Two events took place this week which demonstrate just how remarkably divergent the potential paths of tax policy are next year.

First, the Senate Finance Committee held a rare hearing Tuesday on the challenges faced by American manufacturers. Senator Steve Daines (R-MT) took the opportunity to highlight the importance of 199A to his manufacturers in Montana and how Congress needs to act to make it permanent.

As Daines noted:

The foundation of businesses in Montana are passthrough businesses. They make up 95 percent of all businesses and employ a majority of workers in our country. In Montana, 75 percent of private sector workers are employed by passthroughs. Back in 2017 we placed these businesses on more equal footing with their C corp counterparts, by providing them a 20 percent tax deduction on their qualified business income.

These businesses are absolutely critical to our communities. You look at data in terms of when you come out of a recession, it’s the passthroughs that take the lead in hiring and growing and so forth faster than the C corps. And that’s why I’m proud to be leading the bill that would make this deduction permanent.

The Main Street Tax Certainty Act protects tens of millions of small businesses, allowing them to make more profits, add new jobs, strengthen the economy. Think about the core word in “capitalism,” which is “capital.” This allows these businesses to have more capital to invest. It allows businesses to decide, and the free markets to decide, where to make these capital investments, versus the federal government taking more of those dollars and allocating them here in this city called Washington, DC.

Later, Senator Ron Johnson (R-WI) made a strong case for comprehensive tax reform. As he pointed out:

Why aren’t we talking about simplifying and rationalizing our tax code? What’s a simple way of taxing American businesses? I would suggest, a really simple way, would be to consider cash income taxable income. Then you wouldn’t have all these issues like R&D tax credit and accelerated depreciation, and by the way it would just be a timing difference…Let’s tax cash income and get rid of all this crap.

So to recap, let’s ensure we don’t raise taxes on millions of small and family owned businesses next year, while simultaneously working to enact comprehensive reforms that put all businesses on a level playing field. Amen to that. S Corporations for everyone, is what we say.

Meanwhile, the President released his budget this week, which not only assumes the 199A deduction sunsets at the end of 2025 but calls for an additional $5 trillion in tax hikes over the next decade, many of which are targeted directly at Main Street.

As we wrote about these same policies last year:

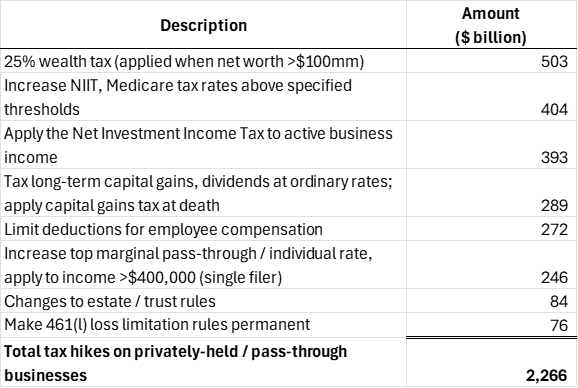

…the President’s budget would raise the top rates paid by pass-through businesses and corporations alike, increase the Net Investment Income Tax and expand it to cover the active business income of pass-through business owners, make permanent the harmful loss limitation rules, make it harder for family-owned businesses to survive from one generation to the next by gutting the existing grantor trust rules, nearly double the tax rate on capital gains, and impose a new minimum tax on larger family businesses that appears to redefine how income is measured. The combination of these policies would raise top tax rates on these businesses to close to 50 percent, both on their operating profits and on any gain when they sell the company.

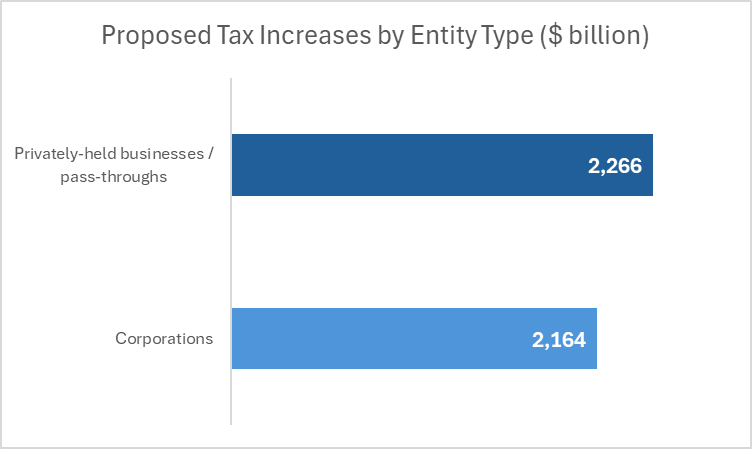

Meanwhile, the changes on the corporate side are gathering lots of ink, but the provisions targeted at the pass-through business community are actually bigger. And that comparison excludes the expiration of Section 199A, the grandaddy of all tax hikes, which is assumed in the baseline of the President’s budget.

Fortunately for our members, the Biden budget is dead on arrival. The House is run by Republicans and that, coupled with a tight Democratic majority in the Senate, means nothing along these lines has a chance this year. That is a huge change from last Congress, when similar policies came within one thin vote (thank you Senator Sinema) of passing both the House and the Senate. The current impasse is welcome relief, albeit transitory.

If we needed a reminder of just how quickly things can change, a recent announcement that Representative Ken Buck will retire next week(!) means the Republican’s House majority is down to just one out of 435 members. That’s as tenuous as you can get.

The elections may go well this November, but they may not, which means the business community needs to be prepared. We need to arm our allies like Daines and Johnson with the best data and the best arguments, so we increase the odds we end up with a positive result.

The alternative is remarkably unattractive. As the Biden budget demonstrates, there are lots of really bad ideas out there and they are hanging right out there on the horizon, just one or two votes away from being enacted.