Good news for Main Street! Long time S-Corp champion Senator Steve Daines from Montana plans to introduce his “Main Street Tax Certainty Act” later today. Cosponsored by more than a dozen of his colleagues, the bill would prevent rate hikes on America’s individually and family-owned businesses by making permanent the Section 199A 20-percent deduction. This deduction was created by the Tax Cuts and Jobs Act but is scheduled to sunset at the end of 2025.

The introduction of this legislation was widely anticipated in the business community, with more than 140 trade associations representing millions of Main Street businesses, including NFIB, the National Restaurant Association, and the American Farm Bureau Federation, adding their names to a strong letter of support. As the letter states:

Individually- and family-owned businesses organized as pass-throughs are the backbone of the American economy. They employ the majority of private-sector workers and represent 95 percent of all businesses. They also make up the economic and social foundation for countless communities nationwide. Without these businesses and the jobs they provide, many communities would face a more uncertain future of lower growth, fewer jobs, and more boarded-up buildings.

Despite this, Section 199A is scheduled to sunset at the end of 2025, even as the businesses it supports continue to recover from the COVID-19 pandemic and the price hikes, labor shortages, and supply chain disruptions that followed.

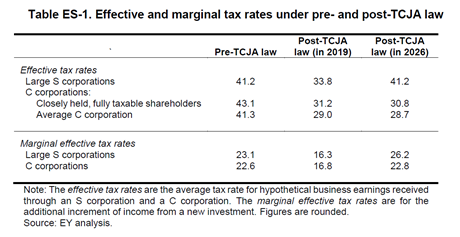

199A permanence is necessary to balance out the tax treatment of pass-through businesses with the lower, 21-percent tax rate paid by C corporations. As our work with EY comparing effective rates demonstrates, absent the 199A deduction, pass-through businesses would be subject to tax rates nearly one-third higher than comparative C corporations.

Making 199A permanent has implications for jobs and growth too.. At a time when businesses of all sizes are confronting rising prices and interest rates, supply chain disruptions, and a possible recession later this year, ensuring that these businesses are not going to see higher rates in the future will help them plan for growth with more certainty. As the letter notes:

Making the Section 199A deduction permanent will help Main Street during this very difficult time, leading to higher economic growth and more employment. Separate studies by economists Barro and Furman, the American Action Forum, and DeBacker and Kasher found that making the pass-through deduction permanent would result in significantly improved parity and lower rates for Main Street businesses.

So congratulations to Senator Daines and his cosponsors on the bill’s pending introduction. This legislation is necessary for Main Street businesses and the communities they serve, and we look forward to working with him and our other allies in Congress to see it enacted.