With the DC tax press continuing to pester Senator Joe Manchin about the BBB’s prospects (response: still dead) we thought we’d revisit yet another reason Congress should leave the BBB behind – inflation.

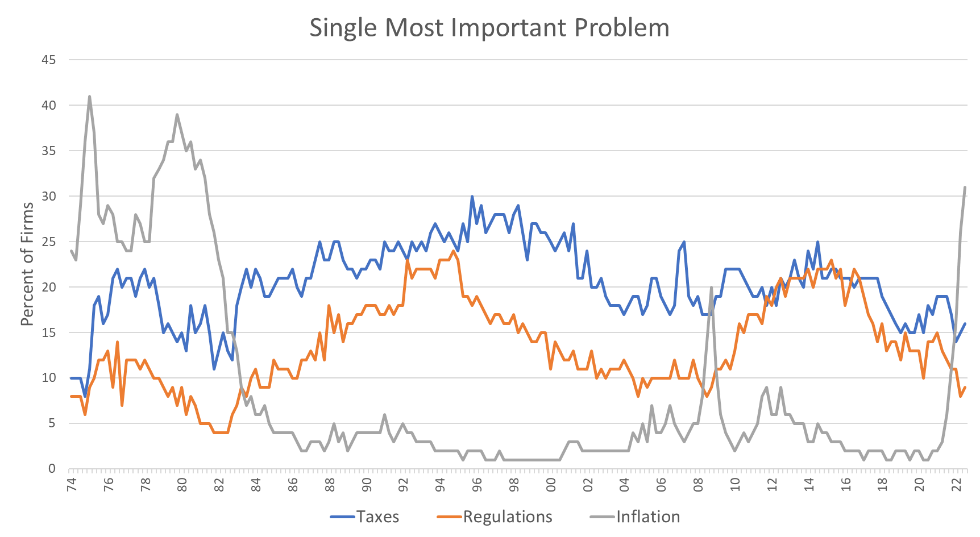

Inflation has exploded in the past year. As this survey from NFIB shows, the issue went from “also-ran” status to the #1 business concern almost overnight.

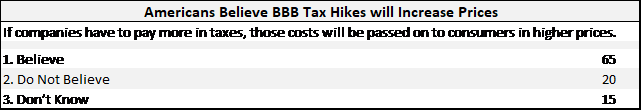

Meanwhile, the American people believe the BBB’s tax hikes are inflationary. In our survey last year, nearly two-thirds of respondents agreed with the statement, “If companies have to pay more in taxes, those costs will be passed on to consumers in higher prices.”

But are the voters correct? Do tax hikes increase prices? The short answer is it depends on what you tax. For example, a 1974 paper authored by Dr. Alan Blinder assessed the impact an income tax increase would have on inflation. As Blinder wrote at the time:

Conventional macroeconomics classifies an increase in the rate of taxation as an anti-inflation device because it reduces aggregate demand. However, an income tax hike may also constrict aggregate supply, making the effect on the price level ambiguous on purely theoretical grounds.

Blinder concluded his paper by asserting that an income tax increase would, on net, reduce aggregate demand and therefore reduce prices in the US.

But what about supply side tax hikes? Wouldn’t they “constrict aggregate supply” more than they discourage demand? The economy is already suffering from supply shocks, including a remarkably constrained labor market, so a sharp increase on business taxes would likely add to those price pressures.

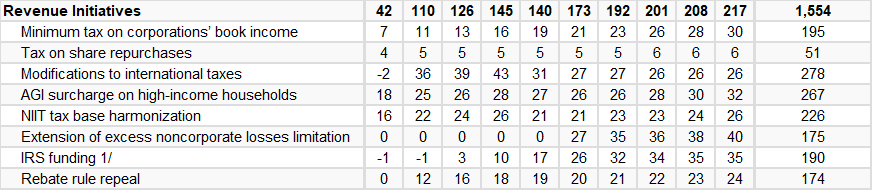

Make no mistake, the tax hikes in the BBB are targeted at businesses. Here’s how the revenue numbers break down according the Penn-Wharton analysis of the bill:

As you can see, of the $1.5 trillion in tax hikes, almost all of them are imposed on business income. Only the new surtaxes would raise taxes on wage and salary income, but even with those, EY estimates that nearly half of the projected revenue would come from pass-through businesses, not individuals.

Most of the tax relief in the BBB, on the other hand, is reserved for families. According to Penn-Warton, the expansion of the child tax credit and EITC alone would reduce family taxes by nearly $2 trillion over the next 10 years.

That’s the inflation challenge of the BBB – the tax hikes are almost exclusively shouldered by producers while the tax relief is reserved mostly for families. On net, those policies are likely to constrict supply and increase demand. That’s inflationary any way you slice it.