In a statement released last week, the White House boasted that February’s employment numbers – which reported 678,000 new jobs – were the result of “the new economic approach [President Biden] talked about in the State of the Union: grow the economy from the bottom up and the middle out.”

In taking a closer look at which companies did the hiring, however, a very different narrative emerges. Instead, what we see is the ongoing consolidation of economic power away from Main Street and into the hands of the largest publicly-traded companies.

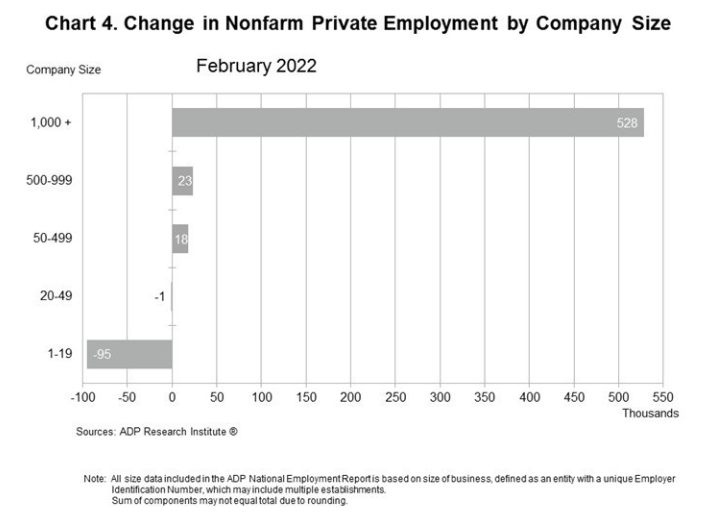

The official Bureau of Labor Statistics report only shows employment figures by industry, but monthly estimates from ADP break the data down by company size:

While ADP showed private sector employment increased by 475,000 net jobs, employment at small businesses – those with between 1 and 49 employees – decreased by 96,000, with the vast majority of those losses occurring at companies with fewer than 20 employees.

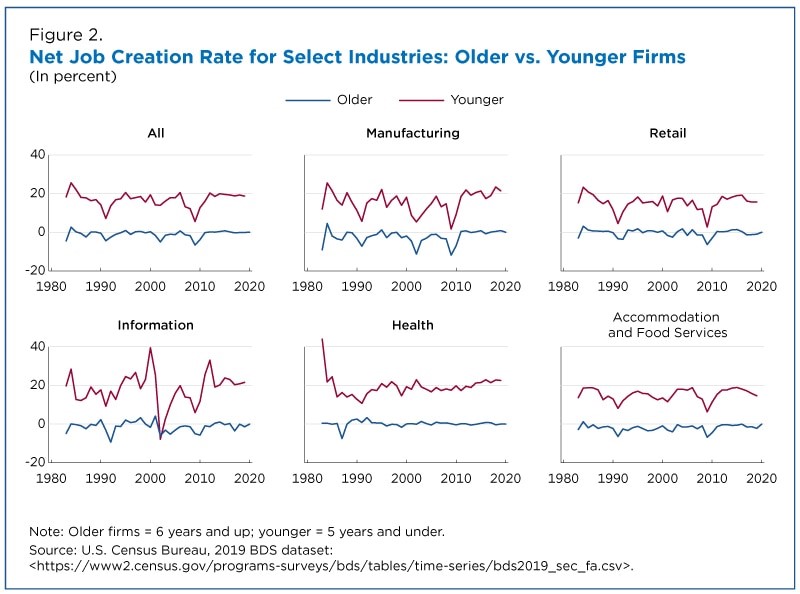

As a report from the Census Bureau makes clear, this trend has been long in the making:

The evolution of job growth and employment in the U.S. economy over the past four decades has been characterized by two important but seemingly contradictory facts: Young start-up businesses have been a key driver of economic growth, yet more and more of the American workforce has become concentrated at older, more mature firms.

