Last week, eight House Republicans, led by Representative Matt Gaetz (FL), voted with the entire Democratic conference to oust Speaker Kevin McCarthy. What implications does this action have for Main Street businesses and tax policy? Here’s our take.

Short-Term Tax Outlook

When the House votes for a new Speaker and gets back to business, its focus will return to those remaining appropriations bills necessary to fund the government. Last month’s CR gave Congress an extra 45 days (until November 17th) to get them done and, at the time, we expected those efforts to crowd out other priorities, including consideration of the tax package adopted by the Ways and Means Committee last Spring.

Now the House is locked down and, coupled with the general chaos that results from a leadership change, days and weeks are being wasted, consuming floor time that could otherwise be used for a possible tax package.

For the Main Street business community, that means the chances of a broad, year-end tax package are getting slimmer. Lawmakers love to say they can walk and chew gum at the same time, but with so many distractions, it is getting increasingly difficult to see a scenario in which tax policy takes center stage. Not impossible, but the business community has some work to do if we’re going to see a tax bill this year.

The 2024 Elections & Fiscal Cliff

How does the Speaker fight affect the upcoming elections? S-Corp put away its crystal ball following the 2016 elections, but it is safe to say Republican control over the House was tenuous to begin with after last year’s midterm elections. Amid President Biden’s historically low approval numbers and rampant inflation, the GOP rolled into 2022 with high expectations but ultimately came up short. In recent months, there were signs that House Republicans could face another difficult election in 2024, including:

- Democratic victories in special elections and off-year ballot measures;

- Various redistricting maps challenged in court; and

- Lingering voter sentiment over the Dobbs decision.

It is hard to see how the circular firing squad we witnessed last week will do anything other than add to these woes, or how it will help the fourteen Republicans who represent districts won by President Biden in 2020. The more Republicans squabble, the worse their election outlook gets, the higher you can expect tax rates to go. How high?

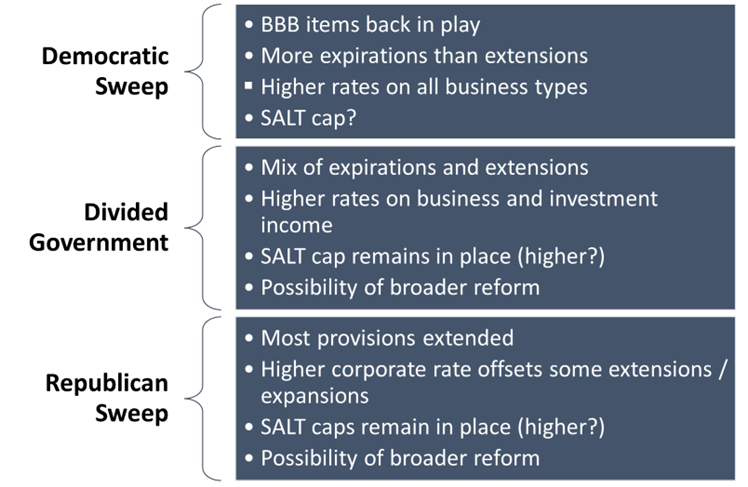

As we’ve noted, the nature of the policies enacted to address the “fiscal cliff” coming at the end of 2025 – when Section 199A and other key tax provisions expire – hinge on who controls the House, Senate, and the White House next Congress.

The table above shows the general expectations depending on who controls what in 2025. As you can see, there is a huge gulf between the direction tax policy takes under a Democratic sweep scenario verses a Republican sweep, or even another Congress with divided government. Just as last week’s events reduced the odds we see a tax bill later this year, they also increased the odds that Main Street businesses face crippling tax hike threats in 2025.

Lessons Learned?

What lessons can be learned from last week? There has been lots of hand wringing about the failures of leadership, but really the lesson here is the importance of embracing good, balanced rules. Rules matter, and bad rules create bad results.

The House has traditionally required support from half of the majority party’s members to bring forward a motion to vacate. But as part of his bid to become Speaker, McCarthy conceded to a new rules package that allowed just one member to bring the motion.

Coupled with a historically small majority, where any five members could shift the balance of power from Republicans to Democrats, and it was simply a matter of time before somebody made the motion. King Solomon couldn’t have survived these conditions.

If the House majority wants to get back on track, a big step will be to rally around a new Speaker. An even bigger step will be to amend the House Rules to restore the old Motion to Vacate thresholds.