Chuck Marr, who heads up tax policy at the Center on Budget and Policy Priorities, took to Twitter recently to slam the Section 199A deduction. It’s a perfect example of the empty rhetoric deployed by critics of the provision:

There’s a lot to unpack here so we’ll start from the top. First, Marr is correct that pass-through businesses do not pay the corporate tax – they pay tax at individual rates.

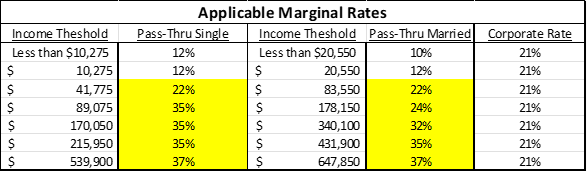

These days, that’s a critical distinction, as the 37-percent top individual rate is well above the 21-percent corporate rate. So are the 35- and 32- and 24- and 22-percent individual rate brackets. In fact, the vast majority of pass-through income is taxed at rates well above the corporate rate that applies to trillion-dollar businesses like Apple and Amazon.

Are all these business owners rich? Well, no. The 22-percent bracket starts at $41,775 for single and $83,550 for married taxpayers. Here’s a table showing the relative rates:

Second, what a weird grouping of industries Marr highlights. What does he have against car dealers and beer distributors? Why does he single them out, as opposed to manufacturers and retailers and home builders and all the other industries with partnerships, LLCs and S corporations among their ranks? There are about 9 million of these businesses – nine million! – so it is safe to say that just about every industry is well represented here.

Third, Marr is focused on rich business owners, but he ignores the rules that limit the 199A deduction for those taxpayers. In simple terms, successful auto dealers, beer distributors, and others don’t get the deduction if they don’t create jobs or invest in their communities. That’s because there are guardrails that limit the 199A deduction tied to the wages a business pays and/or the capital it has invested. (No such guardrails apply to the corporate rate, by the way. That low rate applies to all corporate profits regardless of how few jobs the business creates.)

Fourth, Marr doesn’t mention it, but many readers ask about the so-called double corporate tax. The corporate rate of 21-percent applies to business income, but the shareholders of those business might also be subject to tax when they sell stock or receive a dividend.

The challenge with calculating this second layer of tax is 1) according to the Tax Policy Center, three-fourths of public company shareholders pay no taxes or enjoy significantly reduced rates, and 2) the minority of shareholders who do pay tax have the ability to defer that tax for years or decades. Just ask Warren Buffett. By contrast, the tax imposed on pass-throughs is immediate and full, regardless of whether the business distributes any earnings.

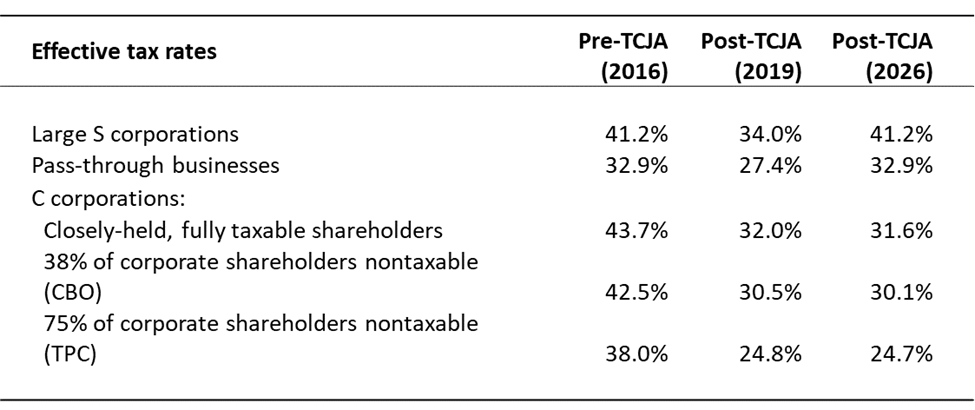

To cut through all this complexity, we asked EY to estimate the effective rates paid by the typical pass-through verses the burden imposed on the typical C corporation. As you can see from the table, pass-throughs and C corporations pay similar levels of tax, but only if the pass-through deduction is available and only if lots of the C corporation’s shareholders actually pay tax.

Absent the Section 199A deduction, that gap widens to as much as 16 percentage points. There’s simply no way for pass-through businesses to compete in that environment, which is why Congress enacted 199A.

Marr’s conclusion that Section 199A is a “trickle-down failure” is where things really fall off the rails. The statement is based on a CBPP paper which finds Section 199A accrues largely to higher-income taxpayers, with 64 percent of the tax benefit going to those households with over $400,000 in annual income. But what’s portrayed as some sort of smoking gun is the natural consequence of a tax structure where business income shows up on a taxpayer’s individual return. As an earlier Treasury study estimated, four out of five taxpayers with incomes exceeding $1 million were business owners.

If Marr gets his way and Section 199A is allowed to expire come 2026, he won’t have to worry about how much tax is paid by “rich” business owners. Faced with a massive rate differential, many of these businesses will be forced to sell, close up shop, or convert to C corporations and use the lower corporate rate to shelter their income. That’s good news for Wall Street and tax accountants, but it’s bad news for the communities and workers who rely on private and family-owned companies.

Luckily, lawmakers on Capitol Hill see things differently. Legislation to make Section 199A permanent now has bicameral and bipartisan support, and is backed by more than 160 national trade associations. With the fate of Main Street on the line, it’s time to stop the false rhetoric and instead focus on helping American employers.