To illustrate further, the Net Job Creation Rate – which shows how many more jobs were created than destroyed, relative to overall employment – is notably higher for young firms than old ones:

The bottom line is that startups and other small businesses have historically been the driver of job creation and economic expansion. But current economic conditions make it hard for these firms to remain competitive, particularly against large, publicly-traded companies. As our EY Jobs Heatmap shows, this trend has significant regional implications. Some states will benefit from ongoing consolidation, while other states will lose.

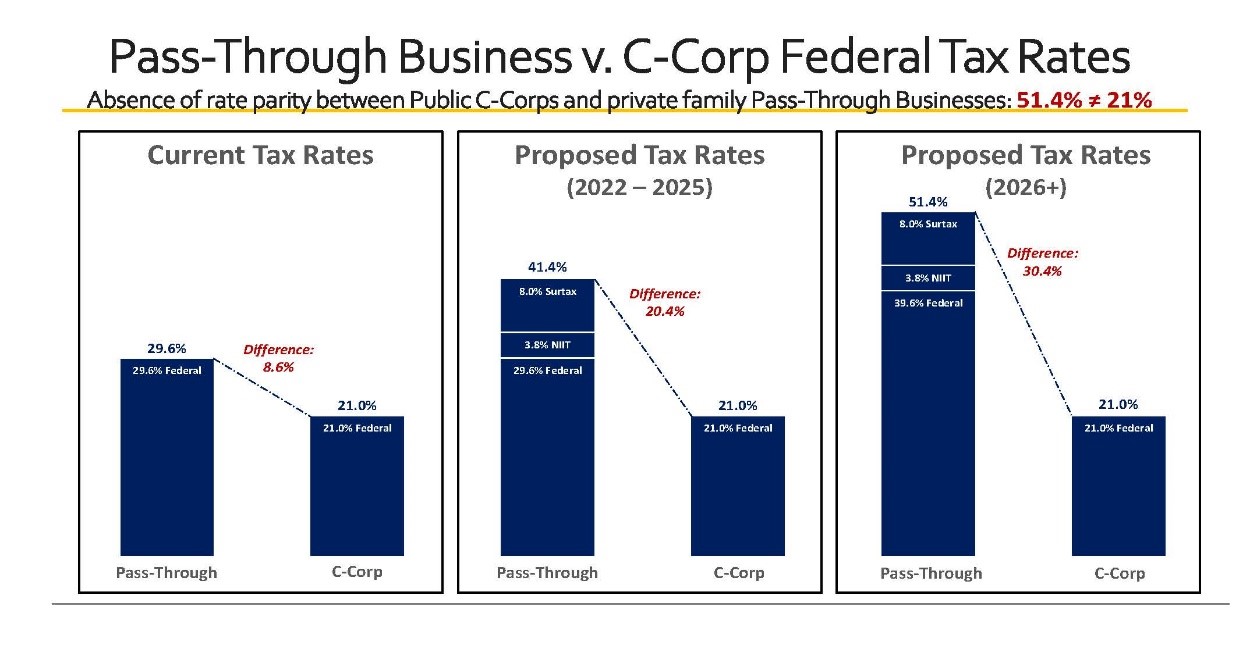

The House-passed Build Back Better Act would exacerbate this dynamic by raising the marginal rates on private companies above 40 and 50 percent, while leaving the rate paid by domestic public corporations at its current 21 percent. Worse, for family businesses these high rates will kick in at relatively low levels — $500,000 for the 8 percent surtax and just $13,000 for the 3.8 percent NIIT expansion.

It is simply impossible for these businesses to compete in the long term when their retained earnings after taxes are less than 50 cents to the dollar compared to a C corporation which is able to retain almost 80 cents. Retained earnings are the lifeblood of growth for private businesses. Unlike public corporations, these companies don’t have access to the capital markets. So lacking parity in their tax treatment, these businesses will have to sell or simply fade away. That means more abandoned factories and more boarded up Main Streets.

The on-going geopolitical challenges in Europe should remind us that national security starts with a robust, diversified economy. The economic consolidation taking place is hurting Main Street and needs to be addressed. The tax hikes in the Build Back Better Act, however, move in the wrong direction and will only make that consolidation worse. Congress should abandon the bad policies, not Main Street.