The progressive case for raising taxes is premised upon two arguments – 1) income shares are increasingly concentrated at the top and 2) the Tax Cuts and Jobs Act (TCJA) reduced taxes for the wealthy and corporations at the expense of everybody else.

The first premise is simply wrong, as demonstrated most recently by new research by Phillip Magness and Vincent Geloso. This paper lands on top of a growing pile of analyses (see here, here, here, and here) showing that the work of French economists Piketty and Saez is deeply flawed and should not be relied upon by anybody.

Recent revenue data from the CBO and Treasury now shows the second premise – that corporations and the rich have stopped paying their fair share – is also wrong.

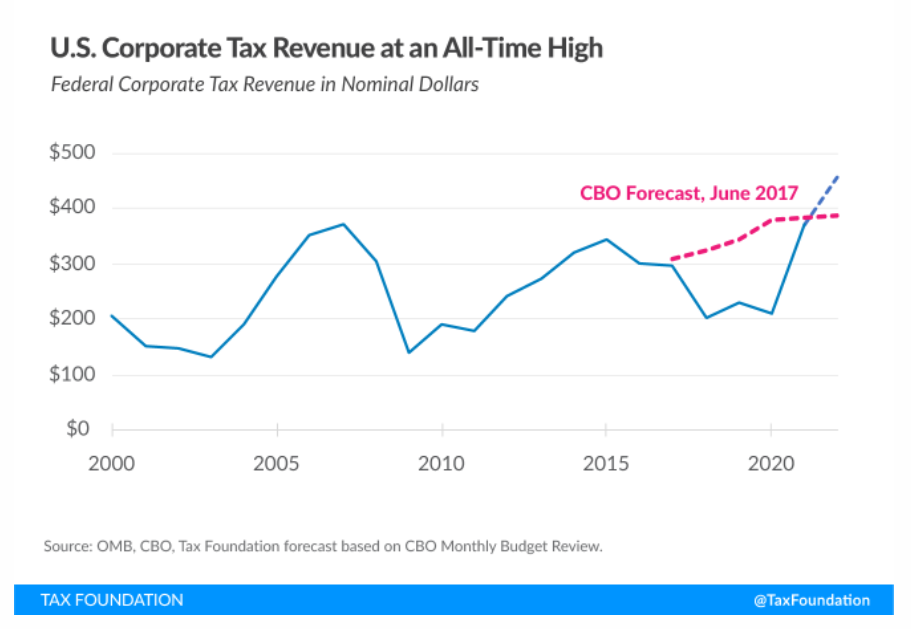

As noted by the Tax Foundation, corporate receipts last year were a record-high $372 billion and growing. That’s up from $230 billion in 2019 (pre-COVID), an increase of 61 percent. And the good news is continuing. In just the first six months of fiscal year 2022, corporate receipts were 22 percent above their already-high 2021 levels.

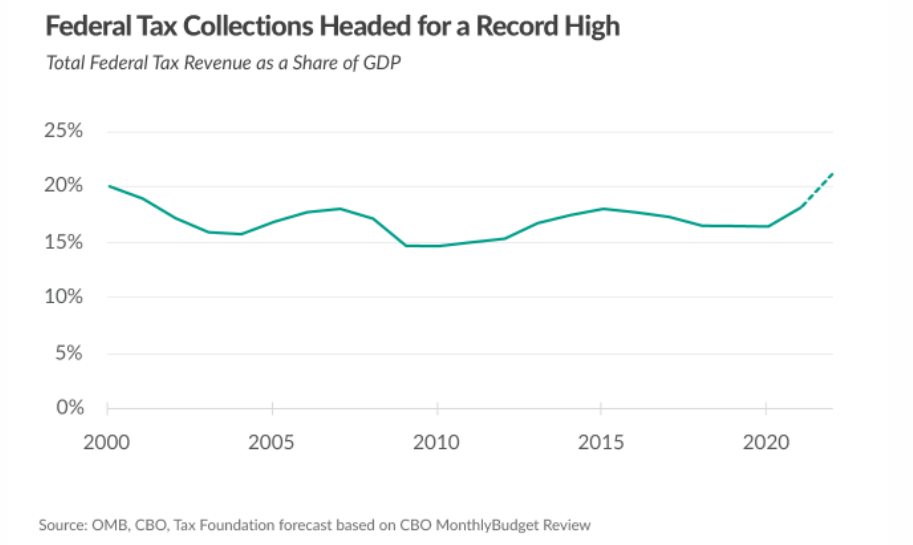

While some of this growth can be explained by inflation, receipts measured against GDP are also rising, suggesting that a premise of the Tax Cuts and Jobs Act – to broaden the corporate tax base while reducing rates – is working to make our Tax Code more competitive while still raising significant levels of revenue.

