it the effective tax rate. What is the maximum effective tax rate someone should pay after all the deductions, et cetera?

Anderson: People are not paying that top rate. We have billionaires taking advantage of loopholes…

Anderson is being disingenuous, as any economist knows that effective rates take into account all the deductions, credits, and other so-called loopholes available to taxpayers. You don’t need to identify them specifically to be able to answer the question.

Unable to extract a straightforward response, the Senator moved on to witness number two:

Sen. Johnson: Dr. Stiglitz, what do you think is the maximum amount anybody ought to pay out of their income?

Stiglitz: I think you begin by asking the question, How do you close the loopholes…

Sen. Johnson: It’s a very simple question. What is the maximum amount an American ought to pay out of a dollar of income? Eliminate all the loopholes, and after that what is the maximum effective rate – what is the amount?

Stiglitz: One of the things I said is if you derive your money from land speculation, you should pay a very, very high tax.

Why the aversion to defining “fair share” as a specific number? Perhaps Stiglitz and Anderson know that Americans consistently support reasonable tax rates regardless of who pays them, while top earners already pay rates well above the levels that Americans think as fair.

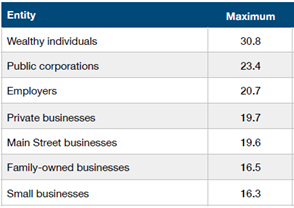

Back in 2019, the Winston Group asked voters: “For each of the following, what is the maximum rate at which you think they should be taxed?” Categories included the wealthy, family businesses, and public corporations, and the average responses were all consistently low, topping out at 31 percent for the wealthy and coming in as low as 17 percent for small and family-owned businesses.

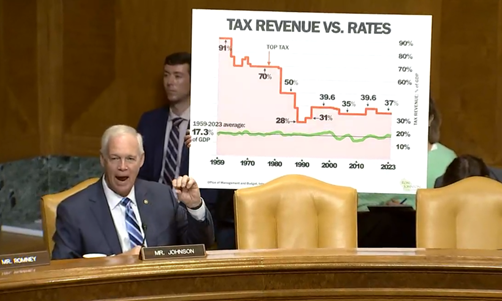

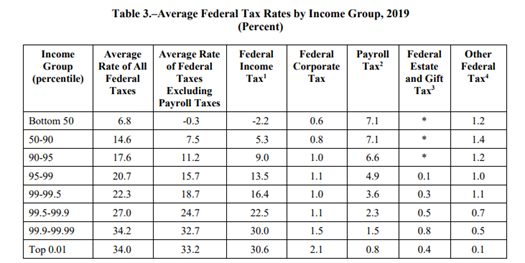

The irony here is that wealthy Americans already pay more than 31 percent of their income to the federal government. According to the Joint Committee on Taxation, top income earners pay an effective rate of 34 percent, while the bottom 50 percent of taxpayers pay 6.8 percent. (Again, these estimates already take into account any deductions or credits.)

Tax hike proponents – starting with President Biden, who recently called for the expiration of the TCJA – deploy the amorphous and vague concept of “fair share” in order to skirt the reality that our Tax Code is highly progressive and that the wealthiest taxpayers already pay more than what Americans think is “fair.” That tactic was on full display at yesterday’s hearing and is yet another reminder that “fair share” is simply code for never-ending tax hikes.