Last week’s release of new Tax Gap estimates continued the recent spate of good news on the tax front. Recall that Treasury’s end-of-fiscal year results earlier this month showed collections rose 21 percent to a whopping $4.9 trillion. As measured against GDP, that’s the third highest tax take in our history.

Individual receipts, including pass-through payments, were a key part of that growth. They accounted for most of the increase, rising by $593 billion, or 29 percent, in just one year. So much for the TCJA or a lack of IRS funding gutting our finances. Obviously, neither of those concerns is proving to be valid.

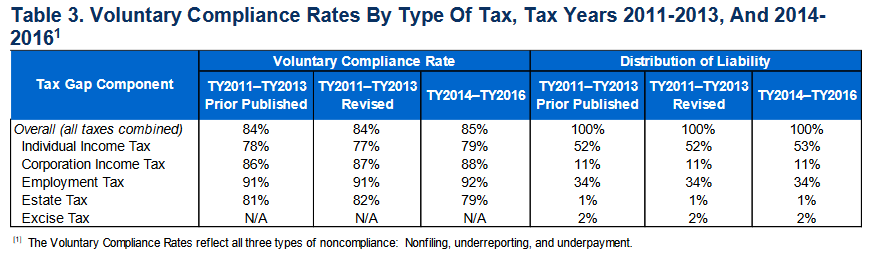

Now, the IRS is reporting that their most recent tax gap estimates show collections of what taxpayers owed increased from 84 percent between 2011-2013 to 85 percent between 2014-2016. That level of what’s referred to as “voluntary compliance” is among the best in the world and should be a cause for celebration.

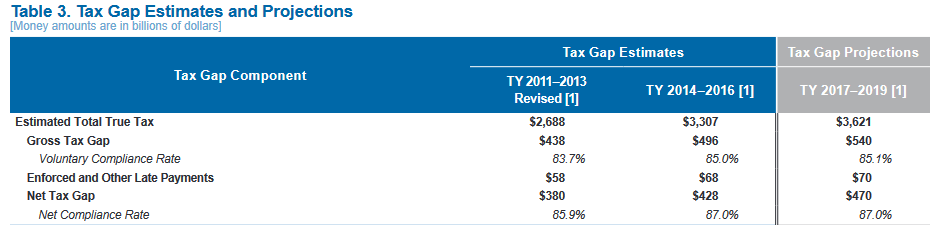

Instead, the press is focused on the nominal gap increase from $438 billion to $496. As Politico headlined on Friday: “New Half-Trillion ‘Tax Gap’ a Talking Point for Democrats.”

The IRS found that taxpayers paid nearly half-a-trillion dollars less than they should have in 2014 through 2016, potentially strengthening Democrats’ case to preserve new enforcement funding.

Does it? Does it really strengthen the case for the $80 billion in new funding provided to the IRS under the Inflation Reduction Act? If you’re seriously wondering (that was a rhetorical question after all) the answer is “No,” it doesn’t.

For starters, the IRS estimate is not adjusted for inflation, so the increase is less than the nominal numbers would suggest. Then you have to account for the fact that revenues increased over that period as the economy grew and the tax hikes embedded in the 2012 Fiscal Cliff and elsewhere took effect. This table from the report shows revenues grew by 23 percent over the three-year periods covered in the tax gap study, while the gross tax gap itself grew by just 13 percent.

Measuring the tax gap against the size of the economy is another way to account for all these variables. The tax estimate increased from $438 billion to $496 billion over three years, or 13.2 percent, while the overall economy increased on average by 12.0 percentage points. That’s basically a push for an estimate as rough as the tax gap so, in real terms, the tax gap didn’t increase at all. Even the IRS admitted as much in its release:

The estimated VCR for TY 2014–2016 (85.0 percent) is slightly higher than the revised TY 2011–2013 estimate, 83.7 percent (Table 2). However, the TY 2014–2016 gross and net tax gap estimates of $496 billion and $428 billion, respectively, are higher than their respective revised TY 2011–2013 estimates by $58 billion (gross) and by $48 billion (net). These increases can be attributed to economic growth between the two periods as evidenced by the more than 23 percent increase in true tax liability shown in the table. (emphasis added)

The press ignored this portion of the report. They also are silent regarding last year’s $1 trillion tax gap. Remember all the hoopla surrounding the IRS Commissioner’s testimony back in 2021? What happened to those estimates?

So the IRS estimate of the tax gap remained steady and total collections increased sharply, all while the IRS budget was falling, and that’s an argument for increasing the IRS budget? Somebody needs to take some remedial math, and maybe a logic class or two as well.