The growth in revenues isn’t just a corporate phenom. Individual collections are rising sharply too and also headed for record highs.

So the second progressive case for hiking taxes – that corporations and rich Americans aren’t paying their fair share — isn’t keeping up with the times either. Corporations and individuals are paying record amounts and those amounts are only expected to grow this year and into the future.

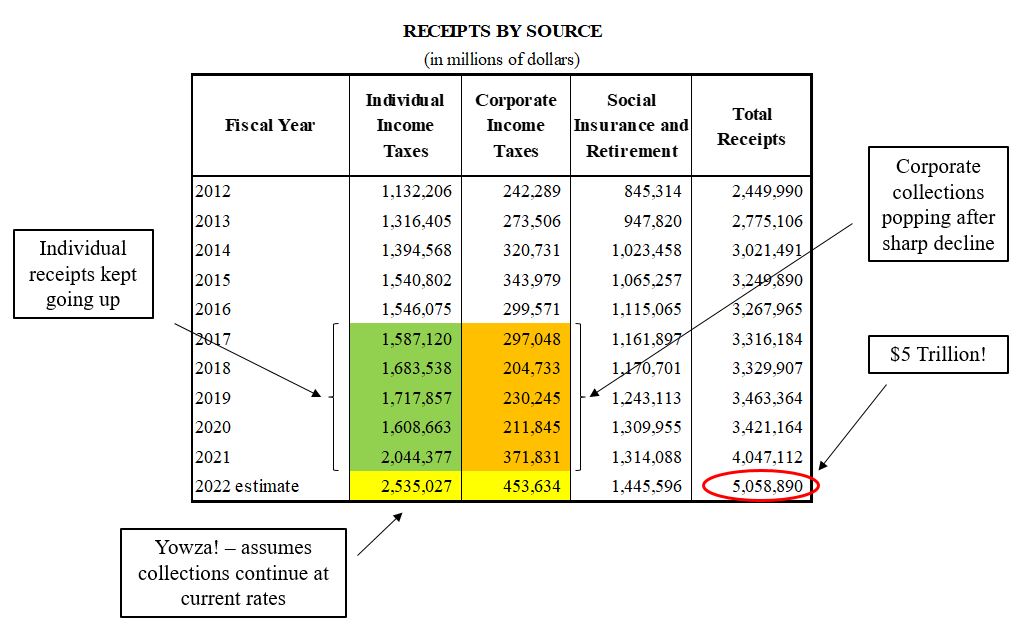

One item not addressed by the Tax Foundation is how the TCJA affected individual tax receipts. As the data from OMB makes clear, collections from corporations dropped sharply following adoption of the TCJA – much more than was expected. We wrote about this in the past. The surge of revenues in 2021 and 2022 has brought corporate collections to their historic levels, but still there was that sharp drop in 2018 and 2019. (We’re ignoring 2020 because of the effects of COVID.)

On the other hand, tax collections for individuals and pass-throughs never declined. In fact, they rose from $1,587 billion in 2017 to $1,683 billion a year later – after the “tax cuts.” It’s correct that collections in 2018 and 2019 were slightly below pre-TCJA projections, but the decline was small and hardly qualifies as a massive giveaway. Now, with the recent surge, individual collections are well above their pre-TCJA baseline.

The simple way to think about the impact of the TCJA on upper-income individuals and pass-throughs is that the results were a mixed bag. If you ran a business that qualified for the 199A deduction, you probably saw a reduction in your taxes. It you didn’t – if your business was designated as a “specified services trade or business” – then it is possible you saw your taxes go up in 2018 and beyond.

So the recent revenue numbers from CBO and Treasury tell us two things. First, they completely undermine what little justification existed for raising taxes on employers post-pandemic. It’s hard for the federal government to claim poverty when it’s literally awash in tax revenues.

Second, they point to the importance of the 199A deduction in maintaining parity with public C corporations. It’s the only thing standing between Main Street and a massive tax hike.